A defining moment for digital behavioral health: Four market trends

As vaccination numbers accelerate and the US edges closer to some semblance of normality, healthcare is due for a dose of cautious optimism. Declining infection rates, herd immunity, and reopenings of all kinds will be cause for great celebration. But as healthcare prepares for what’s next, it’s important to keep in mind that the psychological effects of the pandemic will likely outlast the physical manifestations of the virus.

Though covered extensively, COVID’s exacerbation of behavioral health conditions still startles: in January 2021, 41% of US adults reported symptoms of anxiety and/or depressive disorder, a four-fold increase from 2019. The AMA recently expressed great concern for worsening opioid- and other drug-related mortality rates with more than 40 states reporting increases. Additionally, reports signal the compounding impact of behavioral health issues on COVID infection. For instance, regardless of age, patients with developmental disorders had the highest odds of dying from COVID-19 when compared to patients with other comorbidity risk factors.

Digital behavioral health companies have risen to the occasion and met increasing demand for behavioral health support. In a telling example, Doctor On Demand saw a 109% increase in unscheduled telehealth utilization for behavioral health between February and April 2020. Digital therapeutic companies such as Pear Therapeutics, Click Therapeutics, and Akili Interactive continued to bring to market products that treat and manage behavioral health conditions (e.g., schizophrenia and ADHD). Select startups expanded well beyond healthcare and formed creative partnerships to widen their reach (e.g., Headspace’s partnership with Netflix and Calm’s partnership with HBO Max and Bumble).

The diverse offerings of these companies mirror the multitude of conditions that fall within the category of “behavioral health.” For the purposes of this report, we define the digital behavioral health sector1 to include digitally-enabled startups serving three main clinical areas: mental health, substance use disorders (SUDs), and/or developmental disorders. We also define the digital behavioral health market to include both companies that exclusively serve behavioral health needs, as well as companies that serve behavioral health in addition to other clinical needs. To understand the progress and opportunity within behavioral health and across its three subsectors, this report examines venture funding and exit activity, as well as insights from builders and investors in this space. Four key trends emerged:

- Investors are supporting early- and late-stage innovation, though an increasing amount of capital is being put to work in later-stage deals to ensure mature products can scale to

meet urgent demand - There’s room for generalist and specialist models to meet high and diverse behavioral health demand

- Consolidation for clinical and digital capabilities has sped up and will likely continue

- The relatively low flow of capital to SUDs and developmental disorders compared to mental health signals an opportunity for innovators and investors

Trend #1: Investors are supporting early- and late-stage innovation, though an increasing amount of capital is being put to work in later-stage deals to ensure mature products can scale to meet urgent demand

