Q3 2018: An entrepreneurs’ market leads to digital health’s biggest quarter yet

There has never been a better time to raise money in digital health than in Q3 2018. The pace of fundraising by individual startups suggests it’s an entrepreneurs’ market in which founders are raising larger and more frequent rounds, while the crop of maturing companies in digital health continues to grow.

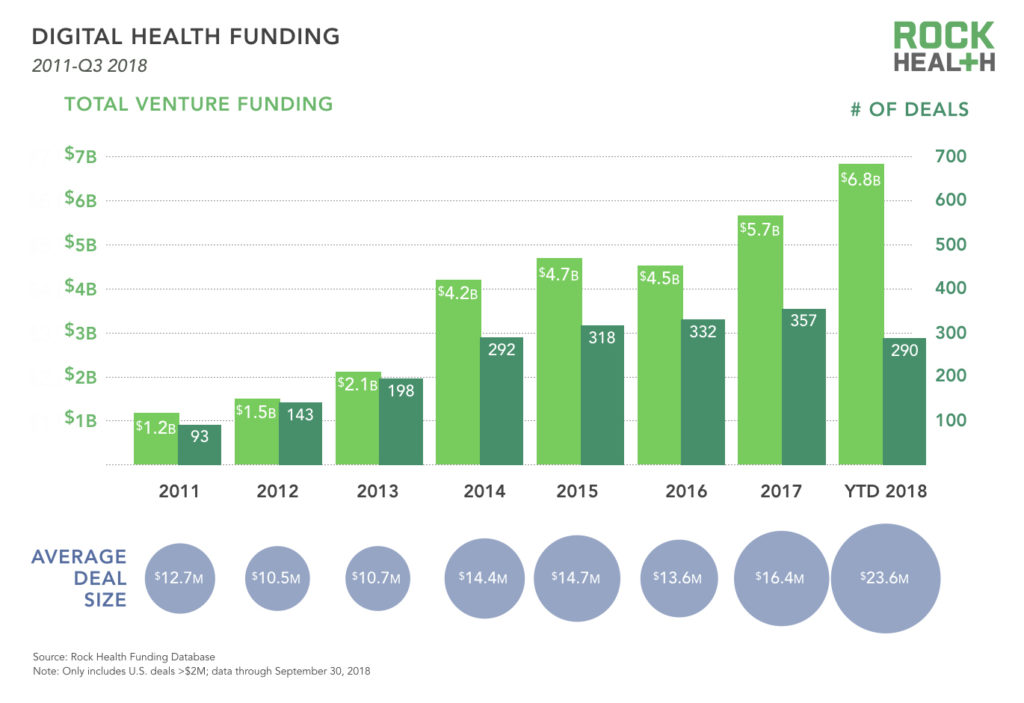

Taken together, these factors have combined to yield the largest quarter ever in digital health venture funding, with $3.3B invested in Q3 2018 alone. The quarter’s funding surge pushed 2018 YTD1 funding to a total of $6.8B, already exceeding last year’s annual funding total by more than a billion dollars. The sheer amount of dollars and deals is notable—but numbers alone don’t tell the full story of the progress made in digital health thus far in 2018.

- More and more startups continue to crack the regulatory code, with 31 FDA approvals in digital health so far this year

- The majority of investors backing digital health companies this year (59%) are repeat investors in digital health

- More deals are being done than ever before, a sign that more investors are spending more time on digital health

Here’s our full quarterly wrap up on the digital health investment market:

1. With one quarter to go, 2018 has already surpassed 2017 as the largest venture funding year yet for digital health companies

Across Q3 2018, digital health startups raised $3.3B over 93 deals, bringing the annual YTD total to $6.8B. Even with one quarter left to go, 2018 has surpassed 2017’s funding total of $5.7B. Larger deals—rather than number of deals—account for this bump, with the average deal size on the year soaring to $23.6M. Even excluding the six deals in 2018 over $200M, average deal size is still greater than last year ($17.6M compared to $16.4M). So far, ten companies have raised mega-deals over $100M in 2018 (note: Q3 deals are bolded): Livongo ($105M), Collective Health ($110M), Tempus ($110M), Outset Medical ($132M), Helix ($200M), HeartFlow ($240M), Butterfly Network ($250M), American Well ($291M), 23andMe ($300M), and Peloton Interactive ($550M).

