2016 Year end funding report: A reality check for digital health

To obtain a PDF version of the report, purchase one here.

Dollars and deals

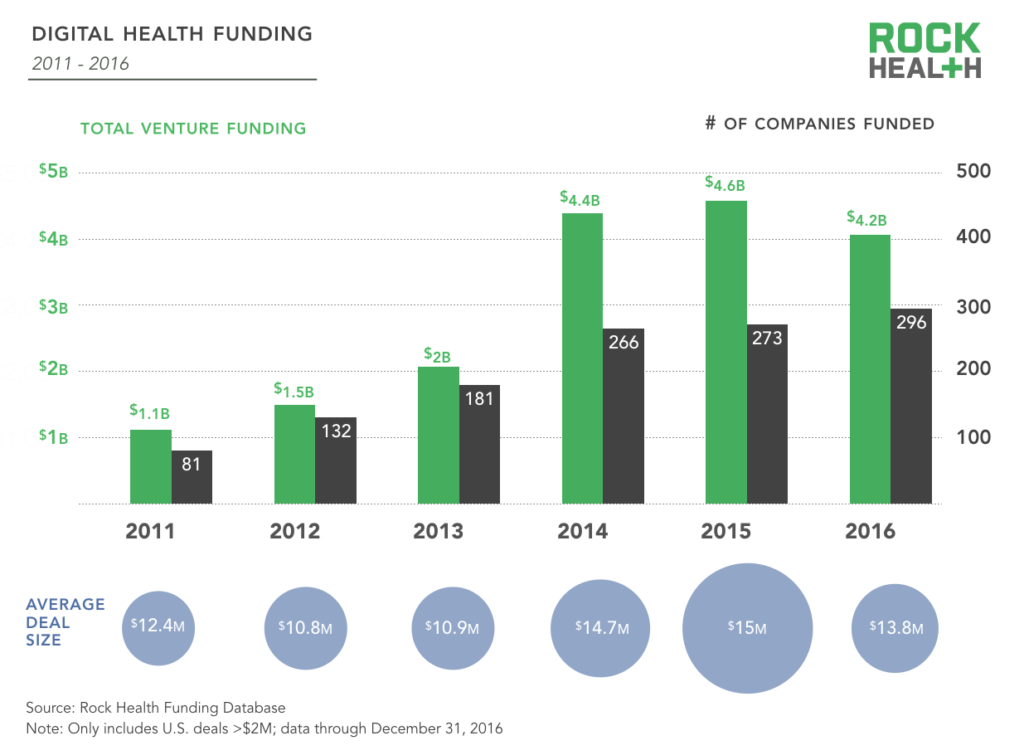

In 2016, there were more, albeit smaller digital health deals and 8% fewer dollars invested than in 2015.

Digital health funding started off strong in early 2016, with January setting a new record for funding. In fact, more venture dollars poured into digital health companies in the month of January than all of 2011 combined. This included half of the largest six deals of the year (Flatiron Health, HealthLine, and Jawbone), which all announced their latest rounds in the first month of the year.

Source: Rock Health Funding Database

While a record number of companies were funded in 2016 (up 8% YoY), the total amount of investment dollars for the year reached $4.2B, down 8% YoY. It may look like digital health’s growth spurt is abating, but it’s important to remember that companies still raised double the amount of dollars compared to just three years ago. Moderation in deal size—the primary driver for the reduction in total invested dollars—is likely an indicator of healthy moderation in startup funding and partly tracks with the larger venture investment picture of 2016.

