Next gen innovation: Opportunities in pediatric digital health

“Children are our future”—but it takes a lot to give children healthy futures of their own. Pediatric healthcare touches everything from immunizations (over 20 recommended before adulthood!) to developmental health, from sick care to rare disease. Yet, because children represent approximately 23% of the national population but less than 10% of national healthcare expenditures, and because they’re not direct customers of most healthcare products and services, they have been historically underrepresented in care delivery and payment model innovation. However, momentum is swinging in an upward direction. While still a single-digit percentage of overall sector funding, investment in pediatric digital health solutions is growing.

The most urgent drivers of sector innovation are the needs of children today. Children in the U.S. represent a more diverse generation by race and ethnicity, are experiencing increased rates of mental health and metabolic conditions, and are disproportionately impacted by systemic care barriers like Medicaid disenrollment—making the time ripe for targeted new approaches that could lead to millions of healthier adult lives, not to mention billions in healthcare cost savings down the line. Both private and public sector players are bringing together pediatric leaders and aligning incentives to work toward addressing these needs.

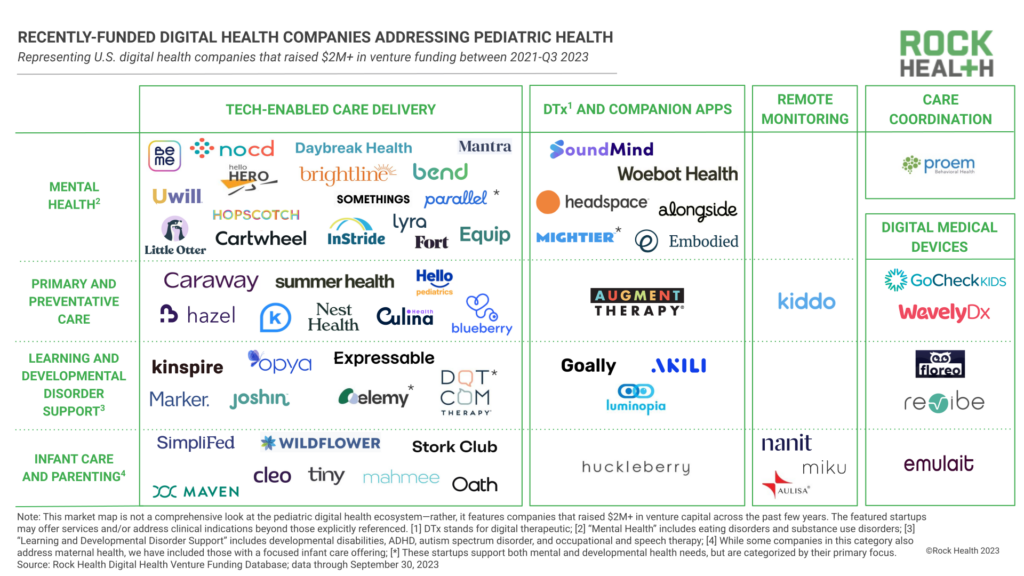

In this piece, we’ll share a market map of recently-funded digital health startups addressing pediatric needs in order to showcase different company approaches and note white space for innovation—particularly around pediatric-specific software and devices, as well as pediatric approaches to chronic conditions such as obesity. We’ll also share six important guidelines for innovators (startups as well as enterprise players across health plans, systems, and biopharma) that are building or moving into this space.

These innovation guidelines build upon learnings from recent investment activity, clinical research, and interviews conducted with pediatric health experts from Stanford University’s Pediatric Digital Health Task Force, Boston Children’s Hospital, Children’s Hospital Los Angeles, the Digital Medicine Society, KidsX, Esplanade Ventures, Backpack Health, and Brightline.1 We thank you all for your contribution to this piece and your dedicated work in this space.

Recent investments in pediatric digital health

Since Rock Health began tracking digital health venture funding activity in 2011, annual funding for digital health startups addressing pediatric health has been a single-digit percentage of overall sector funding. However, pediatrics’ single-digit representation has risen over the past several years, from an average of 1.7% of annual digital health funding in 2011-2019, to an average of 5.1% of annual digital health funding in 2020-Q3 2023. From Q1-Q3 2023, $413.6M was invested in digital health startups addressing pediatric health, spread across 20 deals, to comprise 4.7% of overall sector funding. Recent increases are driven in part by large fundraises for digital health startups that launched pediatric products, such as K Health, Headspace, Lyra Health, and Maven, in addition to raises for exclusively pediatric-focused players.

