Femtech is expansive—it’s time to start treating it as such

Elena Gambon supported this post as part of her work with the Flare Capital Scholars program. As a 2020 Flare Capital Scholar, Elena learned about healthcare venture capital and innovation while helping source investment opportunities—learn more about the program here.

Despite the fact that women control 80% of healthcare decisions in the US and spend 29% more per capita on healthcare compared to men, the sector of digital health for women—popularized as Femtech—has only recently started to draw attention from venture capital investors. Only 3% of the 2,728 US digital health deals since 2011 have focused on women’s health.1 A majority of this funding has gone to companies supporting reproductive health, in part due to the complexity and cost around fertility. We shouldn’t have to say it, but here it goes: women are so much more than their reproductive organs. The shortsightedness of only building around this (important) need means companies miss the greater opportunity to enhance the totality of women’s healthcare experience. While we’ve cheered advancement in the Femtech sector, we’re just at the tip of the iceberg when it comes to transforming the health of all women.

We believe the opportunity extends beyond the connotations of the widely-used term “Femtech,” and see an untapped market capable of supporting the diversity of women’s experiences, with an emphasis on addressing health inequities and tackling stigmatized conditions. In this report, we segment the Femtech landscape and dive deep into twelve areas that we believe are meaningful opportunities for entrepreneurs and investors to impact the services and care received by a broad range of healthcare consumers.

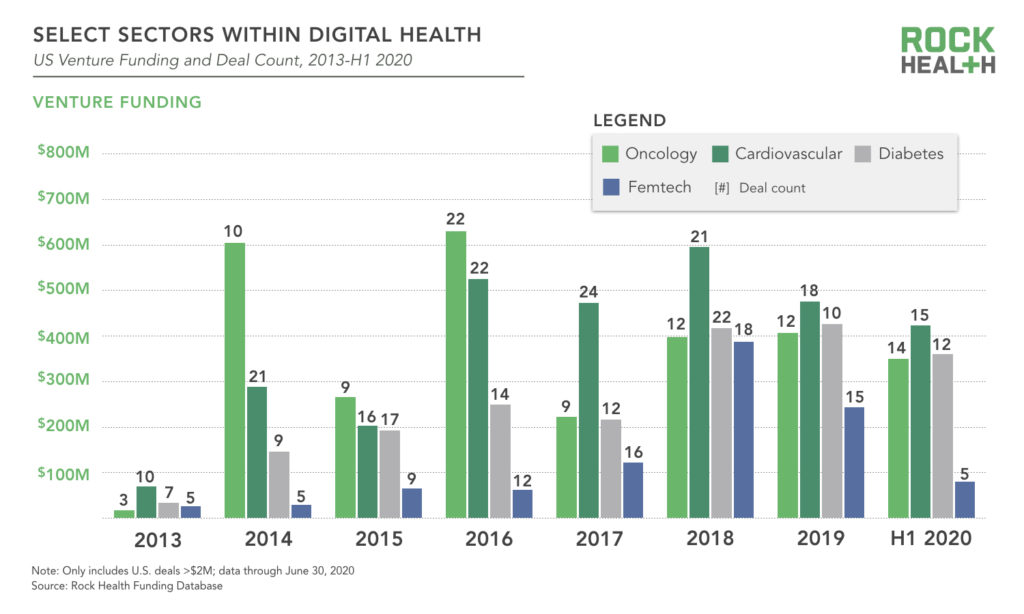

In 2018, US Femtech startups received a record-breaking $388M which represented a mere 4.7% of the year’s total funding. Since then—and despite reports showing the sector’s anticipated growth—both the funding numbers and proportion of total funding in the digital health space have been on the decline. Femtech received just 3.3% of digital health funding in 2019 and 1.5% through the first half of 2020, which is likely to be a banner year for digital health. Conversely, average deal size within Femtech steadily grew from 2013 to 2018, and then held relatively constant across the past few years, due in part to a few larger, later stage deals in the reproductive space. Notably, 80% of the Femtech companies that raised capital last year were led by women, which is markedly higher than the 15% for the digital health industry overall in 2019.