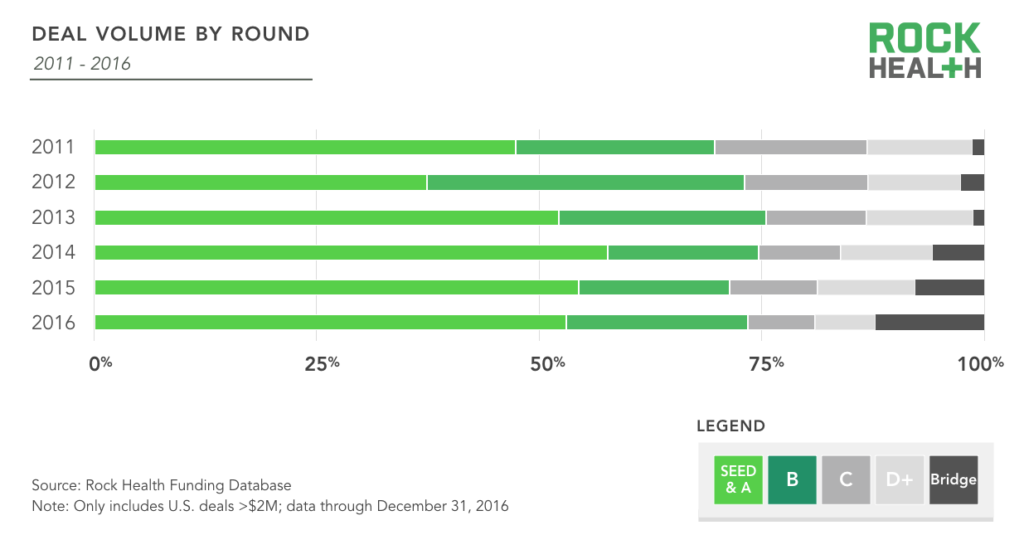

The majority of deals were early stage, and we counted a record number of bridge rounds in 2016.

Similar to past years, roughly half of deals in 2016 were early stage (Seed and Series A). We saw nearly a third more Series B deals than in 2015, although the number of Series C and D+ were down 26% YoY. Most interestingly, bridge deals accounted for a record 12% of all deals in 2016. Founders sometimes turn to these extension rounds when they haven’t made enough progress to justify the next level of funding and valuation.