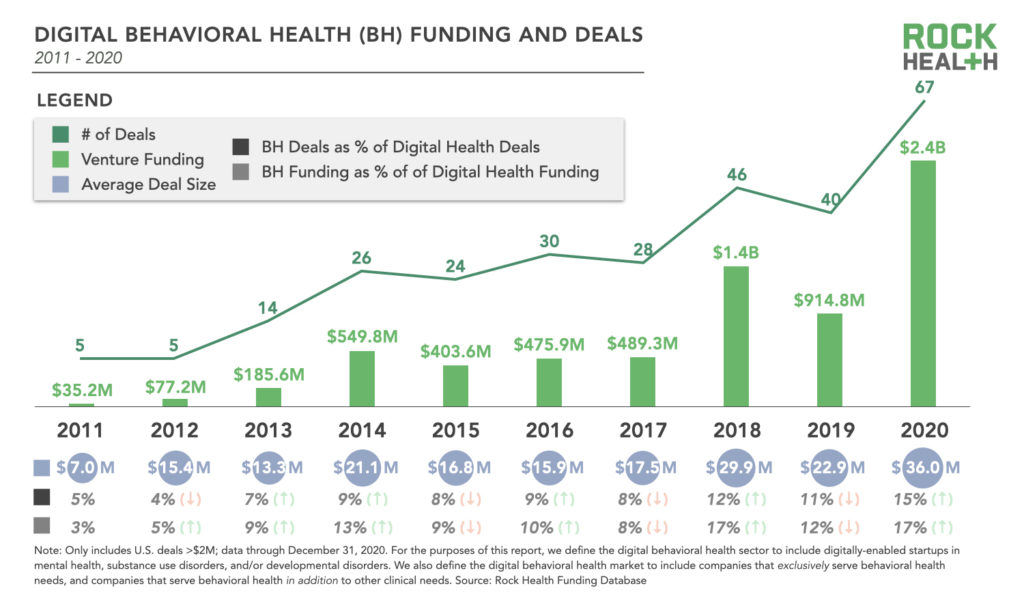

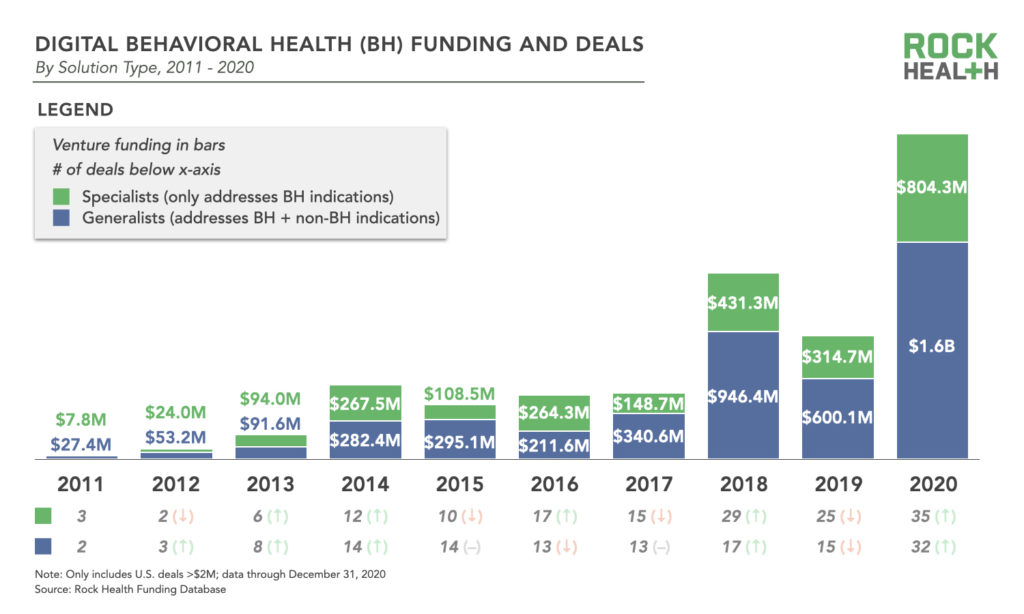

2020 was characterized by high growth in venture funding with $2.4B invested in US-based digital health startups that serve behavioral health needs (either exclusively or alongside other services).2 In addition to growth in overall funding, deal count (67), and average deal size ($36.0M) were 1.5x, and 1.2x greater, respectively, in 2020 than the previous high watermark in 2018. Shrenik Jain of Marigold, a company that offers peer support for mental health and substance use disorders, highlighted COVID as the accelerant, remarking that the large influx of funding “would have happened at some point even without COVID, but COVID was a forcing function.”

Funding for digital behavioral health companies has also grown as a percentage of total digital health funding, representing 17% of all digital health funding and 15% of all digital health deals in 2020 compared to 12% and 11% the prior year. At Rock Health, behavioral health companies comprised 11% of our deal flow pipeline in 2020.3

