H1 2025 market overview: Proof in the pudding

The first half of 2025 played like a highlight reel: big rounds for AI-powered solutions (with even more capital rumored), unprecedented provider tooling adoption and impact, and IPOs for longstanding digital health darlings. With a steady funding pace mirroring the past couple of years, the digital health sector saw several long-awaited developments signaling market maturity and momentum. But that highlight reel played against an economic and policy backdrop that is anything but steady.

This piece explores H1’s validating moments—the thawing of the IPO market and the growth of AI-native provider tools capturing investor attention and provider loyalty—as “proof points” of digital health’s promise to deliver validated, patient-centric, affordable care. We’ll also take a dip into the uncharted waters on the health policy horizon. But first, let’s take a look at where investors are placing their bets.

More than just business as usual

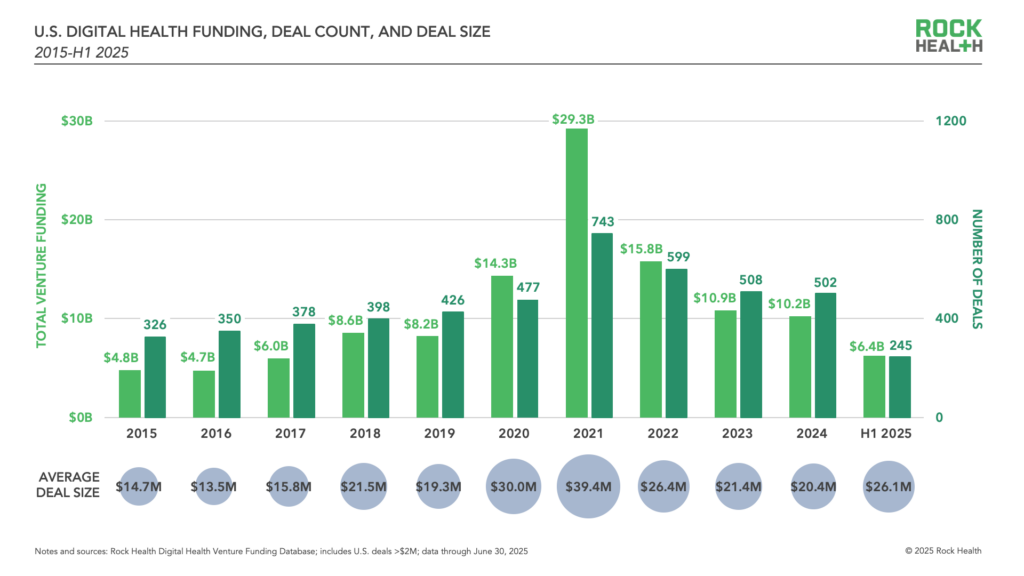

By the numbers, H1 2025 saw a modest increase in digital health venture funding compared to the past two years, signaling a steady venture market that’s found its footing after the pandemic-driven boom. Investors poured $6.4B into US-based digital health companies across 245 deals in the first half of the year, up from $6.0B in H1 2024 and $6.2B in H1 2023. In Q2 alone, the sector brought in $3.4B in venture funding—up from the average of $2.6B per quarter since Q1 2023.

This year saw fewer deals (245) compared to last year’s first half (273). If H2 continues at this pace, this year could yield the lowest overall deal count since 2020. Despite fewer deals, average deal size grew ($26.1M compared to $20.4M in 2024), spurred by larger investments in later stage rounds (Series B-D1) as well as the bolstering impact of AI.