Source: Rock Health Funding Database

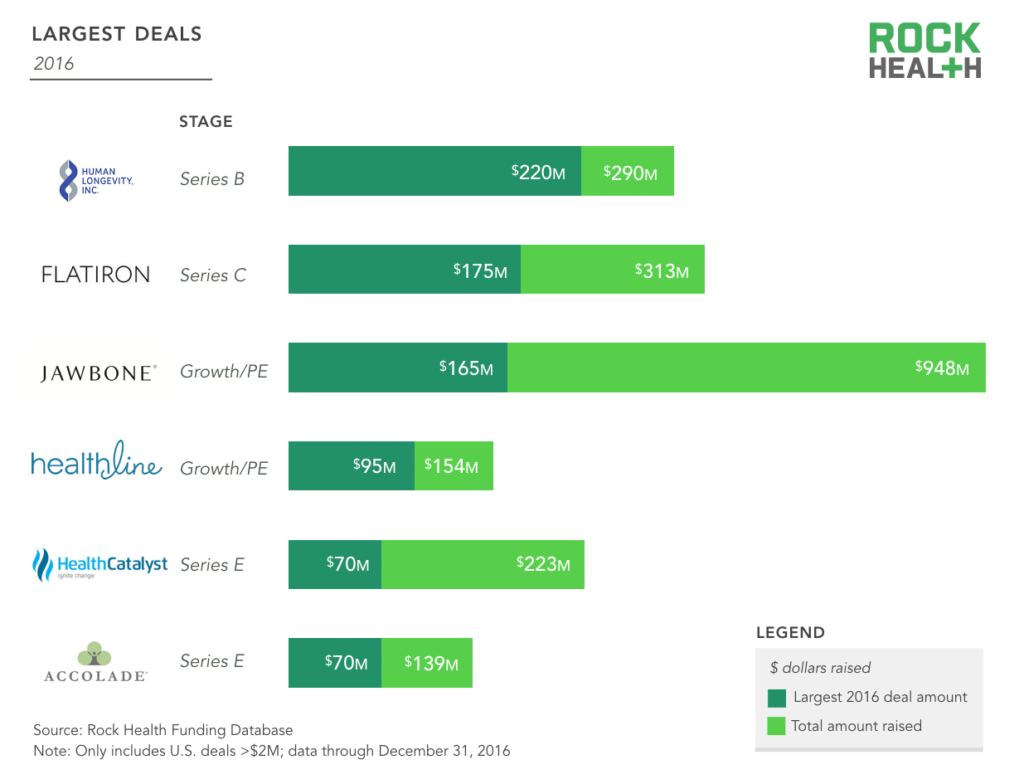

The six largest deals of 2016 made up 19% of all digital health funding.

The six largest deals of 2016 made up 19% of all digital health funding. The youngest on the list—Flatiron Health—is just four years old and, over three rounds of financing, has raised the third most of any venture-backed digital health company since 2011. Despite laying off 15% of its global workforce, Jawbone, which is now solely focused on its fitness business, raised $165M in 2016. This confirms its spot as the most funded digital health company of all time at nearly a billion dollars.

Source: Rock Health Funding Database

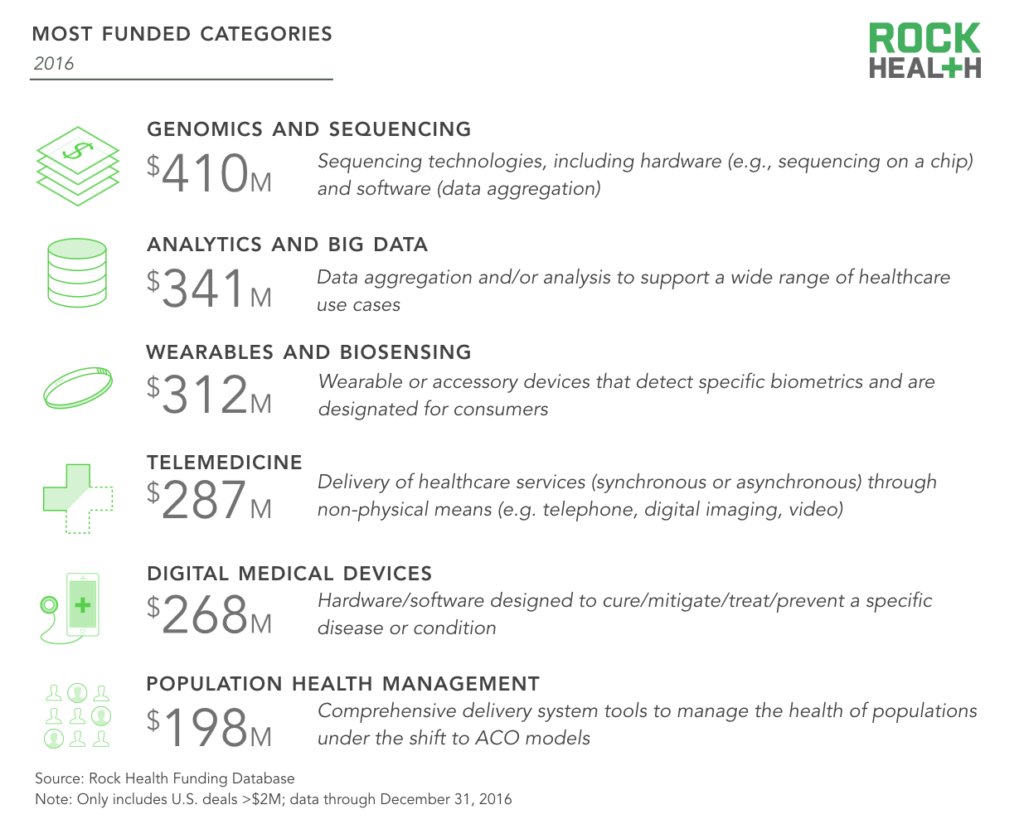

Categories

Digital health companies in the genomics and sequencing space stole investors’ hearts in 2016.