We’ve mapped out the U.S.-based digital health startups serving pediatric health that have raised $2M+ in venture funding 2021-Q3 2023. This map does not represent the full ecosystem of digital health startups in the space, particularly those that have not pursued venture funding. Instead, this map helps to highlight recent funding trends in pediatrics by product type (tech-enabled care delivery, digital therapeutics and companion apps, remote monitoring, care coordination, and digital medical devices), as well as by therapeutic area of focus (mental health,2 primary and preventive care, learning and developmental disorder support,3 and infant care and parenting).4 We’ve been exploring the innovations coming from venture-backed companies featured on this market map, in addition to those that are earlier, bootstrapped, or haven’t raised recently—throughout this piece, we’ll feature solutions from companies that are (and aren’t) reflected in this map.

Digital health has seen a recent flurry of investments in startups addressing pediatric mental health. It’s promising to see market activity and government initiatives address the pediatric mental health crisis, as national studies indicate significant increases in children diagnosed with mental health conditions. However, market saturation in pediatric mental health could lead to a more fragmented landscape (i.e., fewer interoperable solutions) and overwhelm families as well as provider, payer, and employer customers. For these reasons, as well as startup cash constraints, we may see near-term consolidation in pediatric mental health. We’re also interested to see how digital innovators will address chronic conditions prevalent in childhood, including asthma, obesity, and diabetes. With 20% of U.S. children qualifying as obese or pre-diabetic, we were surprised to see limited recent digital health startup activity here beyond pediatric nutrition support from Culina Health.

Additionally, recently-funded digital health startups largely offer pediatric care delivery (e.g., tech-enabled services such as virtual appointments), with fewer offerings in digital therapeutics, remote monitoring devices, care coordination solutions, and digital medical devices that were less represented. In part, these gaps represent the challenges of designing and approving new technologies and digital experiences for children, especially those that collect and interpret data (a topic we’ll dive into later). Notably, many pediatric care delivery players also sell direct-to-consumer (i.e., “direct-to-parent”), a commercialization strategy that sidelines families who are not able to afford these services out-of-pocket.

“User experience, ethical, and design considerations are critical to the success of digital health solutions in pediatrics. Whether it’s a digital product or service offering, children have unique and evolving needs, and solutions must be optimized for multiple users—children and their families.”

– Jennifer Goldsack, CEO at the Digital Medicine Society (DiMe)

Guiding insights for innovators

Whether targeting white-space opportunities across the market map or developing a product or partnership strategy, digital health leaders must play by a different set of rules when addressing pediatrics versus adult digital health. As we heard across multiple expert interviews, product design and go-to-market approaches in pediatrics aren’t just miniaturizing healthcare for adults. Here are six core innovation guidelines for those designing for or partnering in pediatric digital health.

1. Pediatric health requires a hybrid approach

It might be controversial to kick off our innovation guidelines with a digital disclaimer, but fully-digital care models aren’t viable for most children. As evident from virtual school challenges during the COVID-19 pandemic, children thrive when given opportunities to socialize in real life and engage in active play, and they build trust by seeing the same adult figures in-person regularly. These lessons help to inform pediatric healthcare best practices, such as providing children with in-person prompts to communicate their symptoms, hold attention throughout appointments, and get comfortable with pediatric providers.

“Virtual-only does not work in many childhood cases. To illustrate: it’s hard to get a two-year-old to talk about their anxiety. A hybrid approach can work better, and when you’re in a physical space, you can rely on resources and staff in the room to make the environment more comfortable for the child to express their thoughts and feelings.”

– Ella Seitz, Partner at Esplanade Ventures

However, in-person considerations don’t mean that there’s no place for digital in pediatric care. Today’s parents are the first generation of digitally-native parents, and their children are digital natives as well. Parents in particular expect to access at least some of their children’s healthcare experiences digitally (e.g., ordering lab tests, filling prescriptions, conducting repeat mental health visits) and depend on the convenience that digitally-augmented healthcare experiences offer. A sweet spot exists in building digital extensions and reinforcements around in-person “anchor” touch points. For example, Goally, a digital therapeutic for children with ADHD and autism, empowers pediatric occupational therapists to extend the benefit of in-person treatments outside of the office by uploading custom videos of modeling activities for parents and children to review at home.

“The same places where virtual preferences exist for parents, they exist for children. Today’s generation of parents are digital super-users strapped for time, making pediatrics a particularly ripe area for startups to tap into consumer demand.”

– John Brownstein, Chief Innovation Officer at Boston Children’s Hospital

2. There’s a real need to support pediatric clinicians

Pediatric clinicians are at the core of children’s health. More than providers for adults, pediatricians flex between preventive, primary, and specialty care, and they are often families’ most trusted advisors at the frontlines of physical and social challenges. Yet pediatricians are burnt out, underpaid, and navigating health misinformation that impacts their therapeutic relationships with families. These factors have yielded a shrinking pediatric workforce, contributing to provider shortages at children’s hospitals, patient access gaps in pediatric specialty and rural care, and long wait times for pediatric appointments and procedures.