AI buzz is biz

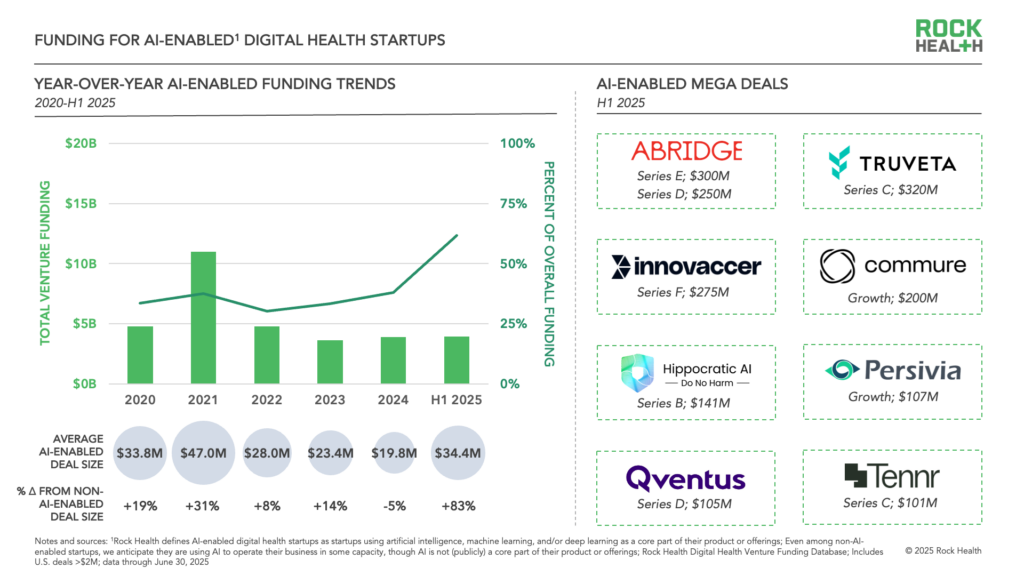

For the first time, AI-enabled startups2 captured a majority (62%) of digital health venture funding in H1 2025. These companies, on average, raised $34.4M in funding per round—a whopping 83% premium compared to the $18.8M of their non-AI-enabled3 counterparts. While this premium was partly driven by supersized growth rounds, it was also evident in early stage deals: the average Series A and Series B deal sizes for AI-enabled startups were $24.4M and $54.8M respectively, compared to $15.6M and $39.6M for non-AI-enabled digital health companies.

Overall, the top three funded value propositions (VPs) of digital health startups in H1 2025 were: non-clinical workflow ($1.9B), clinical workflow ($1.9B), and data infrastructure ($893M)—all of which are being transformed by AI-enablement and automation. These VPs drew more than half (55%) of overall digital health funding in H1—a first in our data since we began tracking venture funding back in 2011.

H1 2025 recorded 11 mega deals (fundraises over $100M), on pace to surpass the 17 mega deals we saw throughout 2024. Nine of the 11 mega deals went to AI-enabled startups—with Abridge, a top competitor in the AI scribe space, announcing two mega rounds in just four months’ time. Back-to-back mega deals within even a year’s time frame is a feat few companies have achieved since 2021.4 And we’re only in the first half of the year—newly minted unicorn OpenEvidence is rumored to be on the verge of a mega deal after its $75M Series A in February. Let’s take a closer look at what’s driving this investor confidence.

In the flow, not in the way

The relationship between clinicians and new technology hasn’t always been a smooth ride, which makes the recent surge in adoption of AI tools (particularly ambient documentation and medical reference solutions) so remarkable. Strong outcomes and clear impact for clinicians have driven the rapid adoption of medical ambient documentation tools—faster than any other technology in healthcare history.5 Today, overall adoption rates hover between 30% and 40% across physician groups, with some leading hospitals reporting utilization as high as 90%.

Consider Abridge—the ambient documentation solution is deployed at over 100 U.S. health systems, and continues expanding its list of enterprise partners and its set of use cases and features. Abridge’s sustained momentum stems not only from proving value and earning trust, but also from strategic partnerships and clear plans for long-term growth. Abridge became the first “pal” in Epic’s Partners and Pals program, enabling native integration into clinical workflows. And expectations for Abridge’s continued growth (and skyrocketing valuation) stem from its expansion into additional hospital workflows including revenue cycle management (RCM), billing, and coding.

Meanwhile, AI-native medical search tool OpenEvidence has become the fastest platform to surpass 100K clinician users. With trusted brand roots and smart partnerships, they’re adding more than 50K doctors monthly. Physicians find OpenEvidence’s chatGPT-style query interface intuitive and conversational, and the output fast, clear, and clinically relevant.