Segmenting the Femtech landscape

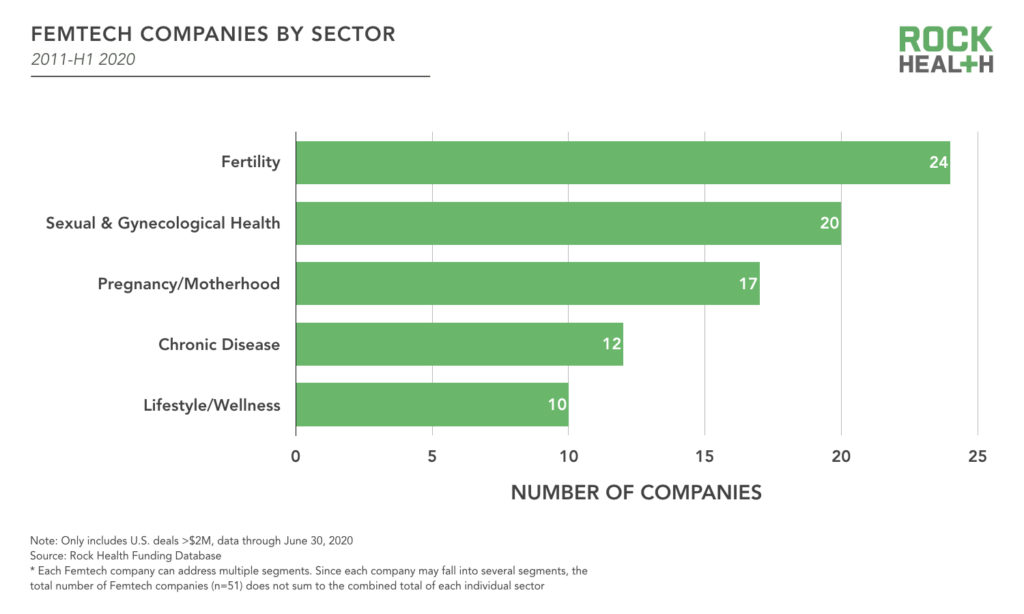

Not only is the Femtech sector trailing in total funding relative to other sectors in digital health, startups in this space have yet to explore building solutions for the full population of women. An analysis of 51 US Femtech companies in the Rock Health Digital Health Funding Database shows the majority of funding was directed toward solutions addressing fertility, pregnancy, and motherhood. Many of these solutions tend to target commercially-insured and younger women. Given the broad and diverse experiences among women, it is more critical than ever to push our definition of Femtech to meet women’s health needs and demands.

When evaluating the Femtech landscape, we see companies operate across five segments2:

- Fertility: Solutions that address health needs associated with period health/tracking and trying to conceive, including intrauterine insemination (IUI), in vitro fertilization (IVF), intracytoplasmic sperm injection (ICSI), preimplantation genetic diagnosis (PGD), egg donation, and egg preservation

- Pregnancy/motherhood: Solutions that focus on assisting mothers from the point of conception through birth and across the newborn period

- Sexual and gynecological health: Solutions that encompass healthcare services related to routine gynecologic care, sexual education, sexually transmitted infections (STIs), menopause, and pelvic health

- Chronic disease: Solutions that target chronic conditions requiring ongoing care (e.g., cancer, heart disease, depression) which are not exclusive to, but prevalent among, women

- Lifestyle/wellness: Solutions that center around mind and body wellbeing, as well as social factors to develop a comprehensive and multidisciplinary approach to holistic health