“Access is by far the biggest issue. Accessing a pediatric specialist is incredibly difficult, especially for underserved communities.”

– Omkar Kulkarni, Chief Transformation Officer and Chief Digital Officer at Children’s Hospital Los Angeles

One pathway for startups to support pediatric clinicians is by helping them manage high patient loads while managing burnout. For example, telehealth provider Hello Pediatrics extends the capacity of local pediatricians by providing their patients with after-hours virtual sick care. After each virtual visit, Hello Pediatrics physicians send their pediatrician customers visit summaries, to be incorporated into the medical record and to inform follow-up care. Other solutions are working to superpower pediatrician’s capabilities. Kismet Health5 is building proprietary large language models (LLM) to streamline clinical note taking and administrative workflows for pediatric clinicians.

Another important task is strengthening the relationship between pediatric clinician, child, and family. Today, over half of U.S. adolescents identify as people of color and one-quarter of all pediatrician office visits are associated with social and psychosomatic concerns—meaning that children and their families need to be comfortable sharing sensitive but relevant information with clinicians, and trust clinicians to provide socially and culturally competent care. In one approach, Rock Health Capital port co Equip Health builds trust around eating disorder care by pairing patients and their families with five-person dedicated care teams. These care teams build trusted rapport with patients and families over several weeks in order to better support recovery.

“Solutions that center patient and family needs for cultural relevance, care navigation, and discharge planning can ultimately result in reductions in no-show rates for procedures, fewer emergency visits, and improved outcomes for patients.”

– Dan Shpilsky, Corporate Ventures Lead at Redesign Health

3. School is a core site of care

While less than half of US children have an established relationship with a healthcare provider, over 95% of children aged 5-17 go to school. Children spend nearly half of their waking hours in the classroom, making school a unique stakeholder and site of care for children. The connection between school and pediatric health is bidirectional: whereas schools can address pediatric access gaps for primary care, immunizations, and health education, healthy students in turn have better grades and attendance, which has led to government programs linking school funding to student health. Accordingly, 17% of public schools offered telehealth services in the 2021-22 school year.

Innovators should consider the opportunity that schools present as a critical screening site for children’s health needs. Digital health startups like Cartwheel Care and Daybreak Health are increasingly working with schools as partners to screen and refer students to mental health care. Other startups are delivering healthcare services directly within school campuses, particularly when government programs offset the cost. Hazel Health partners with school districts to offer K-12 teletherapy and in-person care at no cost to families by blending insurance reimbursement, fees from school districts, and federal funding. Looking forward, as federal funding for school-based telehealth programs expires in 2024, school-based startups will need to double down on proving ROI to demonstrate long-term viability.

“Schools, pediatrician offices, and community-based organizations are anchors of trust for children and families. There, children and families feel recognized and cared for. Partnering with these trusted sites can help digital health startups join care conversations that they never would have been invited to.”

– Jennifer La Guardia, Vice President, Care Innovation at Brightline

4. Pediatrics can’t be uncoupled from poverty and Medicaid

It’s a stark reality that nearly 20% of children in the U.S. live in poverty, putting them at risk for adverse health across their lifetimes and an increased likelihood of worse health outcomes. Related to poverty rates, Medicaid covers 41% of births in the U.S., and Medicaid’s Children’s Health Insurance Program (CHIP) insures nearly 50% of American children. This means that CMS and state Medicaid programs have outsized impacts on pediatric health in the U.S.

“At CHLA, 70% of our pediatric population is Medi-Cal [on California’s Medicaid program]. That leaves limited room for investing in startup partnerships and big bets unless they’re really mindful of the opportunities and nuances of working with Medicaid.”

– Kiyana Turner, Director of Digital Transformation and Innovation at Children’s Hospital Los Angeles

Any startup or enterprise partner looking to have a deep impact on pediatric digital health must consider a commercial roadmap that addresses working with Medicaid programs and plans, including managed care organizations, which are health plan administrators that serve 72% of Medicaid enrollees across multiple states. Some pediatric startups launch with Medicaid as their core customer segment to drive impact and capture program incentives. Rock Health Capital port co Wildflower Health works with Medicaid plans to help women and families access care through virtual visits and remote monitoring, while Backpack Healthcare centers on working with Medicaid plans to offer teletherapy for BIPOC children. Other pediatric startups are folding Medicaid expansion into their roadmap. DotCom Therapy expanded beyond working with commercial plans and schools to accept Medicaid through Wisconsin’s BadgerCare Plus program, which covers one-third of children in the state.