Together, OpenEvidence and Abridge show that breakout growth is possible with the right mix of provider trust, intuitive and impactful products, and capital to scale. Ambient documentation and provider workflow tooling are fiercely competitive and increasingly saturated markets. But with most AI deployments stuck in pilot phases (and real-world performance benchmarks still in early innings), there’s still plenty of room for new applications to grow.

“Currently, only a third of AI pilots successfully scale to full system-wide deployment. To improve those odds, vendors need to earn customer trust, which requires highly secure, accurate, easy-to-use tools. It’s also equally important for pilots to demonstrate consistent end-user engagement or an easy-to-measure ROI. Make it a no-brainer for health systems to adopt.”

—Sofia Guerra, Vice President, Bessemer Venture Partners

Exits and the future of tech-enabled care delivery

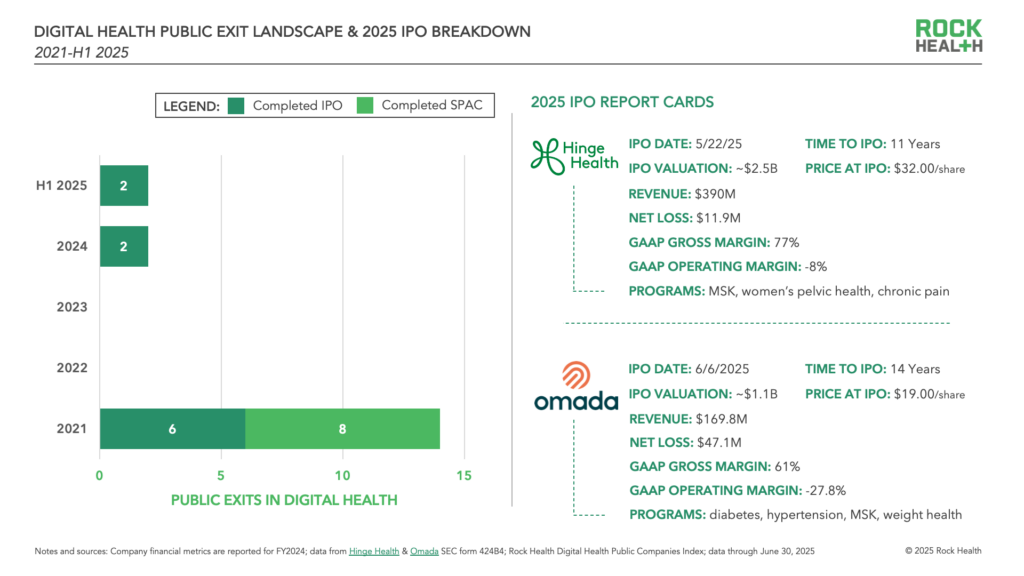

Seeing venture funding propel growth and impact is exciting. What’s also exciting? Exits. Undeniably, the breakout moments of 2025 so far go to tech-enabled care delivery businesses Hinge Health and Omada Health.6 Breaking the recent hiatus in IPOs (just two digital health public exits in the past three years), digital physical therapy platform Hinge Health launched on the NYSE in May, and virtual chronic care provider Omada Health on the Nasdaq in June. These public market debuts have given investors much-needed redemption after an exit drought, tough public market performances, and a string of recent take-privates.

Just as AI-native tools are delivering on the promise of digital health in provider contexts, tech-enabled services companies are realizing transformed, sustainable care delivery. Omada and Hinge spent the past decade-plus weathering first mover challenges: creating first-of-their-kind evidence bases on clinical and economic outcomes, earning customer trust, and applying data science to optimize care delivery. Not to mention, they launched their tech stacks and care models before today’s ecosystem of plug-and-play solutions were available to accelerate time-to-market, making their market resilience and tech evolution particularly impressive. Both are continuously iterating on how to best (and pragmatically) leverage AI. Hinge has shared its push toward automation of care delivery, while Omada has used AI to augment coaching workflows for years and recently released its first consumer-facing AI to offer nutrition support.

“Over the last decade, the foundation of Hinge Health has been built on two things: 1) an exceptional, clinically-validated member experience and 2) strong client relationships and great partners. Those two things are necessary but not sufficient to succeed at scale—AI and computer vision were a critical third element that allowed us to simultaneously improve the member experience and improve our cost structure.”