Digital health companies in the genomics and sequencing space stole investors’ hearts in 2016, raising more funding than any other category and anchored by several large, high-profile deals including Human Longevity ($220M), Color Genomics ($45M), Seven Bridges Genomics ($45M), Pathway Genomics ($40M), and Emulate ($28M).

The analytics and big data category continued its surge in 2016, reaching $341M over 22 deals—up 103% over 2015. The wearables and biosensing category had another big year and came in third for most funding, although total funding for this category was down 32% from 2015. Telemedicine, digital medical devices, and population health management all reappeared on the Top Categories list.

Source: Rock Health Funding Database

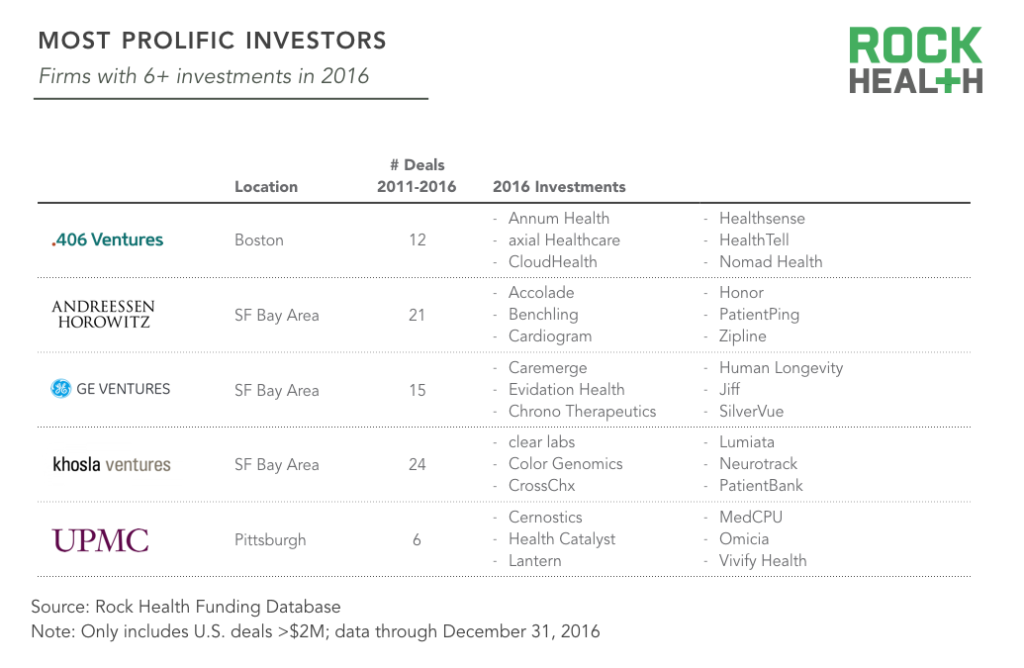

Investors

Digital health continued to receive funding from a wide range of funds, including 214 returning investors and 237 new investors in 2016.

Four hundred fifty-one unique investors made bets in digital health this year—though three-quarters of them invested in just one deal (we call them “dabblers”). We counted 237 investors who made their first digital health investment in 2016, including Campbell’s Soup Company, Expa, New York-Presbyterian, and Pfizer (welcome!). Forty investors were “active” this year, closing three or more deals. Five firms were extra prolific in 2016, making six or more investments, including:

Source: Rock Health Funding Database

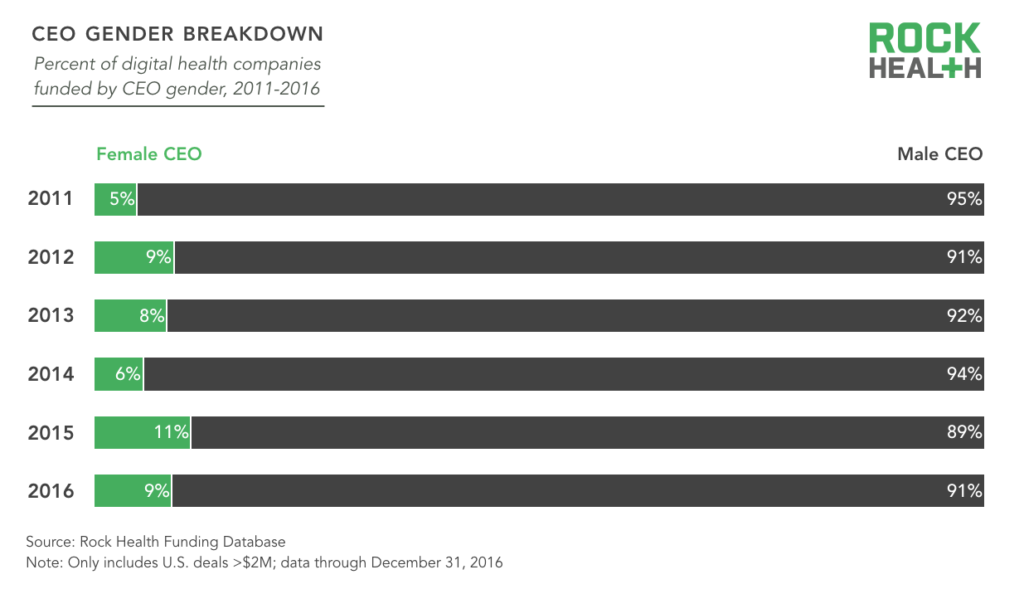

CEO demographics

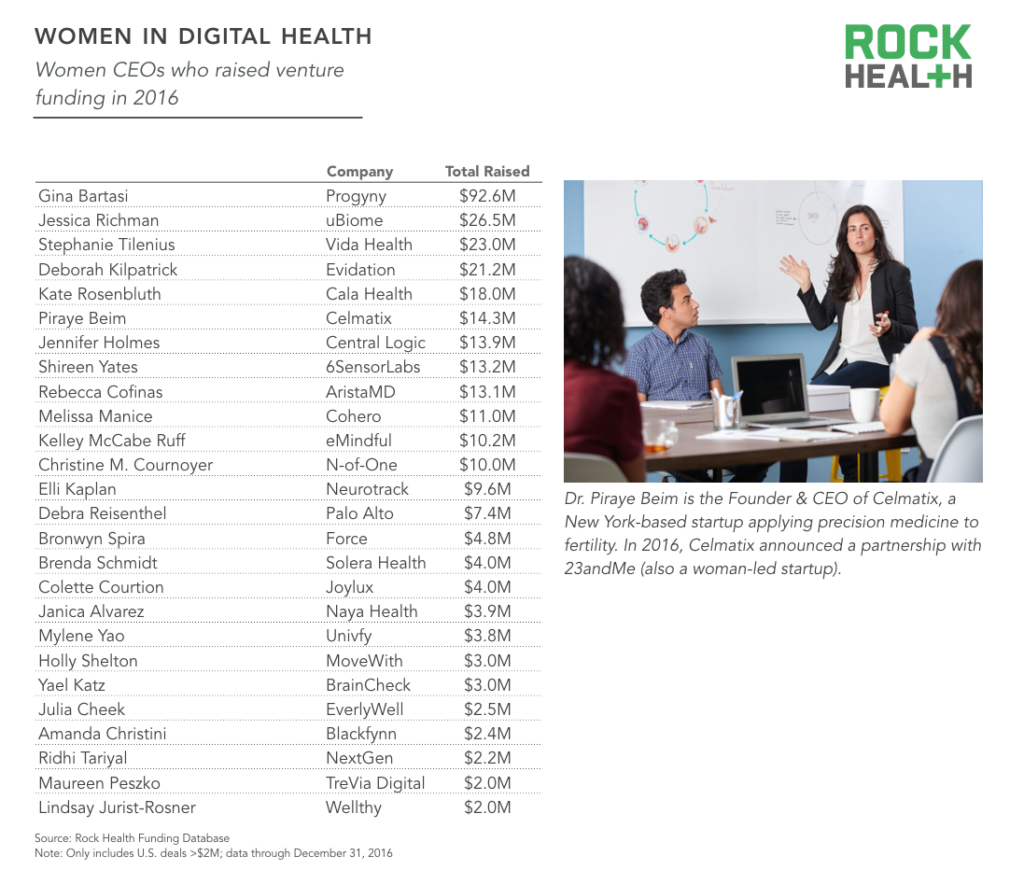

Twenty-six women CEOs received funding in 2016, but men still make up the vast majority of digital health CEOs.

Despite recent diversity efforts, men still make up the vast majority (91%) of funded digital health CEOs. Of the companies funded in 2016, only 9% had a woman CEO, down from 11% in 2015.

The majority of women CEOs have advanced graduate degrees; one-third have MBAs (compared to a quarter of men), 10% have a Ph.D, and 8% have an MD.