2. Fundraising rounds in digital health are bigger, at every stage

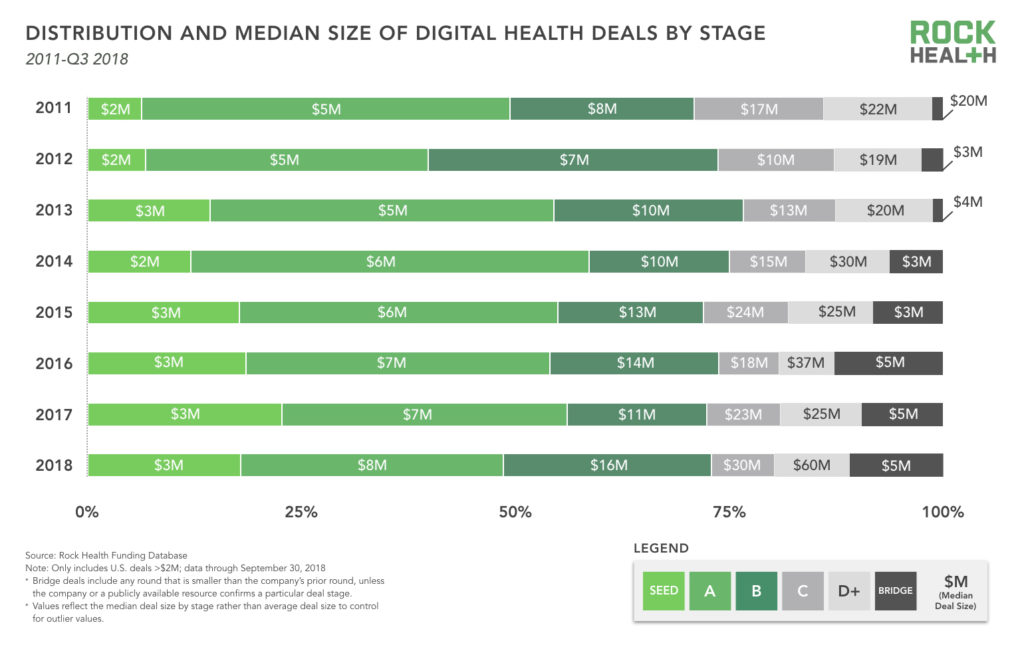

A number of signs point to a favorable fundraising market. Foremost, median deal size by round continues to climb: The median A round today is the size of a Series B in 2011, and the median Series B looks like an old Series C. This trend reflects the overall venture market beyond digital health—Pitchbook reports, “angel and seed rounds… have come to closely resemble historical early-stage rounds.” In digital health, A is the new B.

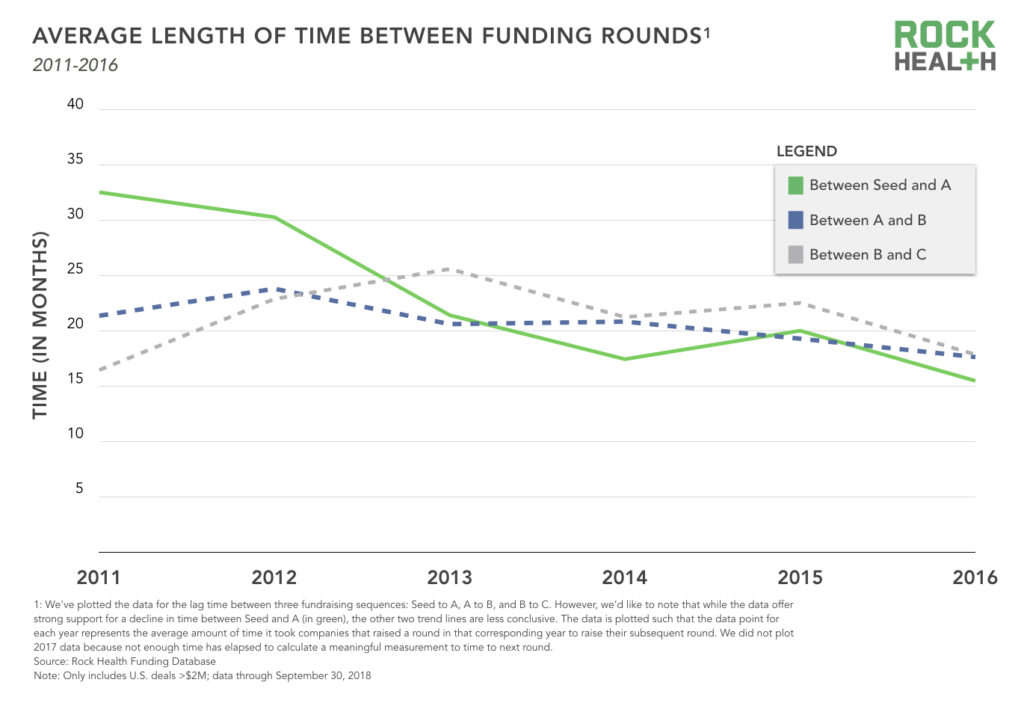

Digital health entrepreneurs aren’t just raising larger rounds—they’re also raising sequential rounds closer together than ever before, particularly in the Seed-to-Series A sequence. The average time between a company’s raises has steadily declined over the past few years. For instance, a company that raised a seed round in 2013 waited an average of 21 months before raising its A. Comparatively, a company that raised its seed in 2016 was likely to raise its A within 15.5 months.2