—Jim Pursley, President, Hinge Health

While IPO celebrations are well-deserved, the long and winding road continues. Hinge took a valuation haircut with a $3B public market debut, relative to its $6.2B valuation in 2021. Both Omada and Hinge are still seeking the promised land—and public market expectations—of sustained profitability and growth. We’ll be watching to see what growth strategies they pursue, with Omada hitting the ground running in the weight loss market and Hinge expanding into in-person care access.

Thanks to their hard-earned wins (and battle scars), there’s a clearer, albeit not perfectly smooth, path for virtual-first care businesses to reach durability and impact at scale. Looking ahead, ongoing public market performance will reveal the long-term value of these businesses, hopefully kickstarting a virtuous cycle of exits and comps that inform healthy investments, valuations, and growth trajectories for emerging digital health startups.

Mergers on the dancefloor

Although the public markets are alluring, most digital health companies take a different exit ramp: M&A. With 107 M&A deals closed in H1 2025, this year is on track to quickly surpass—and nearly double—the 121 M&A deals recorded in 2024. Digital health companies continue to be the most frequent acquirers of other digital health companies, accounting for 63% of all deals so far this half. Many are continuing to execute what we refer to as the “tapestry weaving” playbook—acquiring new capabilities to create more robust and broad offerings (e.g., longevity upstart Superpower acquiring Base and Feminade).

Meanwhile, private equity (PE) players are banking on a new roll-up strategy: AI-native startups coupled with legacy healthcare players. The bet is that combining the established distribution networks and trusted services of legacy companies with cutting-edge technology will drive meaningful efficiency, margin, and scale gains. New Mountain Capital (NMC) has been putting this new playbook to work. Most recently, NMC combined Access Healthcare, a veteran RCM and business process outsourcing firm, with the AI tech of SmarterDx and Thoughtful.ai to form the newly minted Smarter Technologies—making things even more interesting in the RCM space. And earlier this year, NMC acquired Machinify, weaving its AI tech into a (previously) combined entity of legacy payment integrity providers Apixio, Varis, and The Rawlings Group.

Through these roll-ups, PE firms are effectively underwriting the shift from legacy healthcare services to AI-powered solutions. Time will tell if this approach to inorganic growth will be successful long term. As non-AI-native companies seek new capabilities, these platforms will serve as important test cases for buy versus build strategies.

Not just a tale of tailwinds

We’ve covered the IPOs, adoption, and PE-driven proof points for digital health this half, but still haven’t addressed the biggest stories in the healthcare news cycle: broader economic and tariff-related uncertainty, and of course, the impact of the budget bill.