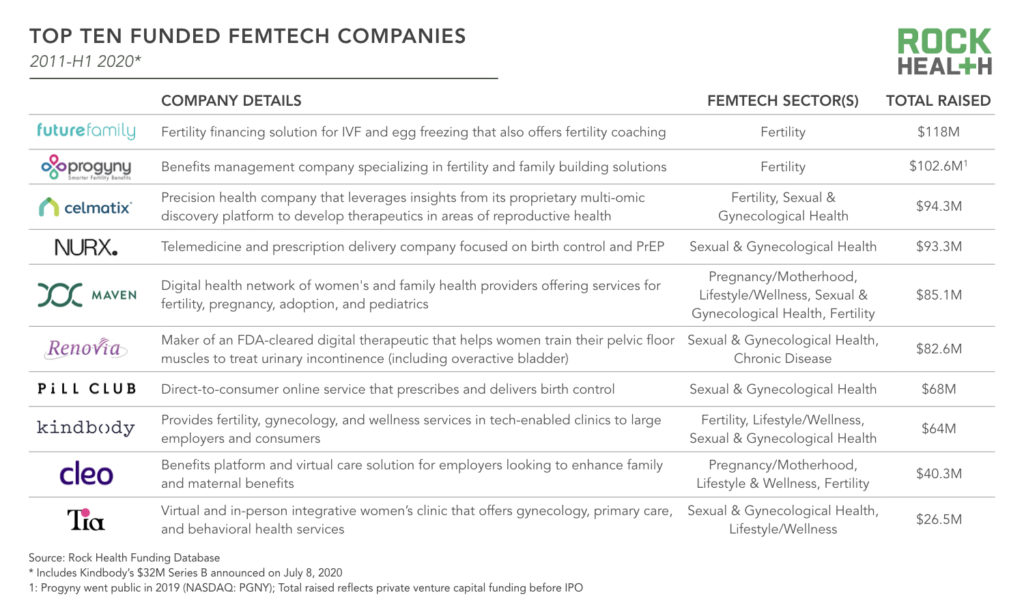

Femtech first received prominent attention from investors in fertility and maternity management. Some of these solutions, such as Rock Health portfolio company Natalist, offer direct-to-consumer products and evidence-based educational content for fertility and pregnancy. Others provide employers with comprehensive maternity and family benefits programs via a mobile app and/or telemedicine (e.g., Ovia Health, Maven) in an effort to help them boost employee return-to-work rates. One fertility benefits solution, Progyny, even went public in 2019 at a fully diluted market value of $1.3B and became a symbol of success in the space.

In total, $688.8M has been invested in digital health companies targeting fertility and pregnancy/motherhood through H1 2020. This represents 65% of all Femtech funding, and includes six of the top 10 funded Femtech companies. Comparatively, less than 45% of the US female population is of reproductive age, and only a portion of this subset is actively trying to get pregnant, is pregnant, or is post-pregnancy. Additionally, only 10% of women in the US between the ages of 15-44 struggle with getting or staying pregnant. That leaves a majority of women deprioritized in the current scope of digital health solutions.

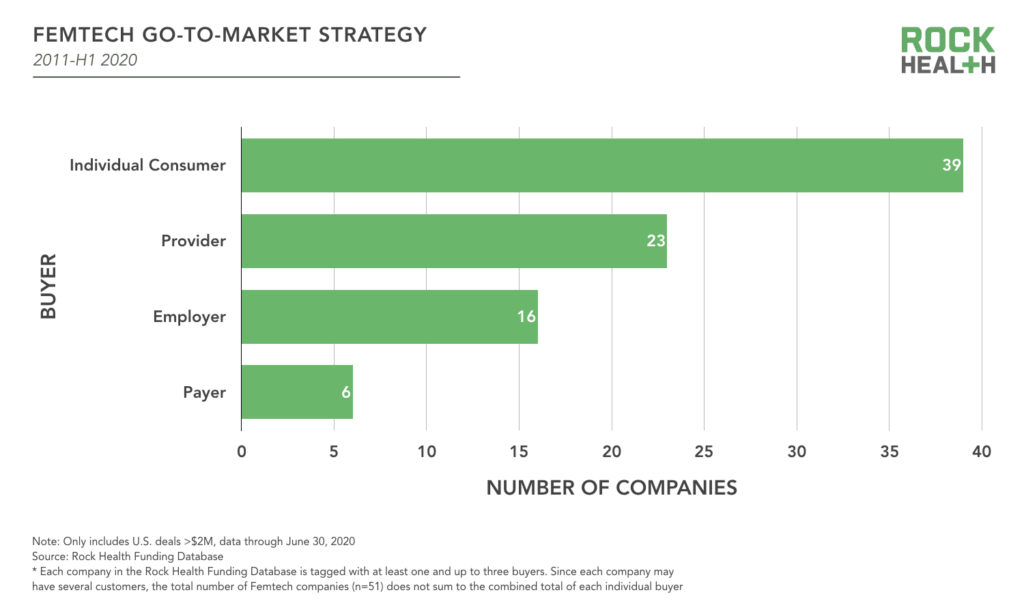

Alongside the boom of fertility and pregnancy/motherhood solutions came a surge of direct-to-consumer solutions focused on sexual and gynecological health. An array of solutions emerged offering online prescription and delivery for contraception and STI testing/treatment (e.g., Nurx, The Pill Club). Many of these well known startups focus on services for young women and offer a convenient digital front door to care while eliminating barriers that traditionally delay or prohibit access. The market is also saturated with period trackers (e.g., Clue, Glow, Flo) empowering women at various points in their health journey to conceive, avoid pregnancy, or monitor their menstrual cycle for a greater understanding of their health. In line with broader trends in digital health, many of these companies aim to reduce the friction associated with accessing services that promote female sexual wellness and gynecological care while putting control in the hands of the patient. Today, primary buyers of Femtech solutions are individuals themselves, with 70% of companies selling D2C (either as the primary business model, or one of their go-to-market channels).

