Building pharma-digital therapeutic alliances

This research was completed in partnership with ZS Associates. Special thanks to Paul Darling, Oladele Ojo, Joe Stevens, Megan Sadiua, and Alex Sajnani for being fantastic collaborators throughout the countless interviews, meetings, and late nights of this research endeavor.

Amidst political scrutiny over drug prices and increasing demand to demonstrate value, pharma companies are pursuing a variety of digital strategies to better serve patients. Most recently, pharma companies have turned to digital therapeutics: software solutions that improve patient outcomes through diagnosis, treatment, and coordination of care. Although pharma companies are hiring digital executives and shifting investment dollars toward digital therapeutic (DTx) solutions, they may not possess the capabilities—technical talent, UX expertise, and agility—necessary to drive these solutions from initial ideation to commercialization. On the flip side, pharma offers complementary competencies to DTx companies: robust R&D expertise, established provider sales channels and networks, and knowledge of global regulatory approval pathways.

With that in mind, we asked whether alliances between pharma and DTx companies represent a match made in heaven to develop, validate, and commercialize digital therapeutics at scale?

To answer this question, we formed an alliance of our own with ZS Associates, a Rock Health corporate partner, to take a snapshot of this moment in time for the DTx space. Across nearly 30 interviews with senior pharma1, DTx2, and health plan leaders, we discovered that building a successful alliance between a DTx and pharma company is contingent on four key elements:

- Shared value proposition: For a pharma-DTx alliance to thrive, both parties must arrive at a joint definition of a digital therapeutic and agree on the alliance’s expected outcomes

- Organizational commitment: Each party must commit to advancing the alliance, and demonstrate that commitment through investment in strategy, structure, and culture

- Evidence standards: Both parties must align on the expected type and timeline of evidence to prove the impact of the DTx solutions

- Channel strategy and business model: Pharma and DTx leaders must share a plan for how DTx solutions will be delivered to patients and paid for—even if explicit tactics will evolve as the alliance matures

The good news is that DTx and pharma leaders enter into alliances with important foundational norms already in place. Every pharma and DTx leader we interviewed articulated a definition for digital therapeutics that included both software-based solutions working in conjunction with drugs or devices as well as digital solutions functioning as standalone interventions. They also all agreed digital therapeutics must deliver meaningful, durable outcomes backed by evidence that fully supports their claims. But despite these areas of agreement, translating ambition into successful execution of pharma-DTx alliances presents challenges. Below we dive into several of the execution risks currently inhibiting pharma-DTx alliances, and the path outlined by pharma and DTx leaders to bring digital therapeutics to scale.

Not all commitment to digital is equal—pharma companies vary significantly in their DTx investment

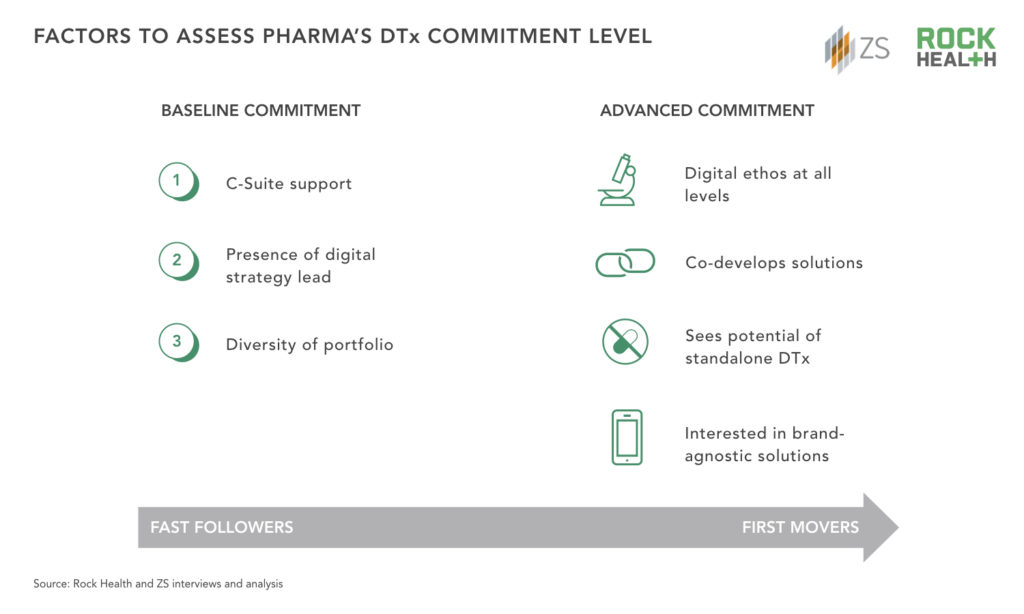

While all interviewed pharma leaders reported having a well-defined digital health strategy, they differed in terms of their committed resources and execution philosophies. Overall, we saw a split between those making baseline commitments, and those we termed “first movers” making advanced commitments.

