We’ve entered an unprecedented market for aging in place

The aging of America presents a unique window of opportunity to support aging in place1 with digital health technologies. A confluence of factors have coalesced to align incentives across payers, older adults, and their families and caregivers. This has created a unique opportunity for digital health-driven transformation. In this review, we discuss three reasons why 2020 marks a material turning point for aging in place and highlight eight areas where we see opportunity for entrepreneurs and investors.

A unique window of opportunity

In 2020, three factors are converging to make us particularly bullish on digital health tools for aging in place:

1. An aging population comprised of tech-savvy Baby Boomers

Baby Boomers2 are driving a significant and lasting shift in the age distribution of our country—one that we are not prepared to manage. Ten thousand Baby Boomers turn 65 years old every day, and by 2030, 18% of the US population will be age 65 or older (compared to 13% today). With this new equilibrium, national health expenditures will increase, Social Security will be strained, and our healthcare workforce will struggle to meet demand. Given the growing costs of independent and assisted living, many middle-income seniors will not be able to afford long-term care. In addition, older adults already face long wait times for care at home amid a home care workforce shortage. To meet these new challenges—and opportunities—we need transformative innovation in senior care. Digital health is poised to offer critical solutions.

We anticipate a growing appetite for solutions that enable older adults to age in place. The US home care market is expected to grow from $100B in 2016 to $225B by 2024. The trend is driven by Baby Boomers, who overwhelmingly prefer to age in place. But, while 77% of people age 55 and older want to age in place, only 50% think they will. As investors, we see a unique opportunity for technology to close the gap.

Conventional wisdom currently lags reality: Baby Boomers are active users of technology—their smartphone use has more than doubled over the past eight years, and 40% self-identify as early tech adopters. When it comes to healthcare, 78% of Baby Boomers use technology to access medical information.

However, tech startups have historically overlooked older adults in favor of Millennial and Gen Z users. Many existing tech products are not designed to deliver value for older audiences. Building for older adults may require different UX/UI principles than the sleek, minimalist ones attractive to younger audiences, and distribution channels need to be thoughtfully crafted to reach seniors outside of Facebook or YouTube. Companies that meet these challenges (e.g., Virtual Senior Center, GoGoGrandparent) are better positioned to capture underinvested older adult markets.

