Q3 2020: A new annual record for digital health (already)

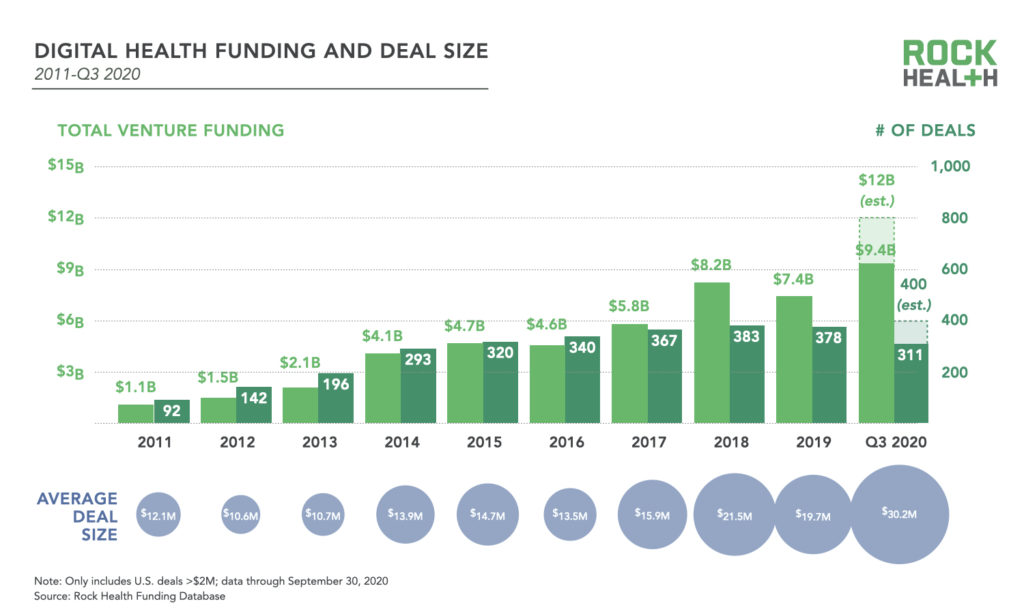

Here’s one more way 2020 is unlike any other year: it is already the largest funding year ever for digital health. The $4.0B invested in US-based digital health startups through Q3 brings the year’s running total to $9.4B, far exceeding what used to be the largest annual sum of $8.2B in 2018. At least $2.4B has been invested each quarter this year—consistently above the quarterly average of $2.1B across 2018-2019. And even more so than in recent years, large deals are driving the top-line numbers. The average deal size in 2020 is $30.2M, 1.5 times greater than the $19.7M average in 2019.

The initial uncertainty and dramatic changes at the outset of the pandemic in the US across March and April coincided with a dip in funding. Investors noted a shift in focus away from deal flow towards shoring up portfolio companies. As Michael Greeley, General Partner at Flare Capital Partners noted at Rock Health Summit, “The venture industry at first didn’t know what to make of this. We were all focused on our portfolio companies. But that concern is now in the rearview mirror. Our companies navigated the disruption and are back building really good companies.”

Since April, the COVID-19 pandemic has accelerated digital health adoption by several years, attracting interest from consumers, entrepreneurs, and investors alike. Julie Yoo, General Partner at Andreessen Horowitz, noted at Rock Health Summit, “It was a pretty bonkers summer in terms of deal volume. We ran the numbers and year to date, deal volume through Q3 in 2020 is up nearly 22% compared to all of last year.” This activity comes amidst a record stock market rebound and hopes for a vaccine before the end of the year—however, medium-term economic uncertainty still looms.

The economy, the healthcare system, and the digital health sector are not out of the woods yet. In the broader economy, the labor market recovery lags behind the stock market recovery. Future outbreaks, lockdowns, shifts in political power (and policy) all create uncertainty around recovery. Communities and their healthcare infrastructure are bracing for future waves of COVID-19—potentially compounded by flu season. Provider systems and practices with depleted finances face the potential of months of lower utilization and a shifting payer mix with more Medicaid, individually insured, and uninsured patients.