3. Investors are supporting the shift to healthcare at home

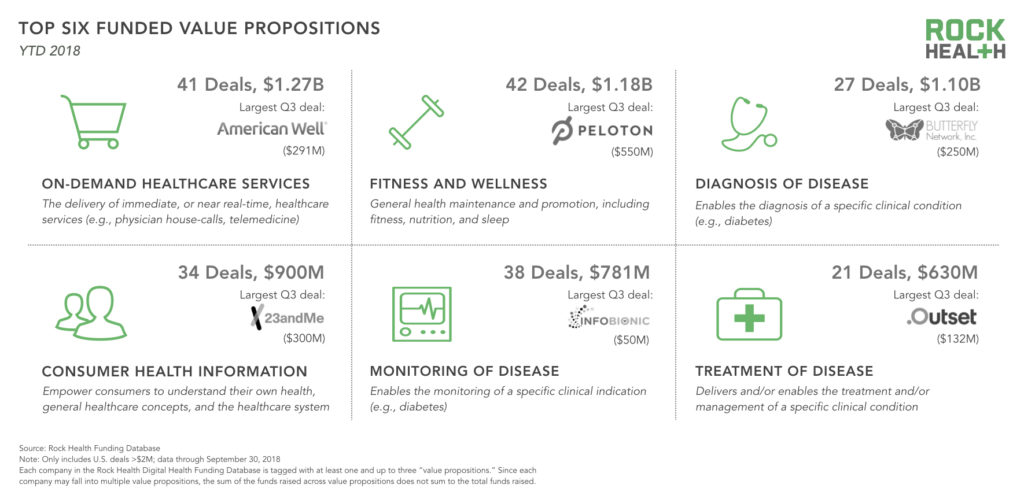

Across the first three quarters of 2018, companies offering on-demand healthcare services as a primary value proposition attracted the most funding. The largest Q3 round in this category went to American Well ($291M), one of the ten mega-deals so far this year. This category contains diverse services offered in or near real-time through various channels. Examples include: Doctor on Demand, a platform enabling patients to video chat with licensed physicians; Honor, an online senior in-home care agency platform; NowRx, an on-demand prescription delivery service; and Nurx, teleprescriptions and home delivery for birth control and PrEP for HIV prevention.

Companies developing digital therapeutics—solutions utilized to support the monitoring and treatment of disease—have raised significant funding so far this year, including: Pear Therapeutics ($46M), Click Therapeutics ($17M), Akili Interactive Labs ($68M), Virta Health ($45M), Propeller Health ($20M), and Hinge Health ($26M).

The top six most-funded value propositions support a shift in the care paradigm, enabling patients to manage their health at-home. While there is still consumer demand for in-person provider relationships, there is an increasing focus on companies that connect patients (and patient data) with providers and care in more continuous, accessible, convenient ways.