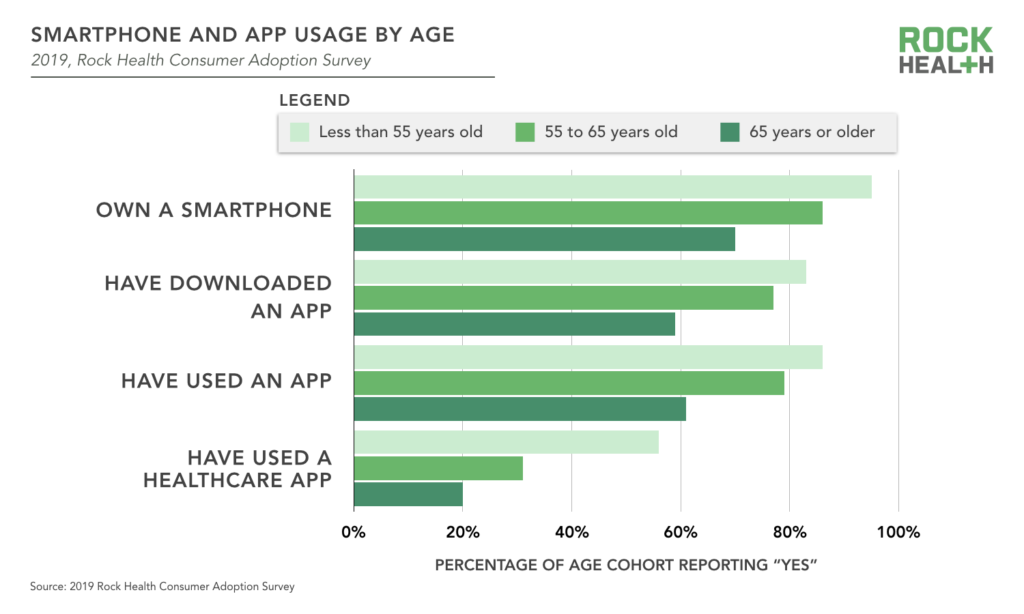

Rock Health’s 2019 Consumer Adoption Data confirmed and expanded on these findings: we saw ample adoption of technology among older adults even before the COVID-19 pandemic—particularly those 55 to 65 years of age. Nonetheless, we also see gaps that suggest digital health companies can design products better suit seniors’ needs. The vast majority of respondents 55 to 65 years old own smartphones, and download and use apps. In fact, smartphone and app use among people 55 to 65 is near that of their younger counterparts (generally within 10%). However, this gap more than doubles for usage of healthcare apps specifically. Given that Baby Boomers use apps in non-healthcare contexts and indicate they want to use technology to track health information, we believe that lower adoptions rates may be more due to a lack of healthcare apps designed for and marketed to Baby Boomers than a result of Baby Boomer preferences or reluctance to adopt.

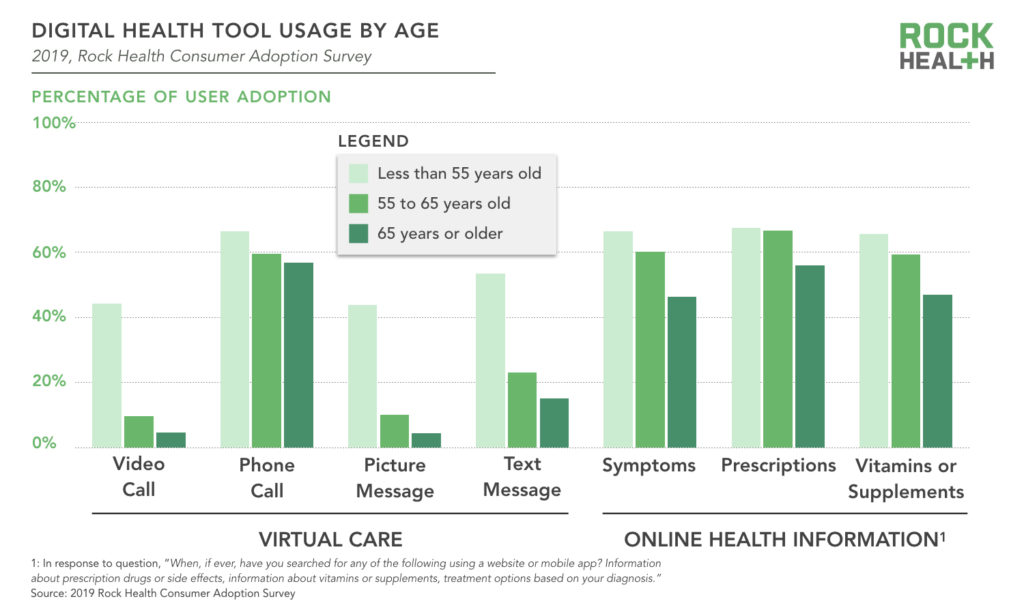

To bring digital health to older adults, we need to meet them where they are and design products they are comfortable using. In 2019, older adults—particularly those 55 to 65 years of age—searched for online health information nearly as much as their younger counterparts. Search advertising and digital education tools, therefore, may be a promising entry point for digital health solutions. Similarly, adults 55 to 65 years old have live phone calls with providers almost as much as their younger counterparts. It may also be useful to build voice-first products for older adults centered around phone calls or voice assistants, to build on already routine behavior.

2. Regulatory and policy changes have created new incentives for aging in place

Over the past two years, CMS introduced two new types of supplemental benefits that opened the door to improved at-home coverage for those on Medicare Advantage plans. “Targeted benefits,” the first benefit introduced by CMS in 2019, allow Medicare Advantage plans to offer a wider range of services non-uniformly to beneficiaries. These targeted benefits may include services that “diagnose or compensate for physical impairments, act to ameliorate the functional/psychological impact of injuries or health conditions, or reduce avoidable emergency and healthcare utilization.” “Chronic benefits,” the second benefit introduced by CMS in 2020, allow Medicare Advantage plans to cover anything with a “reasonable expectation of improving or maintaining the health or overall function” for beneficiaries with one or more chronic diseases. Together these new types of supplemental benefits allow Medicare Advantage plans to cover services essential to aging in place such as in-home services, meals, transportation, and activities of daily living (ADL) and instrumental activities of daily living (IADL) support. To the extent that aging in place digital health solutions can decrease costs and increase member acquisition or retention, Medicare Advantage plans are opening themselves up to be potential cornerstones of a viable go-to-market strategy.