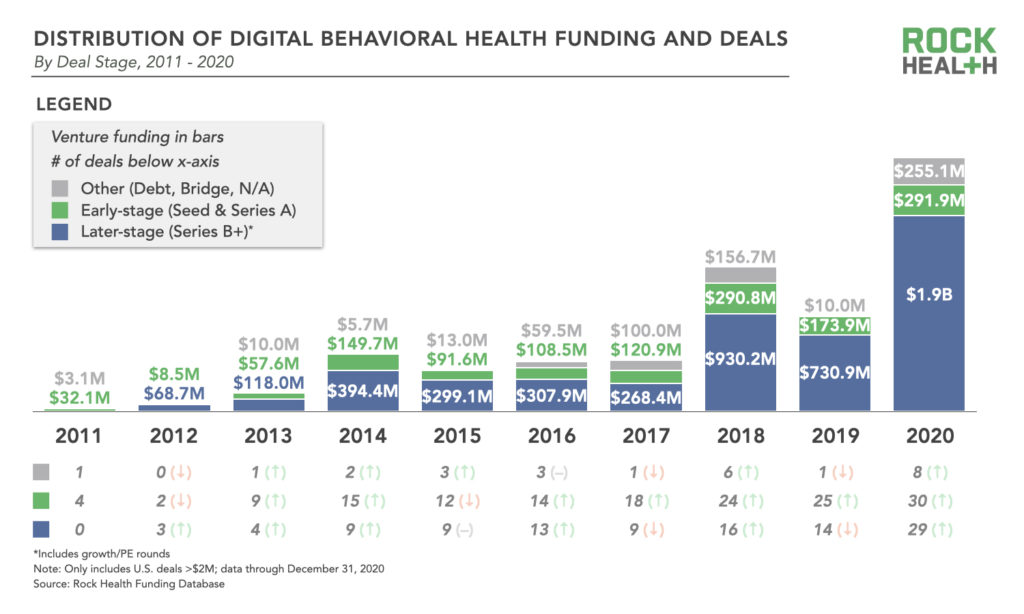

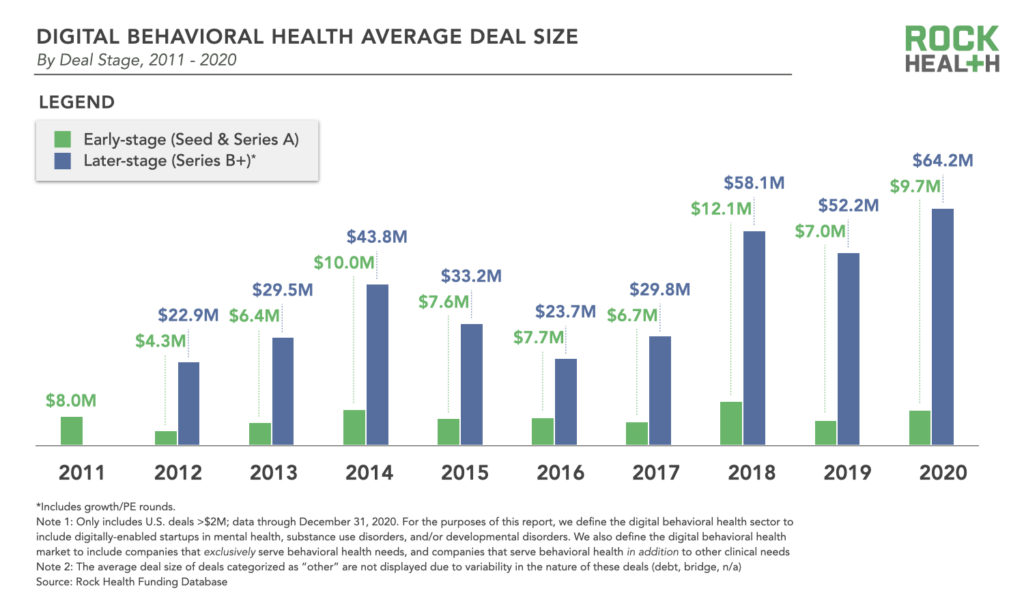

Though most behavioral health funding has gone to larger, later-stage rounds (Series B+)4 since 2011, most deals have been early-stage (Seed & Series A), signaling investors’ continued commitment to new innovation. Even so, alongside overall increases in digital health venture investment, investors have increasingly poured more money into later-stage digital behavioral health companies. While the average deal size for early-stage deals has remained relatively consistent over the last five years, the average deal size for later-stage digital behavioral health companies has increased substantially ($23.7M in 2016 to $64.2M in 2020).