States with the most women digital health CEOs include California (27), Massachusetts (8), and New York (8). The state of Washington has the highest percentage of women CEOs—of 24 funded digital health companies in the state, 17% have women CEOs.

Source: Rock Health Funding Database

Source: Rock Health Funding Database

M&A

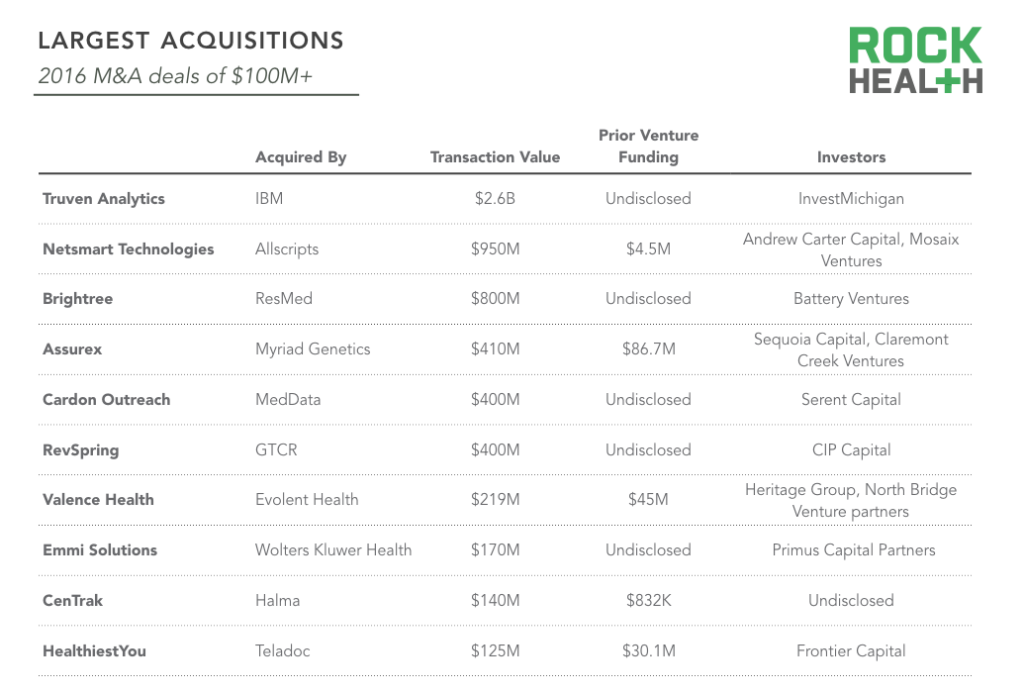

We tracked 136 M&A deals throughout 2016 worth $6.8B in disclosed transaction value, up 9% from 2015.