Existing Femtech solutions on the market are tackling important issues and creating new opportunities to collect and use women’s health data. This can help close a startling gap: women’s health accounts for just 4% of the overall funding of R&D for healthcare products and services. However, it is vital to remember that Femtech is so much more expansive than reproductive health and concerns surrounding female reproductive organs. As investors, we’re excited to fund new solutions that holistically support women’s health—including a wider range of clinical indications, a more diverse patient population, and a greater focus on health equity.

Femtech areas with unmet need are primed for innovation

Here are 12 segments of Femtech where we see significant white space for meaningful innovation—and thus opportunities ripe for investment:

- Support for Medicaid mothers, who represent nearly half of all births in the US

Although Medicaid covers nearly 43% of births in the US, the 2018 Listening to Mothers Survey found that mothers on Medicaid in California are far less likely than their private insurance counterparts to have sources of emotional support, assistance with completing health tasks, or access to information. Given tailwinds from COVID, by January 20213, nearly 17M people could be newly eligible for Medicaid, creating an even larger window of opportunity in the market. Yet few Femtech companies place an explicit emphasis on supporting Medicaid mothers. Wildflower Health, a Rock Health portfolio company, works with Medicaid health plans to empower women and their families to confidently navigate and access care with the support of digital resources on a smartphone or tablet. These virtual care and remote triage solutions offer convenient solutions to help clinicians stay connected, particularly with patients who may have a hard time coming to visits due to transportation or childcare hurdles. With targeted digital health solutions, innovation offers potential to address social determinants of health and eliminate health disparities for Medicaid mothers.

- Combatting the maternal mortality crisis for Black mothers

The US has the worst maternal mortality rates of any developed country and Black women are particularly vulnerable, even when controlling for income and education level. Black women die at three to four times the rate of white mothers in the US—and these disparities are more pronounced in certain geographies. Black women in New York are 12X more likely to die from pregnancy-related causes than white women during pregnancy or within one year postpartum. Digital health solutions offer potential to close prenatal care gaps disproportionately impacting vulnerable and racial minority populations. Emerging digital health solutions such as Candlelit, Culture Care, Poppy Seed Health, and Health In Her Hue offer Black mothers the opportunity to access culturally-competent, evidence-based prenatal and postpartum care.

- Inclusive care for queer and transgender communities

Femtech companies have historically overlooked LGBTQ+ women. Over half of LGBTQ+ identifying individuals have faced discrimination while seeking medical care, and this subsequently results in greater care avoidance. Amidst rising rates of reported violent homicides, transgender and gender non-conforming individuals—especially those of color—are vulnerable when it comes to finding adequate healthcare, and health outcomes are worse as a result. We see an opportunity for digital health to support LGBTQ+ communities, but companies will need to evolve to support this rapidly shifting population. Millennials are significantly more likely than older generations to identify as LGBTQ+, and only 48% of Gen Zs identify as exclusively heterosexual (compared to 65% of Millennials). According to BCG’s 2020 LGBTQ+ Employee Survey, there is a notable rise in the number of women identifying as LGBTQ+ in the workforce—and this is even more pronounced among younger employees, as women make up 71% of the LGBTQ+ population aged 25-34 and 78% of those aged 18-24. Given the poor health outcomes associated with lack of culturally-competent care, there is meaningful opportunity for digital health and Femtech companies to meet the comprehensive healthcare needs of queer and trans communities. We’re heartened to see a new crop of startups such as Queerly Health, Folx Health, Included Health, Violet, and Woven Bodies, who are working to holistically support the healthcare of these vulnerable populations.