4. Corporate VCs are flexing their pocketbooks while deepening strategic partnerships

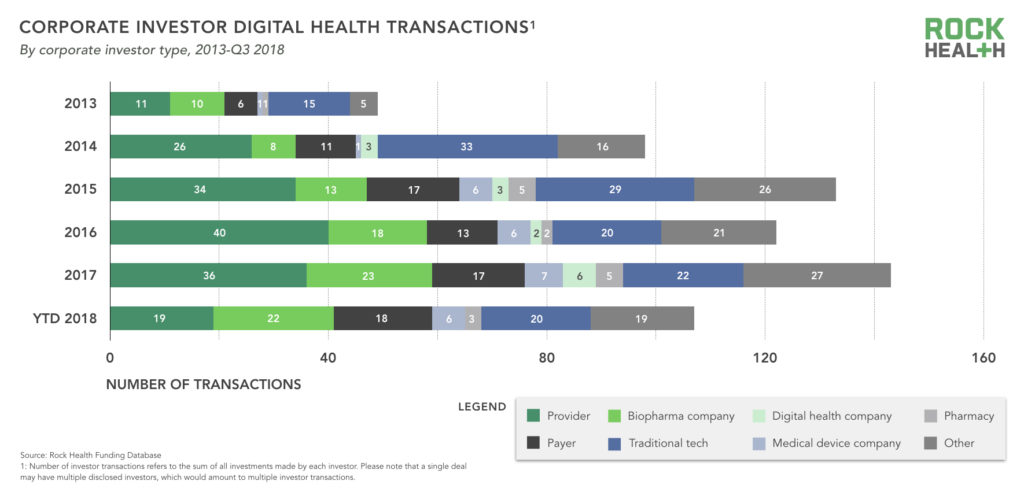

Independent venture funds are still the predominant investor type in digital health, accounting for 63% of 2018’s disclosed investor transactions. Corporate VCs (CVCs) participated in 15% of investor transactions, and many are investing in digital health companies as part of a broader partnership strategy. Here are a few noteworthy strategic investments and partnerships made or expanded upon in 2018:

- In July, GSK invested $300M in 23andMe as part of a four-year collaboration, giving GSK exclusive rights to mine 23andMe’s customer data for drug targets. About 80% of 23andMe’s 5M users opt in to share their data for research purposes, and their survey responses about health and habits enable research into potential links between genetics and conditions, which could reveal potential drug targets. Together they have identified Parkinson’s as a joint area of focus.

- Abbott and Bigfoot Biomedical initiated a partnership last year to integrate Abbott’s continuous glucose monitor, FreeStyle Libre, with Bigfoot’s insulin delivery system. This year, Abbott participated in Bigfoot’s $55M Series B. The funds will help Bigfoot build its diabetes platform, connecting insulin pens, pumps, and glucose monitors to smartphones.

- Cigna led Omada Health’s $50M round in 2017 and expanded their commercial partnership in Q3 of this year. Cigna will offer Omada’s solution to customers with prediabetes and those with a higher risk of chronic conditions such as heart disease and hypertension.

- OSF Ventures participated in this year’s funding round for Level Ex, a company offering apps for physicians to practice diagnosing and performing surgery on virtual patients. In addition to OSF clinicians using Level Ex’s existing apps, OSF hopes to find additional opportunities to collaborate on delivering medical education and training digitally.

Overall, corporate VCs completed 102 deal transactions thus far in 2018. Biopharma companies and tech CVCs (e.g., the Amazon Alexa Fund, Baidu Ventures, GV, Comcast Ventures) each accounted for nearly 20% of those transactions. And provider and payer CVCs have each participated in nearly as many deals.

5. Big tech’s continued push into healthcare: a rising tide lifts all boats?

In the first half of the year, Amazon doubled down on its PBM strategy and acquired PillPack, sending shockwaves across the pharmacy space. Then, just a few weeks ago, Apple announced its Apple Watch Series 4, which has fall detection and an FDA-cleared sensor capable of taking ECG readings and testing for atrial fibrillation. But Apple isn’t the only company exploring elderly monitoring—Google is considering how its Nest product could offer home monitoring for the aging population (and Nest’s own digital health ambitions were revealed by the news that Nest, not Google, acquired smartphone-based health monitoring developer Senosis). Amazon’s Alexa could have similar applications.

It’s unclear exactly how big tech’s strategies will impact startups operating in these market segments. After the Apple announcement, AliveCor’s CEO noted Apple is doing “the thing we’ve been doing for seven years,” referring to its products for detecting atrial fibrillation, one of which received FDA clearance in 2014. While companies may point to proprietary algorithms, competitive pricing, and other features as a means to stay differentiated, big tech entering into the remote monitoring and home care spaces could be a big competitive disruptor. Conversely, the attention big tech brings to digital health is likely to stoke demand and educate consumers, expanding the market for all players. Here are some of the market segments to watch in the short-term:

- On-demand pharmacies: Companies such as Blink Health, NowRx, Alto, Nimble Pharmacy, and TelePharm may be competing with Amazon soon (Amazon’s PillPack acquisition also impacts direct competitors like CVS and Walgreens, who saw their share prices fall after the announcement).

- Telemedicine with a prescription component: Companies like Roman, Hims, Nurx, and Lemonaid may find that Amazon is seeking to enter the on-demand prescription market.

- Home care: Every big tech company is competing in the smart-home space, but nobody has emerged as a clear leader in leveraging this technology for medical purposes. As they make progress, these companies will compete with all kinds of at-home health solutions including remote monitoring, patient medication adherence, telemedicine, and on-demand symptom checkers and triage.