It is unlikely that the economy, healthcare, or our personal lives will return to the “old normal” any time soon. The next normal is still uncertain, but its edges are coming into focus. This market insights report discusses three key trends in digital health investment and exits, and what they mean for the future of healthcare.

Trend #1: Mega deals are on the rise—particularly in virtual care delivery, R&D enablement, and fitness & wellness

Twenty-four (24) digital health companies have raised mega deals of $100M or more through Q3 of 20201. This already doubles the previous annual record of 12 mega deals set in 2018. Mega deals account for well over one-third (41%) of total digital health funding so far this year with connected fitness company Zwift raising the largest round so far—$450M in Series C funding.

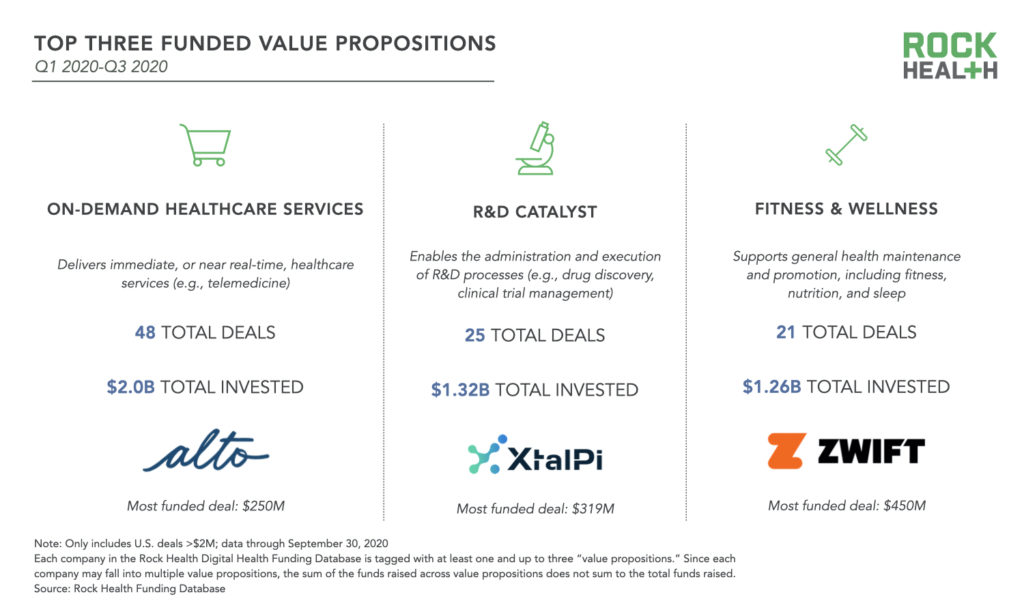

The rise in mega deals reflects a trend towards capital concentration in digital health venture investment. Among the top-funded value propositions—that is, those categories of companies with the most funding—capital concentration is not uniformly distributed.

On-demand healthcare services

On-demand healthcare services, a category that includes companies offering telemedicine services, prescription delivery, and at-home urgent care, is the top-funded value proposition2 with $2.0B invested across 48 deals through Q3 2020; it is also the value proposition with the most number of deals. Investors are making large bets on companies in this space—the average deal size so far this year is $42.1M, 40% larger than the average digital health deal size overall. 56% of on-demand healthcare services deals were Series B or later,3 and Series B or later deals represented 87% of funding for on-demand healthcare services startups.