- Support for caregivers, who are overwhelmingly women in the US

Caregiving responsibilities for both children and elders disproportionately fall on women—in fact, nearly 60% of all caregivers are women. It is estimated that more than 25M women (nearly one in seven) provide care to family members or friends. We anticipate some Femtech companies will see an opportunity to support their user base by expanding into holistic caregiver support platforms. We’re already beginning to see rumblings of this anticipated trend. Cleo, a parenting benefits company, partnered with UrbanSitter to help connect families with vetted babysitters, while Maven bought Bright Parenting, a parent-child relationship app that will be embedded into Maven’s upcoming pediatrics and parenting program. As 37% of caregiving women are part of the “sandwich generation,” providing care to both aging parents and children living at home, we see a unique opportunity for Femtech companies to support women through the challenges surrounding both child and elder caregiving.

- Sexual education for young women—particularly those of color

While several Femtech companies provide some form of sexual education, many are not focused on meeting the unique needs of adolescent and young women, particularly those who are of color. In the US, there are 14.1M girls and young women of color (age 10–24), and women of color will be the majority of all US women by 2060. Given disparities in sexual health education mainly affect young women of color, digital health solutions offer a unique opportunity to help close this gap. Solutions such as Kiira Health, which provides young women with an AI-based care coordinator and 24/7 telemedicine access to a range of women’s health providers, and LOOM, a platform for educating women and non-binary people on sexual and reproductive health, may offer support.

- Prenatal remote monitoring devices for clinical decision support

Many digital health solutions offer connected wearables and devices to monitor women during pregnancy (e.g., contraction trackers, vital sign monitors). While generally useful, improper use of the equipment can lead to false positives, which in turn raises unnecessary alarm for both patients and providers. Nonetheless, these pregnancy trackers and fetal monitors can offer untapped potential to better connect providers and mothers in between office visits to track and manage their pregnancies from the comfort of their homes. For instance, Oula Health offers pregnant mothers telemedicine visits and remote monitoring devices to track and report vital signs to a vertically-integrated, collaborative care team. Remote monitoring devices can be especially important in cases of high-risk birth, where mothers experience conditions such as gestational hypertension or diabetes. While improved management of pregnancies reduces cost for payers, it may also reduce direct reimbursement for providers as it reduces the need for expensive interventions. Nonetheless, forward-thinking providers may be able to leverage value based insurance designs to fund high-value experience for mothers, driving patient loyalty for subsequent births. These dynamics emphasize the importance of preparing for a transition to value-based care while thoughtfully designing a go-to-market strategy that accounts for the fee-for-service incentives governing today’s marketplace.

- Digital programs that provide remote support for highly stigmatized conditions

At least one in four women experiences distressing menstrual pain characterized by a need for medication and absenteeism from study, work, or social activities. In addition, pelvic floor disorders (e.g., urinary incontinence, fecal incontinence) affect more than one in three women in the US. Yet discussing these concerns with a medical provider can be uncomfortable and daunting. Increasingly we see Femtech companies stepping up to the plate to offer discrete, on-demand solutions via remote care and digital therapeutics. Renovia offers an FDA-cleared, connected device to support women with urinary incontinence by strengthening pelvic floor muscles while Renalis is developing digital platforms for fibroids/endometriosis and overactive bladder. Visana Health also provides a 12-week digital program to reduce chronic menstrual pain with diet changes, pelvic floor physical therapy, and cognitive behavioral therapy. Given the high prevalence of—and the physical and mental pain associated with—these conditions, we see room for more innovators.

- Screening for and treating female reproductive cancers

Femtech innovation within oncology has largely focused on breast cancer. Visiopharm and PathAI offer artificial intelligence driven pathology solutions for breast cancer diagnosis. QView Medical has FDA pre-market approval for a 3D automated breast ultrasound system incorporating artificial intelligence to detect suspicious breast tissue, and Ikonopedia offers clinicians mammography reporting and tracking software that auto-populates information on breast density, pertinent patient and family history, and follow-up forms. In addition to breast cancer, gynecologic cancers begin in a woman’s pelvic reproductive organs and approximately 94K new cases are diagnosed in the US each year. Although the HPV vaccine has significantly decreased the rate of cervical cancer within the United States, the global burden of cervical cancer remains high and innovation to improve early screening and detection offers new opportunities for innovation. Emerging solutions, such as UE LifeSciences’ cervAIcal, provides a mobile device for cervical exams. While ovarian and endometrial cancers typically present later in life, an increasingly tech-savvy elderly population combined with the necessity of digital solutions for screening and care delivery in the era of COVID-19 points to an area ripe for disruption.