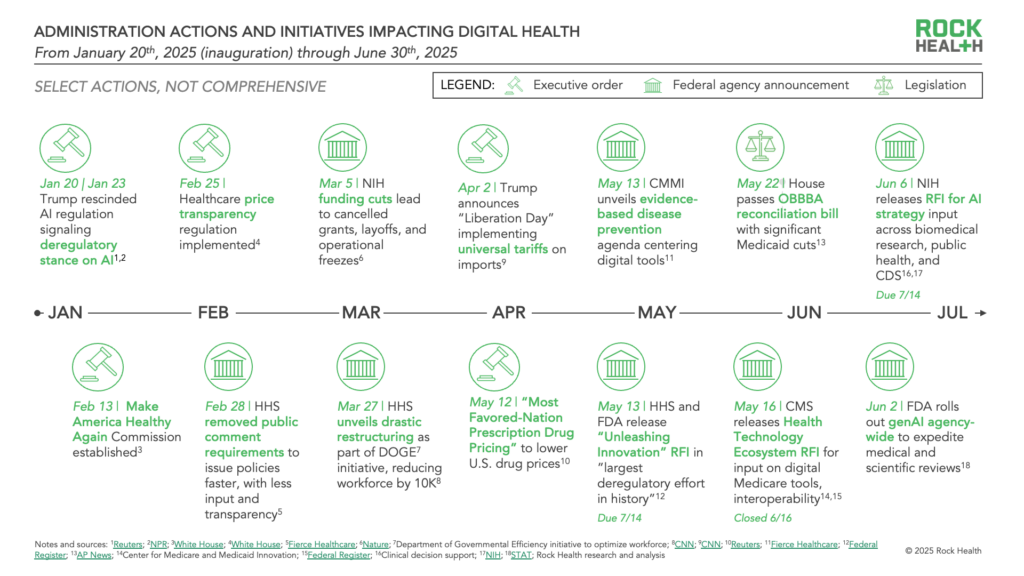

Throughout H1, the Trump administration’s plan to Make America Healthy Again (MAHA) began coming into view. MAHA’s first report focuses on childhood chronic illness, with several decisions to come on the administration’s strategic plan to address it. Meanwhile, the administration has put out an unprecedented volume of executive orders, ranging from AI deregulation and healthcare price transparency to lower prescription drug pricing. In the graphic below, we highlight some of the major actions and initiatives impacting digital health from the first half of this year (a big thank you to the policy reporters and experts whose minute–by–minute analysis keeps us up to date).

Now, most eyes are on the budget bill. The bill introduces Medicaid work requirements and Obamacare marketplace changes that are projected to leave millions uninsured, which could create ripple effects including intensifying uncompensated care losses and shrinking addressable markets. While the bill provides a modest, temporary increase in Medicare reimbursement rates, it does not include provisions from prior versions to address physician payment sustainability in the long term.

The call of innovators has always been to find opportunities amidst change and headwinds. As policies solidify and implementation becomes reality, digital health innovators are wise to identify how they may support federal priorities—such as chronic disease or food as medicine—and elevate initiative-aligned digital health solutions. Federal agencies and legislative committees are hosting listening sessions and hearings emphasizing a more tech-enabled healthcare experience. They’re also seeking responses to requests for information from stakeholders across the ecosystem (e.g., on the use of AI in clinical decision support or new care models). Participating can both steer federal digital health initiatives and strengthen future lobbying positioning. All-in-all, early engagement during this first-year window could shape the contours of policies that will determine how healthcare is paid for, regulated, and accessed—all of which set innovation trajectories in motion.

“Players across the digital health landscape are living in an uncertain environment because they don’t know when, how, or if agencies will implement executive order directives. That being said, there are more opportunities than ever before for digital health companies to get involved and steer evolving regulations—from submitting responses to RFIs to connecting with agencies working on digital health, like CMMI and CMS. They are sincerely hoping to hear from as many people as possible and inviting new voices to these discussions.”

—Rachel Stauffer, Principal, McDermott+

From promise to proof

While this half’s top-line numbers look familiar, several “proof points” give this half strong momentum—from unprecedented provider adoption to fresh IPOs. Digital health is proving it is more than just steady and resilient; the sector is entering a new phase of traction and impact, with AI playing a linchpin role. And although an IPO may not always be on the horizon, the proof is in the pudding—digital health can deliver on its core thesis: to improve care quality, accessibility, and affordability. By staying anchored to these north stars and championing them in key policy forums, digital health will help the healthcare industry weather shifting global, economic, and policy tides.

Tap into insights and strategic guidance for enterprise companies with Rock Health Advisory.

Get in touch with the venture team at Rock Health Capital.

Join us in advancing ecosystem change at RockHealth.org.

And last but not least, stay plugged into the Rock Health community and all things digital health with the Rock Weekly.

Footnotes

- Series D rounds were limited in sample size (n=3).

- Rock Health defines AI-enabled digital health startups as startups using artificial intelligence, machine learning, and/or deep learning as a core part of their product or offerings.

- Even among non AI-enabled startups, we anticipate AI use in some internal or operational capacity, though AI is not (publicly) a core part of their product or offerings.

- In the peak of digital health funding in 2020-2021, we recorded 18 instances in which companies raised back-to-back mega deals, with the second raise happening within a year of the first; since 2022, we have seen only six such back-to-back mega deals in digital health.

- EHRs are widely used among providers, but this surge in adoption happened over decades and with federal incentives for compliance.

- Omada Health is a Rock Health portfolio company.