The top three funded deals in this category are:

- Alto Pharmacy, which offers consumers free prescription delivery, raised $250M

- Ro, which offers virtual consultations for home-delivered prescriptions, raised $200M

- Amwell, a telemedicine platform, raised $194M; Amwell later went public in September and raised $742M after selling 41.2M shares at $18 a share, which was higher than they had planned to raise according to their SEC filing

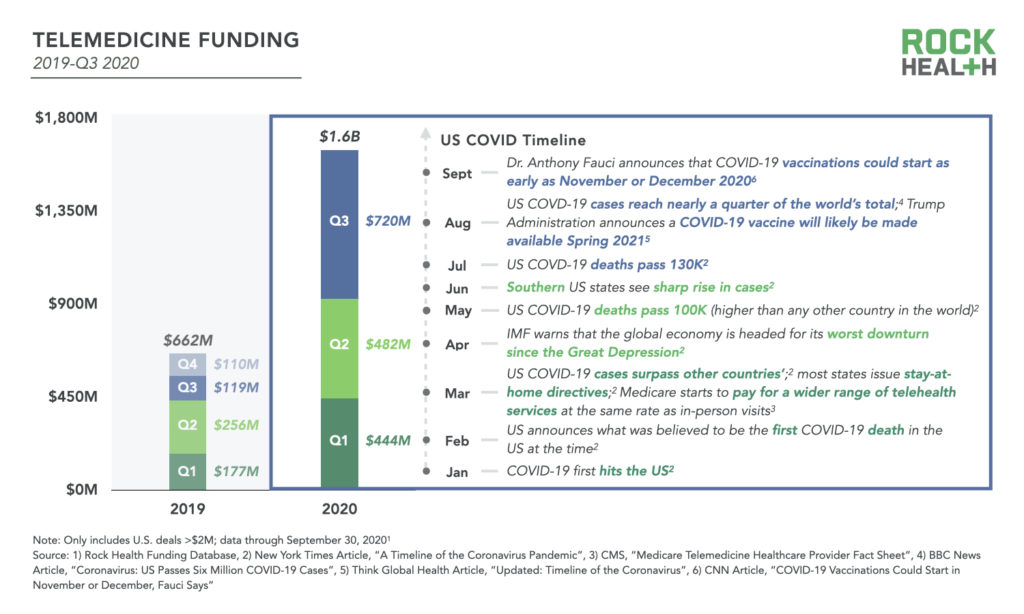

Funding for companies that offer telemedicine4 specifically saw a significant spike from Q1-Q3 2020 compared to Q1-Q3 2019—$1.6B in funding compared to $662M, an over two-fold increase. At Rock Health, we assess “telemedicine” funding by including not just companies offering traditional one-to-one patient-provider interactions, but also including technologies that enable the synchronous or asynchronous delivery of healthcare, from a remote clinician delivered to a patient. Driven by the near shutdown of our traditional healthcare system for in-person visits, utilization of the former—synchronous patient-provider visits—have skyrocketed. By one estimate, telemedicine claims in the US rose by over 4000% between June 2019 and June 2020. In another, telehealth visits comprised 69% of total ambulatory visits in the US—office and telehealth—in April, at the peak of COVID-19 deaths. As states are starting to reopen and patients are returning in-person for deferred elective procedures and treatments, telemedicine visits dropped to 21% of total visits by July, indicating that the initial spike in telemedicine likely does not reflect the new normal. However, we are quite certain that when telemedicine utilization rates do settle, they will be higher than rates in the past. Additionally, we expect to see expansion of telemedicine models that break the traditional mold—those that integrate telemedicine touchpoints with continuous remote care, and unhinge themselves from the labor-intensive delivery of traditional telemedicine. Investor dollars and consumer adoption signal a shift towards a new normal, with models of virtual care emerging as a central part of care delivery.

R&D Catalysts

We observed high capital concentration in companies that support life sciences research and development (R&D): drug discovery, clinical trial management. Enablement of R&D (“R&D catalysts”) is the second-most funded value proposition this year with $1.32B invested across 25 deals for an average deal size of $52.7M, 75% larger than the average digital health deal size overall. Unlike companies offering on-demand healthcare services—which represented both the most total funding and number of deals—R&D catalyst companies represented only the seventh largest number of deals.5 Some of the capital concentration in startups that support life sciences R&D can be explained by the maturity of particular companies in this space–Series B or later deals represented 86% of funding for R&D catalyst startups.