Investors often lament the dearth of exits in digital health. They’ll be happy to know we counted over $6.8B in disclosed M&A transactions (136 deals, 31 in which amounts were disclosed), which is 9% higher than 2015. (Note: in order to be consistent and accurate, we only count transactions where the target company is US-based, regardless of the acquirer’s location). Ten companies sold for $100M+ in 2016, including:

Source: Rock Health M&A Database

Note: Only includes U.S. targets; data through December 31, 2016

Companies that sell to hospitals were popular acquisition targets in 2016, including 10 physician practice management technology companies, 11 hospital administration tools, and 21 companies building EHR/clinical workflow tools. The most common type of acquirer continued to be other digital health companies, followed by tech companies. Welltok made their sixth digital health acquisition this year (Keas), and Teladoc made their fifth acquisition (HealthiestYou).

Public Markets

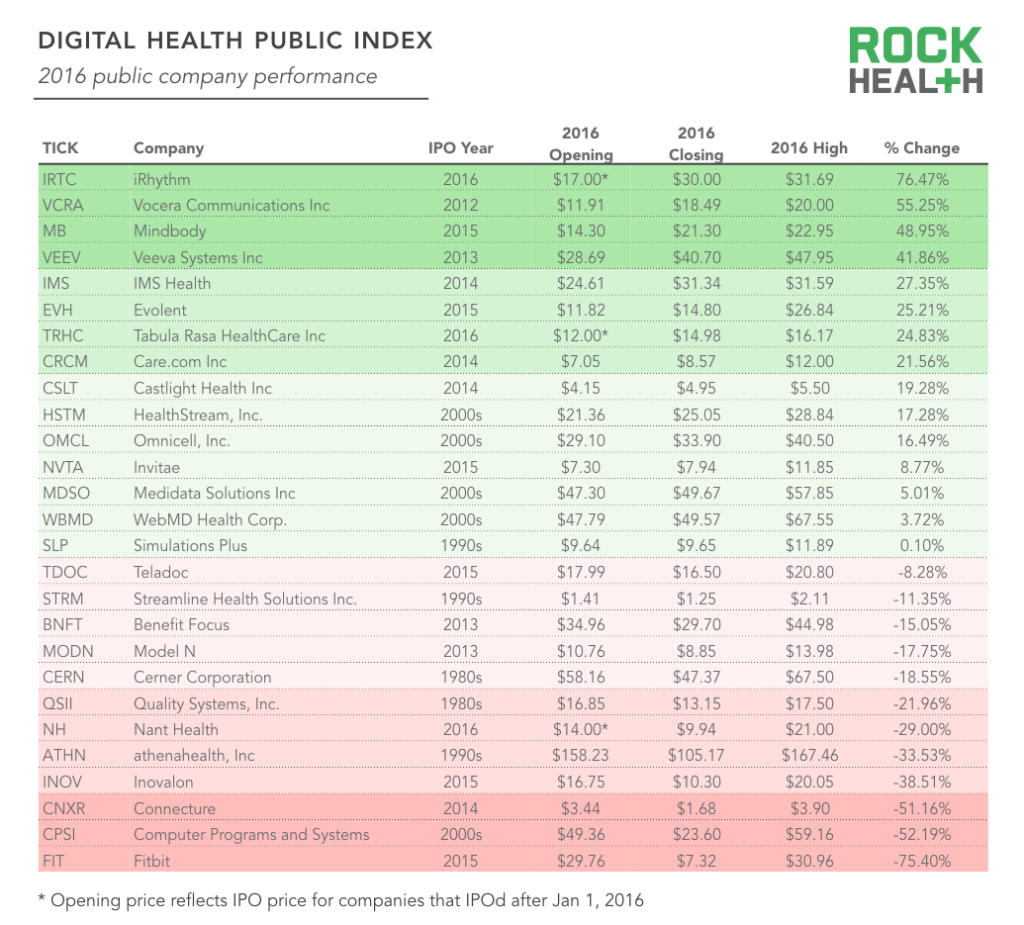

On the backdrop of what Bloomberg called “the worst year for US healthcare shares since the Great Recession,” three digital health companies raised a total of $250M on the public markets in 2016.