There were seven mega deals5 in 2020, and they were all later-stage deals. The largest of these were Ro’s $200.0M Series C (Ro offers virtual consultations for home-delivered prescriptions for smoking cessation among other conditions) and Amwell’s pre-IPO $194.0M Series C (Amwell has a telemedicine platform that offers telepsychiatry, primary care, and other services).

The increase in average deal size for later-stage digital behavioral health companies signals that investors believe there is large public market awareness and willingness to invest in these companies. Investors want to heavily capitalize on this and scale these companies quickly to be on the leading edge of this wave.

— Bill Evans, CEO & Managing Director, Rock Health

Trend #2: There’s room for both generalist and specialist models to meet high and diverse behavioral health demand

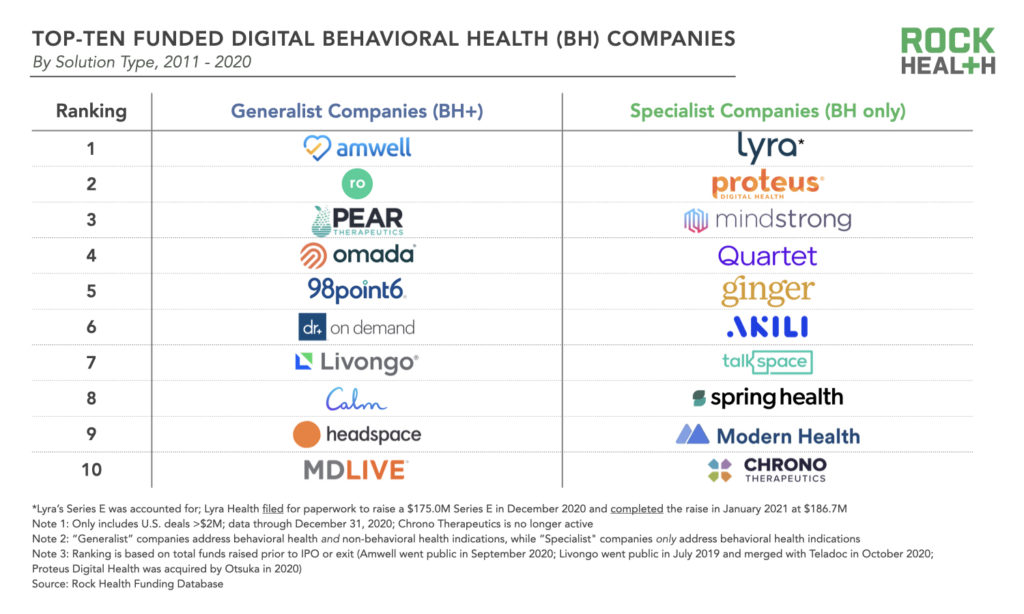

Within the digital behavioral health market, both “generalist” and “specialist” startups have emerged. We define generalists as those companies that address behavioral health and non-behavioral health indications (e.g., Omada, Doctor on Demand), while specialists are those that only address behavioral health indications (e.g., Lyra, Ginger).

In terms of funding, generalist startups led the charge in 2020, accounting for $1.6B of funding compared to the specialists’ $804.3M. As generalist companies tend to have a broader portfolio of offerings, it stands to reason that they would raise more capital (and have larger average deal sizes) than companies exclusively focused on behavioral health. However, interest seems to be rising in specialist models with those startups garnering $242.6M of early-stage funding in 2020, while generalist models raised $49.4M in early-stage capital. While investor Sebastian Caliri of 8VC believes in the value of both generalist and specialist startups, he anticipates, “We are going to start seeing more and more funding going toward specialized providers. In 2020 we saw the emergence of companies that pull out a discrete service line and become best in class in a specific indication or population, like Eleanor Health and Ophelia Health in SUD, and Brightline, Little Otter, and Sprout Therapy in pediatrics. I am excited about investing in companies that can pick a specific indication or patient demographic and deliver better health outcomes and reduce spend in their focus areas.”