The top three funded deals in this category are:

- XtalPi raised $319M to scale its digital drug discovery and development platform

- Insitro raised $143M to scale its machine learning-driven drug discovery platform

- Atomwise raised $123M to further its own AI-driven drug discovery efforts

Fitness & Wellness

We also observed high capital concentration in companies that support general health maintenance and promotion6—fitness, nutrition, and sleep. Fitness & wellness is the third-most funded value proposition this year with $1.26B invested across 21 deals for an average deal size of $59.9M, 99% larger than the average digital health deal size overall. Like with R&D catalysts, there is a mismatch between the ranking of “fitness & wellness” in terms of total funding (third place) and total number of deals (11th place). Some of the capital concentration in startups that support fitness & wellness can be explained by the maturity of this space—57% of fitness & wellness deals were Series B or later; Series B or later deals represented 92% of funding for fitness & wellness startups.

The top three funded deals in this category are:

- Zwift, which has an interactive fitness entertainment platform for indoor cycling workouts, raised $450.0M

- ClassPass, which has an online monthly fitness membership program, raised $285.0M

- Tonal, which has an intelligent fitness system for at-home strength training, raised $110.0M

The most and third-most funded value propositions so far this year—on-demand healthcare services and fitness & wellness—do not come as a surprise. These value propositions were already among the top-funded categories last year, and lock-down lifestyles have increased demand for at-home care and fitness across 2020. The significant capital directed toward life sciences R&D represents more of a shift, as this was the seventh-most funded value proposition in 2019. However, considering the race to develop vaccines and treatments for coronavirus, adding efficiency, precision, and speed to drug development feels more urgent than ever. In fact, many companies in this category are directly working to help find or develop vaccines and treatments: XtalPi is using AI to screen existing drugs that may be able to treat coronavirus, while Atomwise is collaborating with research centers and universities to develop coronavirus treatment candidates.

With the slew of mega-deals, it is possible that other value propositions may sneak into the top three when we look back on 2020 at the end of Q4. For instance, funding for companies that digitally monitor disease ($1.1B) trails closely behind funding for fitness & wellness companies so far this year.

Trend #2: Corporate investors double down on digital health

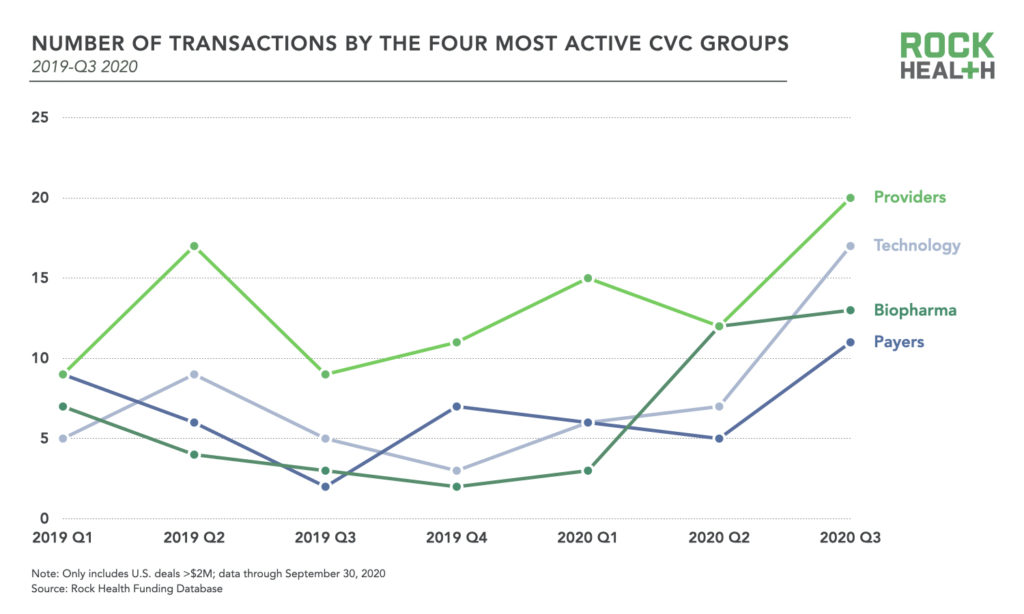

Amidst the volatility of 2020, the investor mix in digital health has remained refreshingly consistent. Sixty-four percent (64%) of this year’s investors have previously made investments in digital health—higher than any previous year. Institutional venture firms continue to account for the largest share of transactions (62%), with corporate venture capital (CVC) holding steady at 15% of transactions.7