Three baseline signals of commitment among pharma companies were C-Suite support, presence of a digital strategy lead, and a diverse portfolio of solutions. Those with the most ambitious DTx agendas went beyond these fundamentals. For instance, they had a greater willingness to consider brand-agnostic DTx solutions (e.g., wraparound apps or platforms that can be used in conjunction with many drugs, as opposed to a single brand of drug). Because pharma companies have historically lived and died by the value created by their brand-centric businesses, considering solutions outside of this paradigm represents a departure from traditional thinking.

A few pharma leaders even acknowledged that closely aligning a DTx with a brand may not be aligned with long-term trends in healthcare. Novo Nordisk Senior Director of Patient Marketing & Digital Health Innovation Amy West, for example, believes the “winner” in the digital therapeutics space will be platform owners, who will push manufacturers to consider more brand-agnostic solutions. Multiple pharma leaders also acknowledged brand-agnostic solutions are more patient-centric, and may result in greater patient satisfaction and increased adherence.

Imagine you are a diabetic patient taking four drugs. If each of these drugs is supported by a different app, it won’t work—no patient will subject themselves to using four different apps.

Alexander Grunewald, Global Head of HealthTech Investment Strategy, Johnson & Johnson

Health plans hold important purse strings, but remain the most skeptical stakeholder

When asked to define digital therapeutics, health plan leaders’ responses conveyed skepticism of the value DTx solutions offer. While all acknowledged the potential of digital therapeutics to support and/or encourage patient behaviors that complement another medical treatment, not a single health plan leader mentioned digital therapeutics as the treatment itself.

Nearly all health plan leaders we spoke with expressed concerns over the perceived lack of clinical evidence collected by DTx companies to demonstrate long-term health and financial outcomes. One health plan leader stated the space “is in its infancy,” while another expressed some offerings “have been more like bells and whistles on top of existing products” and lack an ability to drive clinical outcomes. Others were skeptical of digital technology’s ability to drive and sustain patient behavior change—especially among their high-need, high-cost (HNHC) members. Fortunately, the interviewed DTx leaders seem up to the challenge, acknowledging that they should assume they will be scrutinized more and need to go above and beyond to prove efficacy and outcomes to gain reimbursement.

Digital health is the underdog. You need to publish multiple studies to get medical stakeholders enthusiastic about what you’re doing.

Sean Duffy, CEO & Co-founder, Omada Health

Skepticism of this sort among health plans is not unique to digital therapeutics—but health plans play a critical role when it comes to reimbursement and formulary placement for DTx solutions. One DTx leader noted physicians may hold the key to attaining health plan buy-in of digital therapeutics. In his opinion, health plan leaders will be convinced of the value of digital solutions when physicians start writing prescriptions and clinicians lobby for the use and payment of digital therapeutics. However, we heard significant variation on the best path to securing physician trust and use of digital therapeutics—additional research is needed to understand how health systems and individual providers perceive the value of this sector.

Pharma’s sales channels have been fine-tuned to sell drugs—can they work for digital therapeutics?

Though pharma offers enviable provider sales networks and tactics, a channel partnership with a pharma company may not always be the right long-term fit for all DTx companies. Some DTx leaders cautioned trying to fit digital therapeutics within a pharma portfolio—and have decided to forgo commercial alliances with pharma companies in favor of executing their own channel strategy. For instance, Akili Interactive, which develops prescription drug therapeutics (PDTs) for cognitive dysfunction and brain-related conditions (e.g., ADHD), says it will build its own distribution platform from the ground up, including the end-to-end prescription and procurement process, distribution, medical affairs, technical support, and patient data management. Akili’s intention is to create a platform that enhances the patient experience while allowing for the unique opportunities afforded by digital therapeutics—real-world data collection and iterative, customized solutions.

Today, patients have a limited—if any—relationship with the companies that make and distribute their medicine. The benefit of digital health is we have a chance, through data, to deeply engage with our patients—to listen to them, and take cues from them. This is a philosophy that almost cuts against what the current medication industry has been able to do. But digital is a new modality, and there is no well-oiled machine on how to prescribe and follow-up with a software-based medication.