Additionally, these specialist behavioral health companies have completed more deals than their generalist peers since 2011. In 2020, specialist companies completed 35 deals compared to the generalists’ 32, signalling that in the “generalist” versus “specialist” debate (at least related to behavioral health solutions), both teams still have many horses in the race. We do not anticipate—nor would we want to see—any dropping out soon. Here’s why:

- Supply-demand mismatch allows room for multiple approaches. Eddie Martucci of Akili Interactive (maker of digital therapeutic EndeavorRx™ for pediatric ADHD), suggests looking to the pharmaceutical industry for parallels on the generalist versus specialist approach: “In pharma, you have big, generalist players that address many different conditions as well as targeted, specialized players that only focus on one or two indications. The former has bigger total market caps but the latter has done an extremely good job at bringing incredibly valuable market-leading drugs to the market. Pharma has shown that there is room for both and I expect the same to be the case in the digital behavioral health market.”

- Generalist and specialist behavioral health companies serve distinct needs in different patient populations. Generalist companies tend to tackle mild-to-moderate, lower-severity behavioral health conditions (e.g., anxiety), and importantly, may address behavioral health in the context of other conditions (e.g., anxiety experienced by diabetes patients). On the other hand, specialist companies that exclusively focus on behavioral health conditions (and sometimes among specific populations) can focus on creating tailored solutions for unique needs (e.g., pediatrics) and serve higher-severity conditions (e.g., schizophrenia). Sean Duffy of Omada, a chronic disease management platform that offers mental health support, noted, “Companies that are specialized and focused on specific clinical needs in specific populations have a leg-up in being able to deliver on more precise outcomes.” Naomi Allen of Brightline, a pediatric behavioral health company, also sees the benefits of specialization: “The ‘plant a thousand seeds’ approach to the verticalization of behavioral health around underserved populations is just goodness and we need more of that.”

- Different approaches will fit the differing needs of enterprise customer segments. The task of self-insured employers to address the needs of a broad band of employees leads many to prefer working with generalist companies that can cover multiple indications. Similarly, health plans may be looking for holistic solutions that can tackle a variety of patient needs. However, Kristina Saffran of Equip, a company that offers virtual treatment for adolescent eating disorders, noted the opportunity for specialist startups to tap into these markets through partnership: “There is a tremendous opportunity for specialized companies like Equip to collaborate with generalist companies for member identification. Most people with eating disorders are not diagnosed until three years into their illness. Our emerging partnerships with primary care and other generalist companies enable us to intervene earlier, which translates to better clinical outcomes.” Focused offerings can pair well with the needs of health plans looking for solutions for the most complex, costly patients, as well as DTC customers looking for an innovative, tested approach.

The needs in this space are so diffuse that there are many different ways to win—going a mile wide, singularly focusing on one area, or being selectively broad. The markets are so large that there will likely be winners with each of these strategies.