The aging population is increasingly on employers’ radars as well. On the one hand, employers are faced with an aging workforce. By 2024, one in four workers in the United States will be age 55 or older—a massive shift from the one in ten workers just thirty years ago. On the other hand employers are also managing a caregiving crisis. Unpaid caregivers with full- or part-time jobs spend an additional 20 hours per week caring for older loved ones and 80% report that their dual roles impact productivity. Given that caregiving responsibilities fall disproportionately on women and people who are Black or Hispanic, this represents not just a monetary problem for employees, but also a diversity one.

While employers were at first slow to recognize the caregiver crisis, the tide is rapidly turning: 62% of employees report that it is important to their company to be identified as a “caregiver-friendly” workplace, and 84% believe caregiving will become an increasingly important issue to employers over the next five years. With incentives to improve productivity and meet evolving employee needs, employers are primed to invest in digital health solutions that support caregivers.

3. Digital adoption accelerating due to COVID-19

As COVID-19 has surfaced new fears associated with long-term care facilities, the desire for aging in place has accelerated. Long-term care facilities, which are often underfunded and understaffed, are finding themselves under increased scrutiny. Families have grown fearful and, as a result, senior housing occupancy has hit a 15-year low. In addition, COVID-19 has accelerated technology adoption, as telemedicine services among seniors increased 300% during the pandemic. More healthcare visits are happening virtually and—particularly for older adults—the trend is anticipated to persist. We anticipate COVID has dramatically increased older adults’ comfort with technology—a shift that will accelerate their adoption of digital health tools.

These three factors have coalesced to form a moment of unprecedented and aligned appetite to facilitate aging in place. But older adults still perceive barriers: 29% fear they won’t be able to afford to live at home, 24% feel their homes are not suitable, 19% worry they would feel alone, and 17% think they would not be close enough in proximity to friends and family. Digital health solutions can mitigate these challenges and meet the demand for aging in place.

Digital health can meet the demand to age in place

We see digital health solutions playing important roles through (1) direct enablement of aging in place by bringing accessible, scalable care/support into the home setting and (2) indirect enablement of aging in place through tools that help older adults and their families navigate complex systems or offer caregiver support. As we follow the quickly evolving landscape,3 we see eight areas of opportunity:

1. Bringing transparency to Medicare Advantage open enrollment and supplemental benefits

Older adults perceive ability to pay as the top barrier to aging in place. Due to recent reimbursement changes, a handful of Medicare Advantage plans now cover care essential to aging in place (e.g., support for family caregivers, in-home support services, in-home palliative care). But the process of choosing a plan during open enrollment remains opaque. One in three Medicare beneficiaries find it difficult to compare Medicare options, and nearly half rarely or never review/compare them. Consumers thus find it difficult to informedly select a Medicare Advantage plan, and insurance companies are less able to leverage benefit offerings as a competitive advantage in the market.

We see opportunity for digital health tools to offer consumers more transparency into their choices during Medicare Advantage open enrollment. Existing players such as eHealth, GoHealth (which went public in July), Assurance, Connie Health, EnrollHero, and HealthSherpa have largely used online platforms to connect consumers with licensed insurance agents who are empowered with digital tools to compare and provide quotes for Medicare Advantage plans. Walmart recently confirmed its expansion into the space, and sparse details suggest they, too, will be bolstering insurance agents through technology. We see room for solutions that allow individuals to compare plans themselves, and that recommend plans most suitable for an individual’s specific goals. One such company, EnterMedicare, focuses on recommending Medicare Advantage plans based on older adults’ medical needs. We see room for more players—especially ones that seek to match individuals with the supplemental benefits of Medicare Advantage plans that support aging in place.

2. Fighting loneliness and its detrimental effects on mental health

Older adults cite fear of being alone as the top emotional barrier to aging in place. Social isolation is also a health risk—loneliness is associated with progression of mental and physical conditions such as heart disease, Alzheimer’s, and depression. While long-term care facilities offer community, group interaction and activities are not easily accessible at home. Even before COVID-19, people 60 years and older spent more than half of their day alone.

