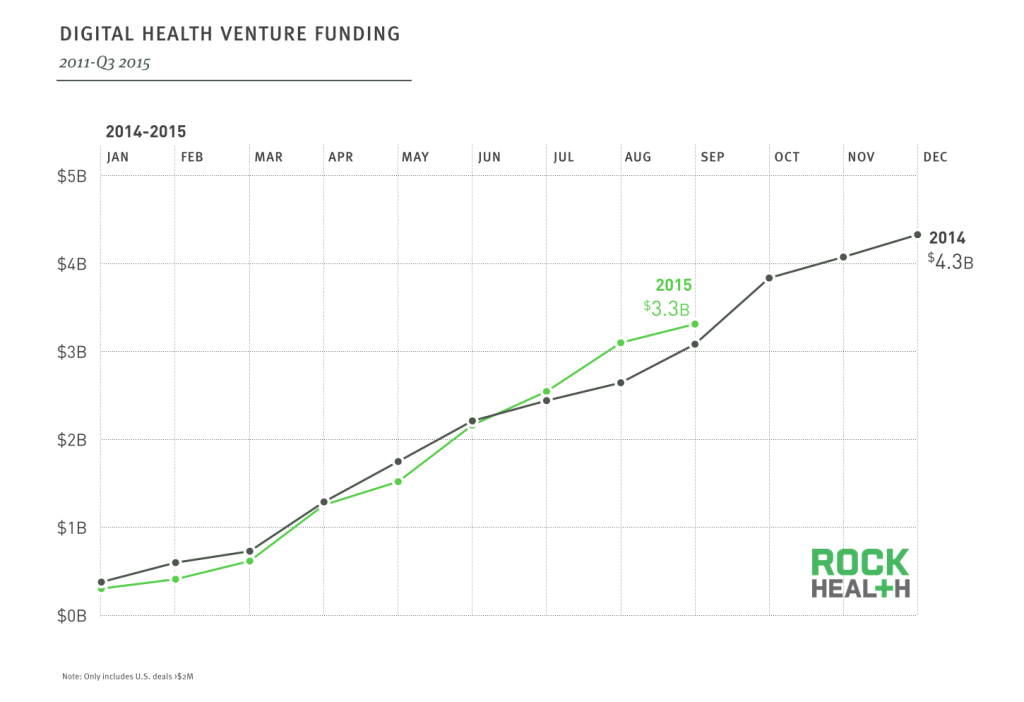

Q3 update: 2015 digital health funding exceeds 2014

At the midyear point, we reported that digital health venture funding in 2015 was on pace with the 2014, the largest year for funding to date. Now three quarters into 2015, venture investments have outpaced 2014’s three quarter total with funding reaching $3.3B, representing 30% TTM growth. The average deal size is the largest yet at $15.8M, although deal count is down 9% compared to last year. The top 8 deals of the quarter contributed to over 50% of the quarter’s transaction value. (Note: Our venture funding data only includes disclosed US deals over $2M. Companies that are sector-agnostic with a healthcare vertical are excluded.)

Source: Rock Health Funding Database

While seed stage and Series A deals comprise roughly 57% of all deal volume, there was an increase in deals for Series D or later. In 2014, Series D+ deals represented 11% versus through Q3 2015, 14% of deals were late-stage. This doesn’t come as a surprise given that digital health companies continue to mature and receive interest from later stage investors.