— Sean Duffy, Co-Founder & CEO, Omada Health

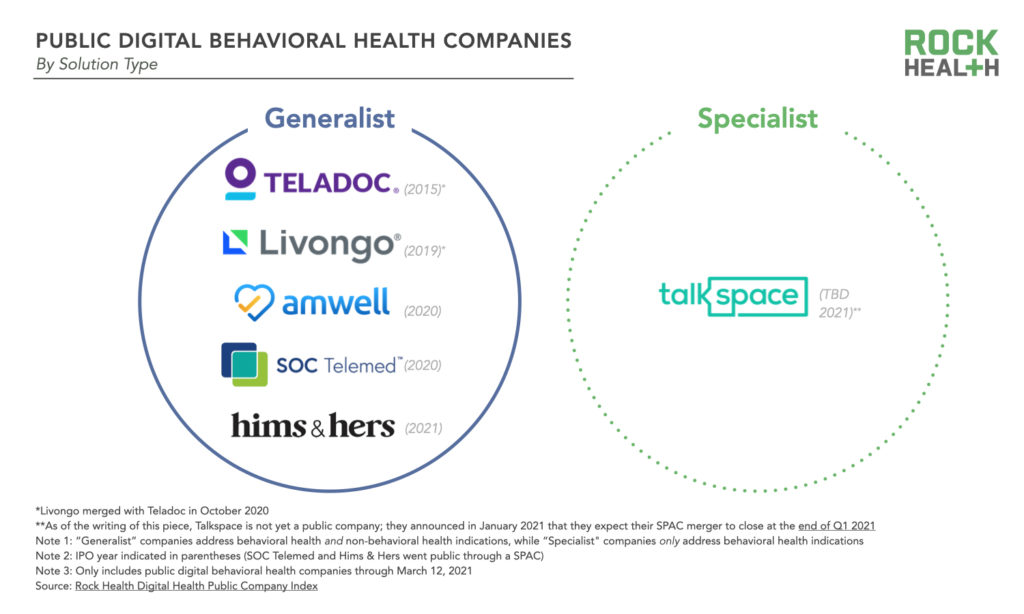

Trend #3: Consolidation for clinical and digital capabilities has sped up and will likely continue

Following the overall exit trend of digital health startups, behavioral health startups are most likely to exit via acquisition, rather than via IPO (or these days, via SPAC). Still, five generalist behavioral health companies—Teladoc, Livongo, Amwell, SOC Telemed, and Hims & Hers—have gone public to date with the latter two doing so through a SPAC. Talkspace, a company exclusively focused on behavioral health, announced in January 2021 that it plans to go public via a SPAC by the end of Q1 2021.

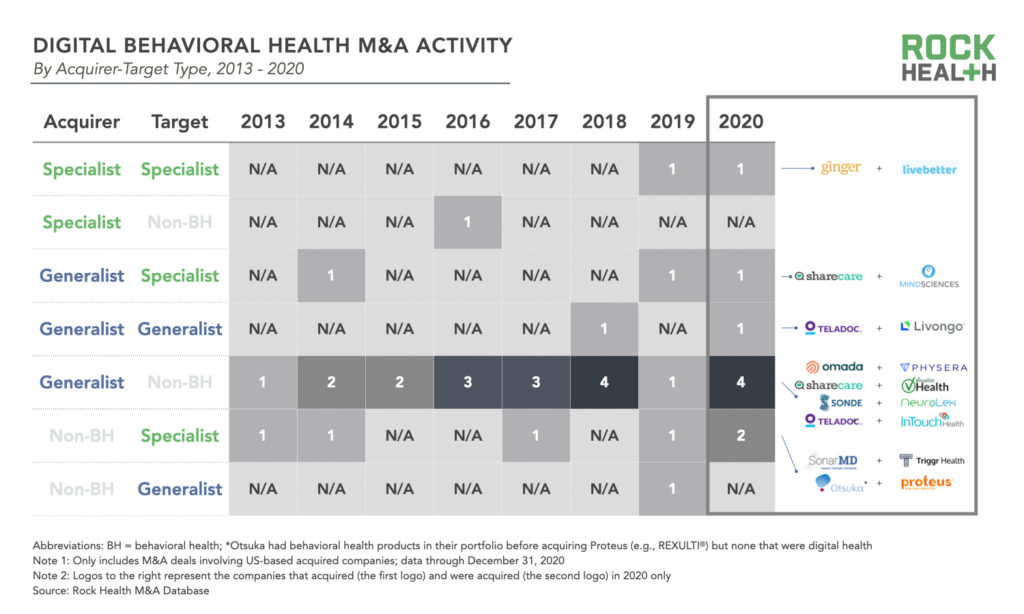

Meanwhile, the 2020 acquisition market included nine M&A deals in which either the acquirer or target was a digital behavioral health company.6 Consolidation in behavioral health in part signals a shift to address behavioral health needs in the context of whole person care. Going forward, we anticipate M&A activity that mimics the strategies of 2020:

- Digital behavioral health companies continue to build out their capabilities (e.g., Ginger’s acquisition of LiveBetter in March 2020)