Three digital health companies raised a total of $250M on the public markets in 2016, including Nant Health, Tabula Rasa HealthCare, and iRhythm. Overall it was a lackluster year for IPOs—only 105 companies across all industries went public this year, down from 170 in 2015 and 275 in 2014.

The Digital Health Public Company Index reached nearly $55B in market capitalization by the end of 2016. Of the 17 digital health companies that have IPO’d since 2011, only one (IMS Health) has reached a market capitalization of $10B—otherwise known as a unicorn. Veeva Systems has a market cap of $5.7B, and the remainder (e.g., Castlight, Fitbit, Teladoc) are valued below $2B.

The biggest market winners of 2016 included recently-public iRhythm, Vocera Communications, and MindBody. The stocks which lost the most value in 2016 included Connecture, CPSI, and Fitbit. Overall, the Digital Health Public Company Index was down 2% for the year, compared to the S&P 500 which was up 14% and the S&P Information Technology Sector which was up 12% for the year.

tl;dr

2016 was a strong year for digital health, but it also created an environment for discretion and focus for founders and investors alike. Demand for healthcare is inelastic—and as a defensive sector, it has historically been protected from economic and market downturns. While we sensed some caution from both founders and investors due to the election and uncertainty around the future of the ACA (hear our conversation on that subject), we remain optimistic in the strength of the sector and the value of the companies improving our healthcare system.

Funding Venture funding for digital health companies reached $4.2B in 2016, down 8% from 2015. This represents a compound annual growth (CAGR) from 2011-2016 of 30%. There were 304 deals across 296 companies, closing with lower average deal size of $13.8M.

Major themes The top six themes of the year that received 19% of all funding included: genomics and sequencing, analytics and big data, wearables and biosensing, telemedicine, digital medical devices, and population health management. The genomics and sequencing category saw a 227% YoY increase, buoyed by Human Longevity’s $220M Series B.

Prolific investors Digital health continues to attract the attention of investors; 451 unique investors made bets in digital health this year— including 237 new investors who made their first digital health investment in 2016. Forty investors were “active” this year, closing three or more deals.

Exits activity 2016 was a strong year for digital health M&A transactions, with 136 deals worth $6.8B in disclosed transaction value, up 9% from 2015. Digital health companies continued to be the most active acquirers, with technology coming in second. Public markets remained a viable exit with over $2B in current market capitalization created through three new digital health IPOs.

1/10/2017 EDIT: Thanks to Rick Beberman for pointing out that if we remove Jawbone’s $300M round in April of 2015 (which is actually debt, not equity), the YoY funding decrease adjusts from 8% to 2.5%.

Want the raw data? Download it now. For full access to our research, insights, and experts, become a Rock Health partner—email partnerships@rockhealth.com.

How we track digital health funding

Rock Health funding data only includes disclosed US deals over $2M. Deals under $2M would be impossible to track comprehensively since companies often do not file their small seed rounds with the SEC or disclose to press. We also believe that deals under $2M generate noise in key statistics, including deal count and average deal size. Disclosed deals under $2M represent less than 5% of the total we report, giving us confidence in our overall figures.

In prior years, we have attempted to include international companies that were funded by U.S. investors, monitoring the portfolios of hundreds of VCs. In reviewing this data, we have concluded that it is challenging to track all international deals and beginning with our 2014 year end report, we are no longer tracking or reporting any international deals. All numbers in this report are for U.S.-based companies only.

Funding tracked includes debt, venture rounds, and growth equity but excludes lines of credit (working capital) and cash/equity associated with merger or acquisition activities.

Deals data is gathered based on publicly available resources (press releases, news outlets, SEC filings, etc.) and supplemented with CapIQ’s venture data.