We’re excited about the role tech can play to help seniors stay connected during the pandemic and beyond. An encouraging number of emerging startups are creating communities to combat loneliness in tandem with other pain points of aging. Companies such as ElliQ leverage AI to scalably offer companionship and help older adults manage day to day appointments and reminders. Nesterly, Silvernest, Papa, and Mon Ami connect older adults with younger companions who can assist with shopping or other ADLs. Revel and Element3 Health create communities for seniors with shared interests, keeping older folks mentally and physically active. While some of these companies focus on AI connection or virtual communities—a necessity during the pandemic—we believe hybrid solutions that offer some element of in-person connection while enabling scale through digital platforms will be best positioned to succeed in the long term. Furthermore, given that loneliness is one of the top factors leading to depression and suicide, and men ages 85 years or older have the highest suicide rate of any age group, we forsee expansion opportunities for existing group teletherapy players (e.g., Supportiv, NEST Health, Hims) to expand to the senior market.

3. Supporting older adults who experience food insecurity

Food insecurity among older adults has severe effects on quality of life and health, and reduces one’s chances of aging in place. Over 10% of older adults are food insecure, and food insecurity has disproportionate impacts on people who are Black or Hispanic, dual-eligible, and/or live alone. With government relief falling short, thousands of older adults are stuck on waiting lists for programs like Meals on Wheels, and are at risk of starvation. This translates to larger expenses for health systems and health plans, as seniors who struggle with food insecurity experience more hospitalizations and higher costs of care.

Companies such as Aunt Bertha and NowPow are bridging the gap between healthcare systems and social services by identifying resources for high needs patients. UniteUs further offers closed loop referrals. While these companies serve important roles, the average Medicare beneficiary only has contact with a health system 17 days per year. We see white space for solutions that directly address the day-to-day challenges of food insecurity. For instance, Propel helps people who qualify for food stamps manage their EBT benefits and shop for healthy, affordable food. While people of all ages experience food insecurity, we are particularly excited about products designed to be accessible for older adults that democratize food as medicine diets, with particular emphasis on meeting the unique nutritional needs of older populations.

4. Bridging the gap between seniors and healthcare professionals

9 in 10 Americans find it challenging to obtain, process, and understand basic health information and services needed to make appropriate health decisions. Older adults struggle more than their younger counterparts: 29% of adults age 65 and older have “below basic” health literacy compared to 10% to 13% for other age groups. Low health literacy is correlated with decreased chances of aging in place, increased emergency department visits, and increased hospital readmissions. It is estimated to cost the US economy $106B to $238B annually.

Health systems and providers play key roles in delivering understandable care. Indeed, institutions that prioritize effective communication, provide easy access to health information, services, and navigation, and include their patients in design, implementation, and evaluation deliver more understandable, higher quality care. We see an opportunity for digital health solutions to integrate into care delivery systems and provide patients with understandable information and navigation support, tailored to their clinical needs. ConsejoSano provides patient engagement solutions centered around culturally competent care navigators. Education startups Osmosis and SketchyMedical, while targeting medical school students rather than patients, offer visual information on complex medical topics. Digital health companies that sit at the intersection of information and navigation must be cognizant to design with older adults in mind—especially as they benefit from visual explanations and repetition.

5. Enabling at-home rehabilitation—particularly in rural areas

Transitions to home after major health events are difficult, and the current state of discharge instructions don’t make it easy for older adults. As some of the top causes of hospitalization among older adults, cardiac events and stroke remain high priorities for innovation within rehabilitation. We see room to help people recover at home, especially in more rural communities. In urban areas with greater access to specialist care, hospitals have robust referral networks to stroke and cardiac rehab centers that will be harder to disrupt. Rural areas, however, have fewer specialists and poorer access to stroke and cardiac rehabilitation centers. In response, the CDC has placed an emphasis on enabling telemedicine solutions for cardiac and stroke rehab to address some of the stark inequality in health outcomes between rural and urban populations that arises after age 65.

Our portfolio company Neurotrack provides solutions upstream of emergencies, allowing older adults to detect, track, and manage their cognitive health at home. Startups such as Moving Analytics and Recora Health are building at-home digital rehabilitation clinics for cardiac care while companies such as MindMaze and FlintRehab assist with stroke rehab. But overcoming the realities of slow broadband internet speeds that have prevented telemedicine adoption in rural areas will not be easy. We’re excited about companies that design solutions for rural communities first, taking into consideration the obstacles urban areas far too often take for granted.

6. Extending the acuity of care that can be safely delivered at home

Delivering higher acuity care at home has the potential to ease care transitions and improve health outcomes. By moving patients from hospitals and post acute care facilities to home settings, we can decrease strain on at-capacity providers, lower costs, and reduce hospital acquired infections—especially for high-risk patients. Fear of hospital-acquired COVID-19 infections has already accelerated the adoption of hospitals at home, particularly among Medicare populations. CMS is also leading the charge to spur this trend, proposing Medicare payment changes to support increased access for dialysis at home.