- Companies serving behavioral health and other clinical needs combine efforts (e.g., Sharecare’s acquisition of MindSciences in June 2020, Livongo’s merger with Teladoc in October 2020)

- Companies with a behavioral health component add new, additional clinical indications to their portfolio (e.g., Omada’s acquisition of Physera in May 2020)

- Companies not operating in behavioral health add those new assets to their repertoire. Interestingly, and in the case of Triggr and Proteus’ respective acquisitions, the underlying technology that enables behavioral health treatment (i.e., in the case of Triggr, care coordination and predictive analytics) may be valued not just for behavioral health applications but for its broad applicability to other clinical indications.

Trend #4: The relatively low flow of capital to SUDs and developmental disorders compared to mental health signals an opportunity for innovators and investors

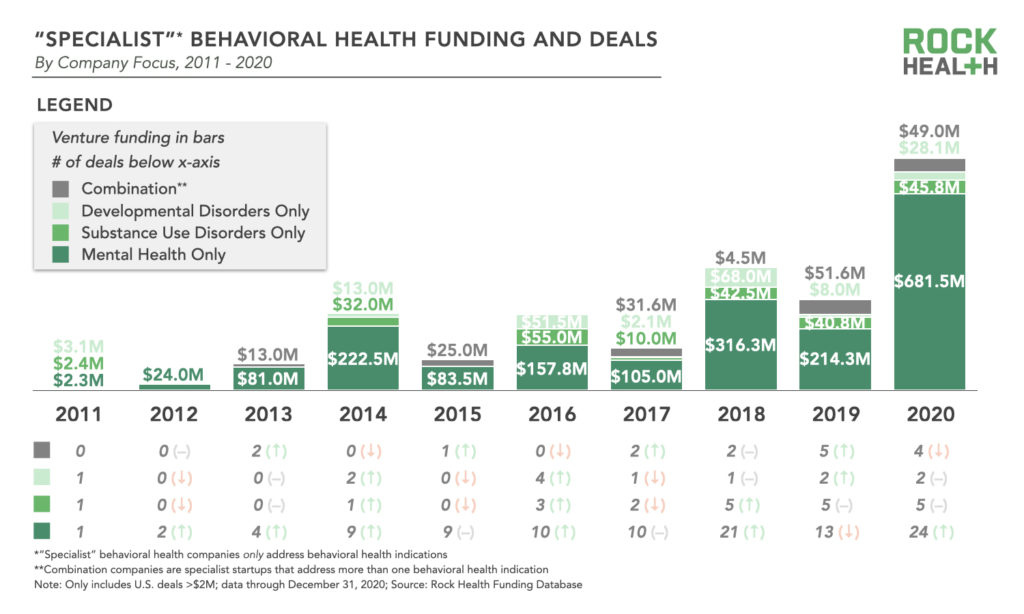

US venture-backed startups that exclusively focus on mental health (56, by our count) are more common than those that address substance use disorders (SUD—17 count), developmental disorders (DD—9 count), or a combination7 thereof (11 count). Across 2018-2020, these mental health companies saw funding and average deal size increase by 2.2x and 1.9x, respectively, while companies focused on SUD or DD did not register a meaningful increase across either metric. In 2020, mental health startups had an average deal size of $28.4M, three times that of SUD companies ($9.2M) and two times that of DD companies ($14.1M).

Our interviews illuminated a couple of explanations for investors’ greater investment in mental health relative to SUD and DD. First, market size. Patient prevalence of mental health exceeds that of SUD or DD. In 2018, 47.6M adults in the U.S. experienced mental health issues while 20.3M people aged 12 or older experienced SUD, and between 2009-2017, approximately 10.4M8 US children annually aged 3-17 had DD. Eddie Martucci of Akili Interactive remarked, “There is under-investment and under-representation in companies that address pediatric developmental disorders because this population does not have as large of a total addressable market (TAM) as, say, adults with depression. Companies and investors tend to go after the biggest pie. What that has led to are massive unmet needs in the smaller markets. Frankly, it takes a lot of gumption and boldness in sticking with a market that does not have the biggest TAM.”