Still, it may be premature to read too much into these “big moves.” Apple acquired Gliimpse, a secure platform for consumers to manage and share their own medical records, in 2016. Two years later, it appears that this acquisition enabled Apple to advance its strategy, while digital health startups such as CareCloud, Modernizing Medicine, and drchrono have carried on.

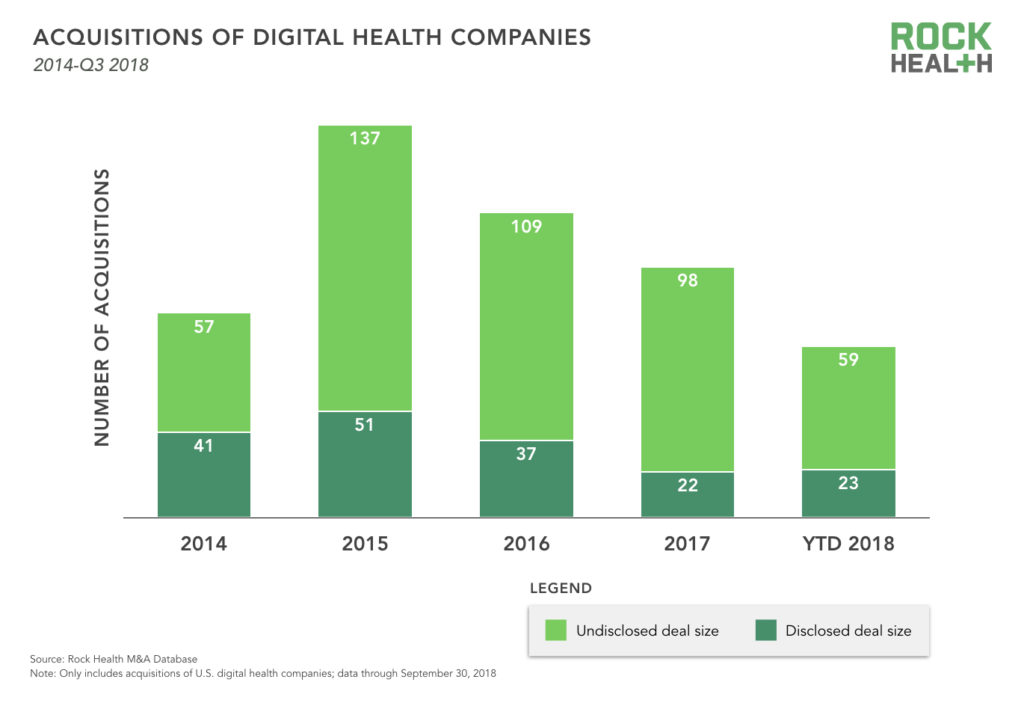

6. Exits remain sluggish, with digital health companies proving to be the most likely acquirer for other digital health startups

Eighty-two digital health companies were acquired in the first three quarters of 2018, almost on pace with 2017’s year-end total of 120. Companies focused on enhancing electronic health records and clinical workflow were the most likely to be acquired, with 11 companies making an exit. The IPO drought continues (the last digital health IPO was in 2016)—but as we discussed in our 2018 midyear report, a slow exit market isn’t unique to digital health. The Digital Health Public Company Index is up 38% YTD, compared to the S&P 500 Index which is up 8.99% YTD.

We’ve witnessed broad healthcare consolidation, but it remains to be seen if consolidation in the digital health space will accelerate. Though certainly not yet a trend, a couple of data points suggest a shift in this direction—a shift we believe will accelerate in the year or two ahead. Our data suggest digital health companies are far and away the most prolific type of acquirer, accounting for about half of all M&A deals this year (payers, providers, and pharma are each the acquirer in less than 10% of M&A deals). With available capital and a desire to build out product lines, talent, and client bases, it’s not surprising to see a great deal of M&A activity within digital health. For example, in September, Welltok acquired WellPass (itself a merger between Sense Health and Voxiva), continuing Wellotk’s acquisition spree of digital health companies including Mindbloom and Predilytics. Given this trend, we speculate a mix of private equity and growth stage investors will at some point fuel a period of consolidation in digital health as investors look to package valuable, complementary products together into larger service offerings.

We’ll continue exploring funding and exit trends at our upcoming seventh annual Rock Health Summit. Tickets are going fast—snag yours before they’re gone!

A special thank you to our generous industry partners for their continued support. Learn more about how your organization can work alongside Rock Health.

1YTD represents funding totals through September 30, 2018.

2We’ve plotted the data for the lag time between three fundraising sequences: Seed to A, A to B, and B to C. However, we’d like our readers to note that while the data offer strong support for a decline in time between Seed and A (in green), the other two trend lines are less conclusive.