- Perimenopause and menopause symptom management

Menopause remains taboo even though half of the population will experience it in their lifetimes, with up to 85% of women experiencing a menopause-related symptom. Solutions for menopause take a wide range of approaches: wearables (e.g., Embr’s Wave Bracelet), community-oriented symptom tracking apps (e.g., Chorus Health, Lisa Health), telemedicine services that support one-on-one provider consults, access to hormone replacement therapy, and at-home hormone testing (e.g., The Cusp, Gennev, Elektra Health, CurieMD). Yet many women still do not receive adequate information regarding menopause: only about 50% of all women discuss menopause with their healthcare provider and 35% of women age 40-49 (the prime age for perimenopause) have discussed their symptoms or concerns. Seeking support for menopause is still taboo and women often rely on conversations with trusted friends and family for menopausal health information. Femtech solutions designed to address women’s health concerns during menopause have the potential to not only provide necessary care and alleviate stigma, but also offer opportunity for the medical community to dispel rumors and directly communicate care guidelines to patients. As guidelines and recommendations for mammograms, breast ultrasounds, and hormone therapy have evolved with new research over the past decade, there is significant opportunity for digital health solutions to supplement in-person care and empower women.

- Support for aging women across conditions such as Alzheimer’s and Osteoporosis

Nearly 75% of Americans living with Alzheimer’s and 80% of Americans living with Osteoporosis are women. However, Femtech has yet to deliver prominent solutions specifically catering to women in these areas. There is an unmet need for more solutions like Rock Health portfolio company, Neurotrack, which uses a mobile app to help individuals measure their cognition with clinically-validated assessments and learn how to make impactful changes for brain health by engaging in Neurotrack’s Cognitive Health Program. More digital tools are needed to democratize and improve screening, early detection, management, and follow-up. As these conditions rely on effective collaboration between a range of providers, new opportunities for effective communication between the patient, primary care team, gynecologist, neurologist, orthopedics, and psychiatrists are essential to effectively detect and manage these conditions. Women’s health clinics with a collaborative and multidisciplinary care team, such as Tia, may be poised to help.

- Shedding light on behavioral health and integrating it into whole person care

Women are nearly twice as likely to be diagnosed with depression as men. Although several Femtech solutions have a behavioral health component, few solutions focus on this as a core competency. Understanding and addressing the unique mental health aspects impacting women such as miscarriages, gender discrimination, and isolation during menopause highlights the importance and potential of Femtech to offer individualized programs for women. Real, for instance, is a membership-based digital and in-person provider that helps women and non-binary members maintain their mental wellness through one-on-one and group therapy sessions organized around themes such as body image, dating, and miscarriage. In addition, we see unmet need when it comes to supporting victims of sexual violence, who are disproportionately women. Nearly 1 in 5 women have experienced completed or attempted rape during their lifetime. Despite low overall screening rates for intimate partner violence (IPV), computerized screenings have been shown to be as effective for disclosing IPV as talking with a clinician. We thus see opportunities for digital health solutions to screen for and support women through sexual violence—for now, solutions from academia and nonprofits are predominantly filling this need (e.g., the myPlan app developed with Johns Hopkins, Callisto).

- Delivering sex-aware care for non-reproductive conditions

Although it is well understood that certain conditions, such as heart attacks and stroke, present with different signs and symptoms based on biological sex, women still represent less than 40% of the people enrolled in heart disease and stroke clinical research. Companies such as Bloomer Tech are tackling this discrepancy head-on by developing a multi-lead ECG for women to manage their cardiovascular health. Solutions like this offer new opportunities to not only provide women with information on unique health risk factors, but also contribute to research, collect data for female-specific health concerns, and inform clinical guidelines and recommendations.

Are you building a Femtech company and looking for early-stage funding?

Our investment team would love to chat! Send us your pitch deck to explain how you’re working to improve the health of women.

Footnotes

1 Digital health deals through H1 2020. Our definition of digital women’s health (Femtech) follows Rock Health’s definition of digital health and excludes companies that employ product subscription solutions (e.g., Cora, Uqora), telemedicine platforms with prescription delivery services that have a sub-brand focused on Femtech (e.g., Ro/Rory, Hims/Hers), and at-home lab testing that expands beyond women’s health (e.g., Everlywell).

2 Femtech companies may be included in more than one segment

3 When unemployment insurance benefits cease for most people who lost jobs between March 1 and May 2, 2020