Second, clinical protocols around mental health are more established than those for SUD and DD, which offer an important foundation for new startups to build from. Naomi Allen of Brightline noted, “Most companies, including Brightline, start with bread-and-butter cognitive behavioral therapy for anxiety and depression because they are wrapped around a fairly known set of protocols. The next-generation offerings around eating disorders or SUD are harder because they are new care models to craft. Starting with clinical protocols that are battle-tested is a great place for many companies to start.”

As investors, we are convinced of the impact and returns of directing more capital toward companies that diagnose, treat, and manage SUD and DD. Behavioral health issues often are comorbid: SUD can prompt downstream mental health issues (and vice versa), and people with DD have a higher prevalence of serious mental health and SUD issues. As healthcare companies seek to offer whole person care—acknowledging the interconnectedness between and within physical and behavioral health—we anticipate that solutions that focus on SUD and DD will play a critical and increasingly integrated role in this ecosystem. Additionally, while the total addressable market from a prevalence perspective may be smaller for certain, higher acuity conditions, the costs to the healthcare system of those conditions are often significant. Addressing those costs while improving patient outcomes is a compelling value proposition to investors and enterprise customers, not to mention the value of building a product precisely for the patient who needs it most.

Cautious optimism abounds

Digital behavioral health startups had their work cut out for them in 2020—and still do. For the generations that have lived through this pandemic, the trauma of COVID-induced social isolation, home-confinement, deaths, and job losses may be ever-present. There is also work still to be done to address pre-COVID era issues, exacerbated by the pandemic, such as reaching underserved communities and reducing costs that inhibit access to behavioral health care. However, we have faith that our individual experiences during the pandemic will compel us to continue breaking down any lingering stigmas, possess a deeper level of empathy for those of us who have, are, or will suffer from these conditions, and work towards ensuring that everyone who needs it has equitable access to quality and affordable behavioral health care.

We are eager to see what is in store for this market in 2021 and beyond. If you are a digital behavioral health company looking for early-stage funding, our investment team would love to chat. If you are interested in getting access to cross-industry datasets such as the ones featured in this blogpost, reach out to us. Finally, join our community of 50K+ Rock Weekly subscribers to stay up to date with the latest digital health news.

Acknowledgements

Special thanks to investor and thought-leader Sebastian Caliri (Principal, 8VC) and the startup leaders who generously shared their insights for this report: Sean Duffy (Co-Founder & CEO, Omada Health), Eddie Martucci (Co-Founder & CEO, Akili Interactive), Naomi Allen (Co-Founder & CEO, Brightline), Kristina Saffran (Co-Founder & CEO, Equip), and Shrenik Jain (Founder & CEO, Marigold Health). Thank you, as always, to our Enterprise Members for your continued support and partnership.

Footnotes

- Companies whose products, services, or offerings (e.g., teletherapy/coaching, self-help/guided programs, digital therapeutics, wearables, etc.) contribute to the prevention, diagnosis, treatment, and/or management of behavioral health indications.

- All funding data in this report is from the Rock Health Venture Funding database, which tracks US-based companies who have raised deals over >$2M since 2011.

- Rock Health is an investor in the following companies delivering mental and behavioral health services: Omada Health, Brightline, Equip, Marigold Health, and Doctor on Demand.

- Includes growth/PE deals and excludes all deals for which the series was not identifiable or applicable, as well as all bridge and debt rounds.

- Venture deals of $100.0M or more.

- Optum was reported to be in the final stages of purchasing discussions of AbleTo in April 2020; however, this acquisition has not been finalized yet and therefore is not accounted in our total.

- For example, if a company addresses both mental health and developmental disorders but not any other non-behavioral health indications (e.g., Cognoa whose pipeline as of the writing of this piece includes anxiety, ADHD, speech & language, and autism diagnostics and therapeutics), they would be considered a combination company.

- Calculated using the referenced statistic of 16.93% (overall prevalence of DD between 2009-2017) and the number of children (61,698,600) between 3-17 in 2017.