CVC has always been an integral part of the digital health funding landscape. Enterprise organizations offer their portfolio companies buy-side perspective and, in some cases, commercialization opportunities. So when COVID-19 hit the US, there were concerns that the financial impact and diversion of resources to address COVID-related imperatives might result in a broad contraction in CVC venture investment. That certainly isn’t how it’s played out so far this year in digital health, or in other industries.

Corporate investors have made 149 investments in digital health across three quarters this year, which already exceeds the previous record of 145 investments across all of 2017. Quarterly investments by the four most active CVC groups—providers, technology companies,8 biopharma, and payers—are all trending upwards over the last 12 months. Provider CVCs lead the way with at least 12 investments per quarter in each of the last three quarters. Such sustained investment activity is remarkable given the fact that so many provider organizations have been in crisis-response mode preparing for and reacting to COVID-19 outbreaks in their regions.

Technology companies and biopharma have substantially increased their investment activity in digital health over the past 12 months. Technology companies’ quarterly deal count climbed steadily across the COVID-19 pandemic, from three in Q4 2019 to 17 in Q3 2020. Biopharma’s deal count jumped from an average of 2.5 investments per quarter across Q4 2019-Q1 2020 to an average of 12.5 investments per quarter across Q2-Q3 2020.

The sustained commitment of corporate investors in the digital health sector is a signal that healthcare incumbents and big new entrants view the pandemic as a pivotal “FOMO” moment in which unprecedented, instantaneous shifts in consumer demand and regulation are rapidly driving evolution and growth in the space. And they want to be a part of—and investors in—this transformative moment.

Trend #3: Digital health companies capitalize on the stock market’s sharp recovery and relaxed regulations

IPOs

Several digital health companies went public this summer or have announced plans to do so: Accolade and GoHealth went public in July; Amwell, Outset Medical and GoodRx went public in September; high-growth, D2C platform Hims Inc. has struck a deal to go public by merging with a blank-check company, and MDLive’s CEO announced intentions to take the company public early next year. These filings come on the heels of six digital health IPOs in 2019, leaving the 2017-2018 IPO drought in the rearview mirror.9

The current flurry of digital health exits is fueled by the stock market’s sharp recovery which puts more potential money on the table for companies that go public. However, at least four factors create uncertainty about the durability of the current IPO window:

- A potentially slower-than-expected economic recovery

- Further COVID-19 outbreaks

- Global trade disputes

- Upcoming presidential, congressional, state, and local elections, particularly when the presidential candidates are laying out starkly different visions for the future of US healthcare policy.

M&A

At a macro level, overall M&A activity is down in 2020 compared to prior years. There have been 63 acquisitions of digital health companies through Q3—on track to fall short of the 113 last year and 115 average from the prior three years. We speculate that potential acquirers may be conserving cash in light of the economic uncertainty created by COVID-19. Teladoc, however, is not one of them. Surging stock prices made it possible for the virtual care platforms race to begin—the $18.5B Teladoc-Livongo merger was paid almost entirely with shares (plus $11.33 per share in cash). The combined company will be a digital health behemoth whose tech-enabled workforce of physicians and health coaches can address a broad set of primary care, mental health, and chronic disease management needs. The announcement sent the digital health community into a frenzy of speculation about the ways that the company might cross-sell across its customer bases, satisfy employers’ desires for a single platform to address multiple conditions, support new digital front door pathways, and spur further M&A activity.

If the Teladoc-Livongo merger is the starting pistol, Otsuka’s acquisition of Proteus might be a caution sign. Proteus, the smart pill maker that raised nearly $500M and was previously valued at $1.5B, was acquired for $15M. We perceive significant partnership opportunities for pharma and digital and the Proteus story offers lessons to push forward. Pharma’s interest in digital therapeutics (DTx) has not dampened. Boehringer Ingelheim signed a $500M contract with Click Therapeutics in September to co-develop and commercialize a prescription-based DTx for schizophrenia.