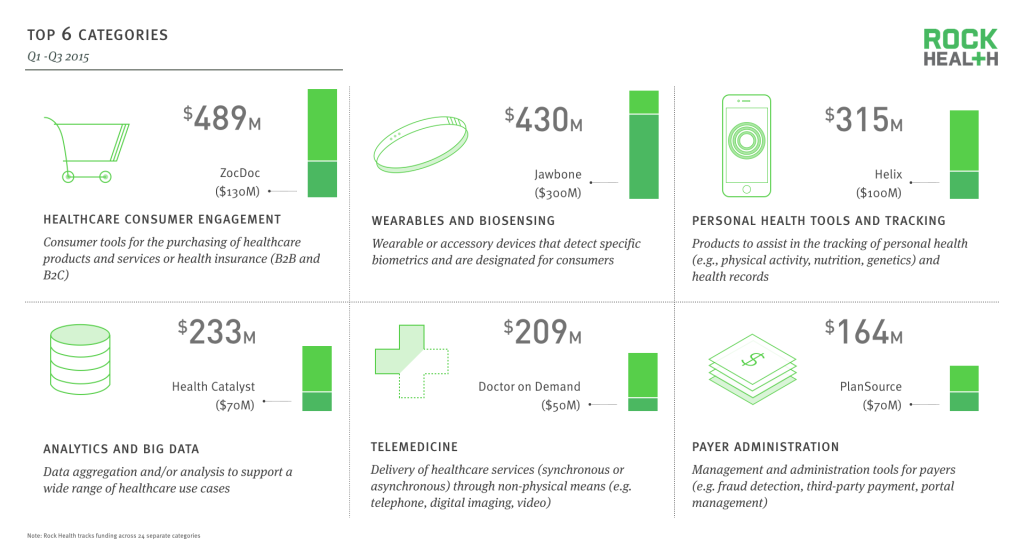

Top 6 Categories

The top six categories accounted for 56% of deal value through Q3 2015, and have remained fairly consistent from the midyear, with the exception of enterprise wellness and EHR / clinical workflow solutions being replaced by personal health tools and tracking and payer administration technologies. Two big deals contributed to personal health tools and tracking breaking into the top: Helix’s $100M launch funding and 23andMe’s $79M Series E.

Source: Rock Health Funding Database

With 22% of the US population expected to be 65+ by 2040, there’s been strong investor interest in services and technologies that are designed for seniors. For instance, Honor raised a $20M Series A to help seniors age in place by providing convenient access to in-home caregivers and a software platform to connect caregivers, seniors, and the family through an in-home, custom tablet device and companion mobile software.

Additional categories that have experienced significant growth include: digital diagnostics and life sciences commercialization tools, 195% and 110% YoY growth respectively.

M&A Activity

Payer and provider industries aren’t the only hot M&A markets—digital health continues to see a steady flow of acquisitions, reaching 146 deals YTD. There were only forty-four deals with disclosed transaction values that totaled a slim $5.1B. Growth through acquisition is becoming a popular strategy as industry players eye new opportunities for expansion into new verticals, functions, and revenue streams. EHR and clinical workflow solutions accounted for 25% of acquired deal volume this quarter, making it the most popular target category. Twenty-six percent of the target companies were acquired by companies outside of healthcare, compared to only 19% in 2014. This growing interest in digital health reflects the importance of health in every segment of the market. Deal highlights from this quarter include:

- IBM acquires Merge Healthcare: In a $1B deal, IBM continues to aggressively expand its healthcare vertical by combining Merge Healthcare’s medical imaging competencies with Watson’s computing platform. The goal is to apply machine learning analytics to imaging so that Watson can provide recommendations to radiologists for more accurate diagnosis. This is IBM’s third deal of the year (previously acquired Explorys and Phytel).

- Millennium Healthcare grows software offerings: Millennium’s scope of business range from distribution of medical devices, revenue cycle management, and technology platforms. As hardware businesses face decreasing margins, healthcare companies are eager to improve their software products. Their first acquisition this quarter was HealthPath and its WellPath system that will provide HIE capabilities. With the acquisition of MedX, a software company offering EHRs and practice management solutions, Millennium will be able to reach both the hospital and ambulatory markets.

- Cardinal Health acquires majority stake in naviHealth: For $290M in cash, Cardinal Health will own 71% of naviHealth, allowing Cardinal Health to extend its services into the post-acute market. naviHealth’s software platform helps physicians manage bundled payments through decision support and evidence-based protocols. As Medicare rethinks how they distribute more than $450B in payments, naviHealth provides an entry point for Cardinal Health to take on additional risk and capture profits associated with bundled payments.

Funding and M&A activity validates that digital health is here to stay—ready to close out 2015 strong!

Want to dive into the data for yourself? Get it here.