5. Pediatric data management requires a nuanced approach

When it comes to pediatric health, parents and other caregivers are often highly engaged in care. Most adolescent patient portals have proxy accounts, which adult caregivers use to understand their child’s health and communicate with providers. However, as children age, proxy account management grows more complicated. Privacy laws vary across states and institutions (for instance, 12-year-olds in Maryland can keep mental health information separate from parents). Proxy permissions are emotionally charged, balancing a patient’s right to privacy and a parent’s right to access their child’s medical records.

The challenges of managing how pediatric patient data is shared with other parties, or proxies, has severely curbed digital health and data management initiatives in this space, as many startups and enterprises are nervous about legal or PR repercussions. But pediatric leaders are calling for more attention here, both in terms of technological innovation for pediatric patient portals—following in the steps of pediatric EMR Develo, which prioritizes adolescent confidentiality, or patient portal Bridge, which offers pediatric and proxy portals—and in data interoperability to drive device innovation, especially for remote monitoring. Innovators developing offerings in this space need to make sure their products can flex to future privacy laws, as well as regulatory and health data infrastructure changes.

“Regardless of a patient’s age, there will be a time in their lives when they need to share their information with another party. Requirements for data sharing and privacy are complicated and changing. Having the flexibility to adapt data sharing is key. Pediatrics is an important testing ground for understanding how to responsibly share information and manage privacy settings.”

– Lindsay Stevens, Clinical Professor of Pediatrics and Co-Chair of Pediatric Digital Health Taskforce at Stanford University

6. Life stage transitions should not be overlooked

There are pivotal transition periods within a child’s life stage, especially from infant to child (the first 1,000 days), and from adolescent to young adult. However, existing healthcare infrastructure is not necessarily handling these transitions smoothly. One of the most important areas is the transition out of infancy, and fortunately, we do see parenting and development startups addressing this space. For example, BabySparks offers parents a mobile app that provides personalized activities and milestone-tracking tools to support child development from infancy to age three. Babbly, an AI-enabled software platform that analyzes infant speech against developmental milestones, is helping parents to identify developmental delays early and seek intervention.

The second transition stage focuses on adolescents growing in their independence and transitioning into young adults, starting in the late teens. This period brings important changes in routine, site of care (e.g., receiving care at a college campus), and reproductive and mental health needs. Lack of support at this stage creates challenges such as medication adherence— the net result being more medical complications, higher emergency department use, and increased cost of care. While digital health activity in this stage is limited, we’re excited by players like Caraway Health, Mantra Health, and UWill that are addressing this transition phase. For innovators looking to develop stronger relationships with young healthcare consumers, building adolescent confidence and health literacy is key, especially as they start to create their own routines and age out of pediatrics.

“The transition from adolescent to adult care is a big opportunity for startups and large healthcare companies to connect with young people who are taking on more ownership of their health.”

– Chethan Sarabu, Clinical Assistant Professor of Pediatrics at Stanford Medicine and Director of Clinical Informatics at Sharecare

Nurturing beyond healthcare: It takes a village

It really does take a village to raise a child. Dozens of parties (parents, caregivers, clinicians, therapists, schools, payers, and policymakers) must connect several touchpoints (homes, hospitals, doctor’s offices, classrooms, and public spaces) across multiple life stages to keep children healthy and safe. And as healthcare becomes increasingly digital—augmented by phones, tablets, home devices, and backend AI—it’s important that digital tools keep the village of pediatric care stakeholders in mind.

“We need to think about kids holistically. Children are still developing. They need direct treatment, early intervention, as well as wraparound family and community care to manage and mitigate conditions. When you understand that, technology becomes a uniquely helpful tool to help address all of those problems—instead of focusing on just one problem.”

– Sabrina Braham, Clinical Assistant Professor, Pediatrics, Stanford School of Medicine and Founder and CEO Wellio.Health

For providers, payers, and biopharma players thinking about innovating for pediatrics more meaningfully, industry initiatives are forming and incentives are aligning globally to bolster activity. But strong leadership is needed to align user research, design thinking, and commercialization strategies to target the unique needs of children and their families—rather than miniaturizing adult approaches. At Rock Health Advisory, we’re ready to roll up our sleeves and support. Our future depends on it.

Footnotes

- Brightline is a Rock Health Capital portfolio company.

- Mental health includes eating disorders and substance use disorders.

- Learning and developmental disorder support includes developmental disabilities, ADHD, autism spectrum disorder, and occupational and speech therapy.

- While some companies in this category also address maternal health, we have included those with a focused infant care offering.

- Kismet Health Founder and CEO Cierra Gromoff is a 2023 RockHealth.org Innovation Fellow. Kismet raised its $2.5M seed round in October 2023.

Health system, payer, and biopharma leaders: tap into insights and strategic guidance with Rock Health Advisory.

Get in touch with the venture team at Rock Health Capital.

Join us in building a more equitable future at RockHealth.org.

And last but not least, stay plugged into the Rock Health community and all things digital health with the Rock Weekly.