Digital health companies continue to be the most frequent acquirers of other digital health startups—half of all M&A deals this year are of this nature, in line with prior years. Notable transactions include Unite Us’s acquisition of Staple Health in the social determinants of health arena and Omada’s acquisition of Physera, which adds musculoskeletal care to Omada’s chronic disease management platform.

Commercialization Prompted by Pandemic-driven Regulatory Flexibility

Back in April, the FDA announced they “do not intend to object to the distribution and use of computerized behavioral therapy devices and other digital health therapeutic devices for psychiatric disorders” that otherwise may have had to undergo formal regulatory review. Of note, the policy is the first time the FDA has mentioned “digital therapeutics” by name in a formal guidance document. Several companies have taken advantage of the relaxed regulations to release psychiatric digital health products into the market, including:

- Akili Interactive Lab’s EndeavorRx (ADHD); EndeavorRx has since received formal de novo clearance

- Pear Therapeutics’s Pear-004 (schizophrenia)

- Orexo’s deprexis (depression), vorvida (alcohol use), and OXD01 (opioid use disorder)

However, this policy is only “for the duration of the public health emergency related to COVID-19” and does not mention how the FDA plans on wrapping up the temporary regulatory allowance once the public health emergency is over. But recent activities signal the FDA is paying close attention to this sector. They launched the Digital Health Center of Excellence as a central resource for digital health policy and regulation, connecting experts across industry, government, and the general public. And Pear Therapeutics’s Somryst (chronic insomnia) was the first prescription DTx to be simultaneously reviewed through the FDA’s Pre-Cert Pilot and 510(k) program and receive formal FDA clearance.

Where do we go from here?

The strength of 2020 investment to date matches this moment of unparalleled demand and opportunity for digital health. Our optimism for tech-driven transformation is reinforced by the legitimization of business models, demonstration of strong clinical and economic outcomes, increasing FDA clearances and approvals, and industry efforts to develop scalable payment mechanisms for digital health products. However, we are just on the cusp of this momentum. As the pandemic continues to unfold, we are eager to see the industry come together to cement advancements already made this year, and continue on this trajectory.

As always, Rock Health is investing in the entrepreneurs bringing life-saving technology to healthcare. We’ve been meeting with companies (virtually)—and investing—and would love to hear from you. Get in touch!

A special thank you to our generous corporate members for their continued support and partnership. Email us for more information about how your organization can work alongside Rock Health and receive full access to our digital health market updates and databases.

Footnotes

1We did not include Google Cloud’s $100M investment in Amwell in our list of mega deals because it was a concurrent private placement with Amwell’s IPO and therefore is not a unique venture deal.

2We define the “value proposition” of a company as value that accrues to the buyer directly, irrespective of the mechanism used to deliver the value. Each company in the Rock Health Funding Database is tagged with at least one and up to three value propositions. Rock Health Corporate Members have access to the complete Digital Health Funding Database.

3The calculation for percentage of deals Series B or later includes growth/PE deals and excludes all deals for which the series was not identifiable or applicable, as well as all bridge and debt rounds.

4We define ‘telemedicine’ as technologies that enable the delivery of healthcare services (synchronous or asynchronous) from a person (not a chat-bot, automated symptom checker, etc.) when the service provider is in a different physical location from the service recipient. Companies in this category may offer virtual visits via telephone, digital imaging, video conferencing, and coaching.

5 Rock Health tags companies in the Rock Health Funding Database with at least one of 20 value propositions.

6Where the prevention of illness does not associate with an ICD code.

7The remaining 23% of investor transactions include private equity, accelerators/incubators, family offices, and angel groups.

8Examples of technology companies with CVC businesses include Qualcomm, Intel, Comcast, Samsung, Bose, etc.

9See Digital Health Public Company Index compiled by Rock Health for more information.