Eddie Martucci, CEO & Co-founder, Akili Interactive

On the other hand, some pharma companies are partnering with DTx companies with the intention of accelerating their path to market. For instance, Pear Therapeutics joined forces with Sandoz, a division of Novartis, to commercialize the launch of reSET, its first FDA-authorized PDT for treatment of Substance Use Disorder.

The dominant commercial strategies of the DTx sector are still unfolding—the jury is out on which of these commercial paths (among many others) will prevail. But DTx companies contemplating a pharma alliance should consider how it may enhance—or detract from—the relationship they hold or want to build with all of their customers.

To tackle these execution risks, pharma and DTx leaders suggested the following considerations when pursuing alliances:

- Pharma leaders: Clarify the plan to act as either a first mover or fast follower in your digital strategy—and align brands and functional groups with these goals

- DTx leaders: Leverage pharmaceutical companies and health plans early on as thought partners to raise and address concerns about the level of evidence for digital therapeutics, particularly where there is no existing playbook (e.g., selecting a placebo control, proving a solution’s durability, defining novel endpoints)

- Pharma and DTx leaders: In addition to portfolio and implementation considerations, consider how the alliance enhances the position of each partner with their customers including patients, health plans, providers, employers, and other healthcare stakeholders

A look ahead

The promise of DTx solutions—positively impacting patient outcomes and generating new, patient-level data—is not lost on pharma leaders in this space. This, in fact, is the foundation of the pharma-DTx alliances being built today.

We predict that the visibility, credibility, and availability of digital therapeutics will continue to advance incrementally, step by step—not in one fell swoop. In turn, this will drive a progressive shift in the mindset of key influencers, entire organizations, and ultimately the healthcare industry as a whole—from pharma, health plans, health systems, and the government. DTx companies must also continue to prove that they can live up to the high expectations of other stakeholders by delivering demonstrated patient outcomes with commercial value, at scale.

We also believe that the execution risks and complexity of forming pharma-DTx alliances will be addressed as new alliances are formed and the industry builds on the lessons learned from early successes. To that end, the insights gathered in our full report offer important guideposts and guardrails for leaders to work through issues of mutual value creation, investment, evidence, and commercialization. Upfront alignment on these points is critically important to the long-term success of these alliances individually, and to the DTx sector as a whole.

Rock Health and ZS Associates look forward to working in partnership with pharma and DTx leaders to envision and implement a future in which safe, evidence-based digital therapeutics are used to provide better care at lower cost. Please reach out to continue the conversation. And, of course, let us know if you think our fund would be a good fit for your emerging digital therapeutic (or other digital health) solution.

Further information

This is an excerpt from our full report, “Building Pharma-DTx Alliances,” which is made available to Rock Health corporate partners—industry-leading organizations committed to building the enterprise market for digital health. To access all of the insights featured in the publication or to learn more about our partnerships, please email partnerships@rockhealth.com. Additionally, if you are an academic, nonprofit, or startup who is interested in the report, please reach out to research@rockhealth.com.

For all the latest news in digital health, subscribe to the Rock Weekly!

Acknowledgements

This report would not have been possible without the help of a number of individuals who have graciously shared their expertise.

Special thanks to Stephanie Bova (HATCH@Takeda), Megan Coder (Digital Therapeutics Alliance), Josh Claman (Rimidi), Sean Duffy (Omada Health), Alexander Grunewald (Johnson & Johnson), Peter Hames (Big Health), Ronny Hashmonay (Novartis), Bozidar Jovicevic (Sanofi), Ian Marks (GSK Consumer Healthcare), Eddie Martucci (Akili Interactive), Corey McCann (Pear Therapeutics), Konstantin Mehl (Kaia Health), Jon Michaeli (Medisafe), David O’Reilly (Proteus Digital Health), Robert Sarrazin (GSK Consumer Healthcare), Stephanie Tilenius (Vida Health), Joris Van Dam (Novartis Institutes for BioMedical Research), Olivia Ware (Proteus Digital Health), Amy West (Novo Nordisk), and Salina Wong (Blue Shield of California).

Footnotes

1Pharma leaders interviewed for this research hold or previously held roles with a focus on digital strategy

2While all companies interviewed create solutions to improve patient clinical outcomes, they use a variety of terms to characterize themselves, including (but not limited to) “digital therapeutics,” “digital medicine,” and “digital health”