Of course, at-home care can only be accomplished if the necessary medical teams and equipment are readily available. Medically Home offers a virtual hospital for patients in the home setting, while Tomorrow Health allows patients to access in-home healthcare equipment and supplies, often referred to as durable medical equipment, to manage their conditions (e.g., ventilators, catheters, prosthetics). Along with these platforms, other companies offer full-stack care programs for specific clinical indications. For example, Cricket Health and Somatus support people with kidney disease through a combination of remote monitoring, in-home dialysis, and coordination with care teams. We see further opportunities for companies to offer thoughtful end-to-end services that help patients and providers manage more acute conditions at home.

7. Connecting more home care providers to families—especially for assisting ADL and IADLs

Family members often step up to care for older loved ones. Given the association between caregiver stress and patient admission into long-term care facilities, solutions that address the high rates of caregiver burnout are central to making aging in place more sustainable. More than 1 in 6 Americans help care for older family or friends, and despite avenues for caregivers of veterans and Medicaid enrollees to be compensated, caregivers at large still accrue $450M in unpaid work per year. Caregiving is associated with higher levels of depression and anxiety, worse physical health, and increased risk of premature death. There is particular concern for mothers in the “sandwich generation,” who care for both their children and aging parent(s), and report greater stress levels as compared to other age groups. Addressing the factors most associated with high caregiver stress—physical strain, sleep deprivation, and financial hardship—can improve quality of life for caregivers and keep older adults in their homes for longer.

Bringing paid caregivers into the home—especially to help older adults with ADLs and IADLs—can reduce physical strain and burnout for unpaid caregivers. But home care can be hard to find. Rock Health portfolio company Honor makes it easier to find reliable, trusted home care. By partnering with home care agencies, Honor creates a national network of providers and empowers them to expand and serve more people. Honor then leverages this network to help families find home caregivers for older loved ones and stay up-to-date with their care.

Given the homecare worker shortage, there is a growing market for solutions that increase the supply of home care providers. We see opportunities for companies to operationalize and scale home care provider recruitment and training required to build the workforce necessary to serve our aging population. For example, CareAcademy provides virtual training for home care agencies’ new hires. NextStep provides a new source of home care professionals by recruiting prospective caregivers from other industries and training them virtually.

8. Proactively supporting unpaid caregivers as they navigate complex decisions

Unpaid caregivers may select insurance, coordinate home care, and make end of life decisions for older adults. These decisions can be complicated and unrelenting, leading to decision fatigue among caregivers. COVID-19 has exacerbated these concerns, as one in three unpaid caregivers had thought about suicide in June 2020. These issues have not escaped notice at a national level, with presidential candidate Joseph Biden making a $775B commitment to working parents and caregivers.

We see a huge opportunity to effectively support caregivers, and several digital health companies are already changing how families navigate care for older loved ones. Bright Horizons, Torchlight, Grayce, CareTribe, and ianacare help unpaid caregivers navigate and coordinate care for older adults through solutions that offer information to help understand Medicare options, management of appointments and medications, and 24/7 white glove service for individual questions. In addition, Cake’s platform eases questions around end of life care by guiding older adults through a comprehensive planning process, and giving friends and family access to the plan.

Solutions can become more comprehensive and proactive. Unlike childcare, care for older adults becomes more complex as they age and caregivers manage unique struggles when helping older loved ones with ADLs, IADLs, dementia, and more. Solutions that proactively surface resources across the wide range of needs that emerge with aging (e.g., healthcare, financial, legal) are on the horizon. As companies such as Cleo and Maven are offering child support, we anticipate opportunities for Femtech companies to expand their support platforms to women caring for older adults as well.

Are you building a solution to help older adults age in place?

Our investment team would love to chat! Send us your pitch deck.

Footnotes

1We define aging in place as “the ability to live in one’s own home and community safely, independently, and comfortably, regardless of age, income, or ability level,” per the CDC’s definition.

2Those born between 1946-1964 and currently ages 55 to 74

3This overview focuses on tools that enable aging in place. As such, we’ve excluded technologies that primarily support long-term care facilities (e.g., Curve Health, Tembo Health) and broad telemedicine platforms (e.g., Amwell, Doctor on Demand).