Digital health funding: 2015 year in review

For full access to all of our funding reports and database, become a Rock Health partner—email partnerships@rockhealth.com.

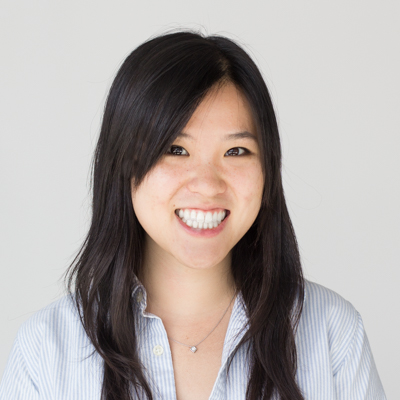

With 2014 breaking all records, we entered 2015 wondering if digital health funding would

be able to keep pace. To our pleasant surprise, digital health saw $4.5B in total venture funding, ending the year slightly above 2014’s $4.3B mark. While skeptics may question

the attractiveness of digital health as an industry, it’s important to keep in perspective what an incredible feat it was for 2015 to be on pace with 2014.

Last year, records were not just broken—they were doubled. But digital health continues to account for a healthy 7% of total venture funding. The steady amount of funding should calm any concerns of a bubble. Digital health is no longer a novelty as well. We’re seeing company growth, with late stage deals accounting for almost a quarter of all deal volume.

And exits abound—2015 was a record year for industry consolidation, and digital health was no exception. M&A activity nearly doubled in volume with 187 deals and $6B in disclosed activity. Public markets remain a viable exit opportunity with $1.4B raised in five IPOs this year, to create $8B in market capitalization.

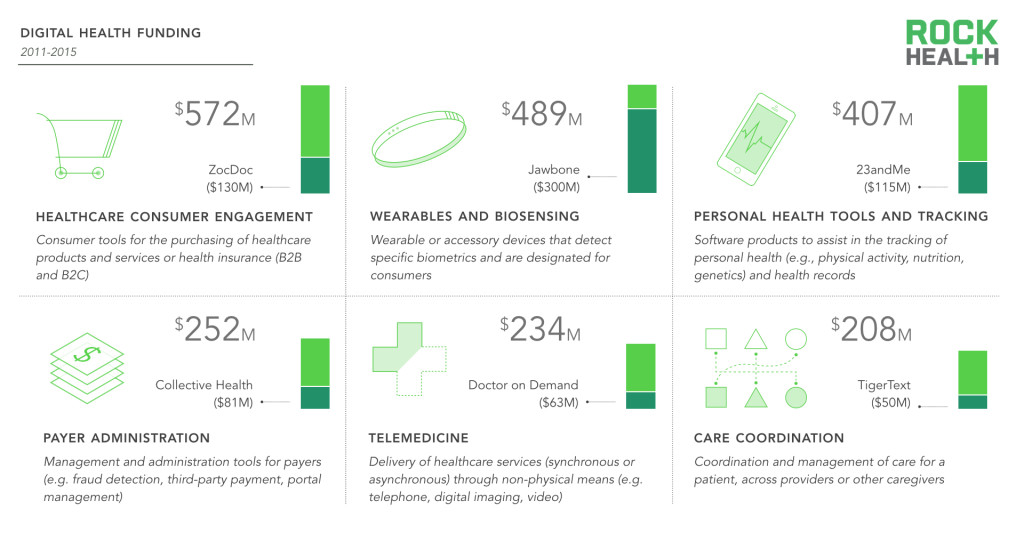

Perhaps the largest theme of 2015 was an increased focus on the consumerization of healthcare. The healthcare consumer engagement and personal health tools and tracking categories alone account for 23% of overall funding. As we look to 2016, we are optimistic and excited about the growing role of the consumer and the consequent B2C opportunities. You can see our report on the topic here.

Dollars and deals

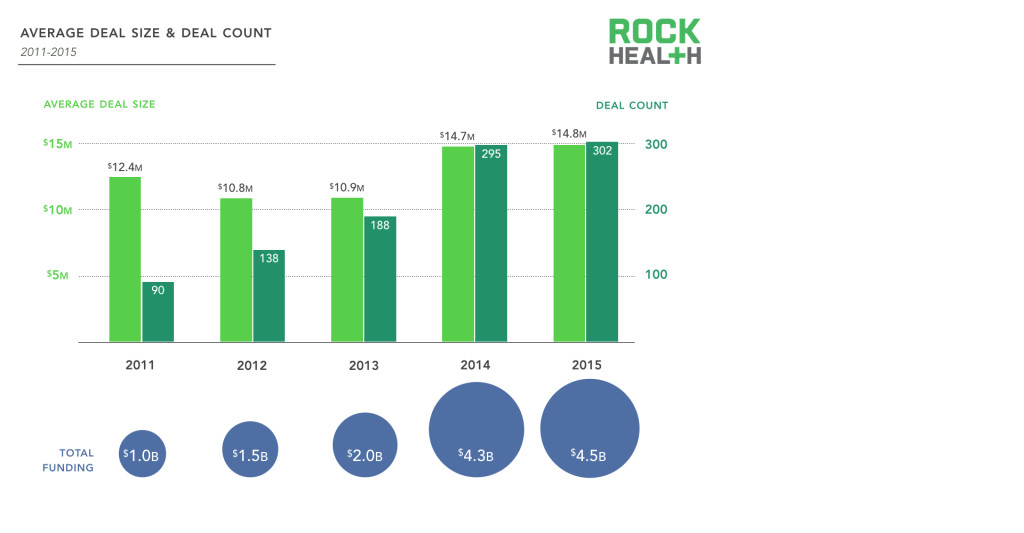

In 2015, venture funding of digital health companies reached $4.5B, ending slightly above 2014.

Source: Rock Health Funding Database

Note: Only includes U.S. deals >$2M; data through December 8, 2015

2015 saw steady funding throughout the year, closing out right above 2014 and reaching the $4.5B mark. With yet another year of ample funding, compound annual growth (CAGR) from 2011-2015 was 32%.

The year started off slightly slower, but quickly picked up steam in the second quarter, which is when the largest amount of deals and largest average deal size took place. The year closed out with 302 deals and an average of $14.8M.

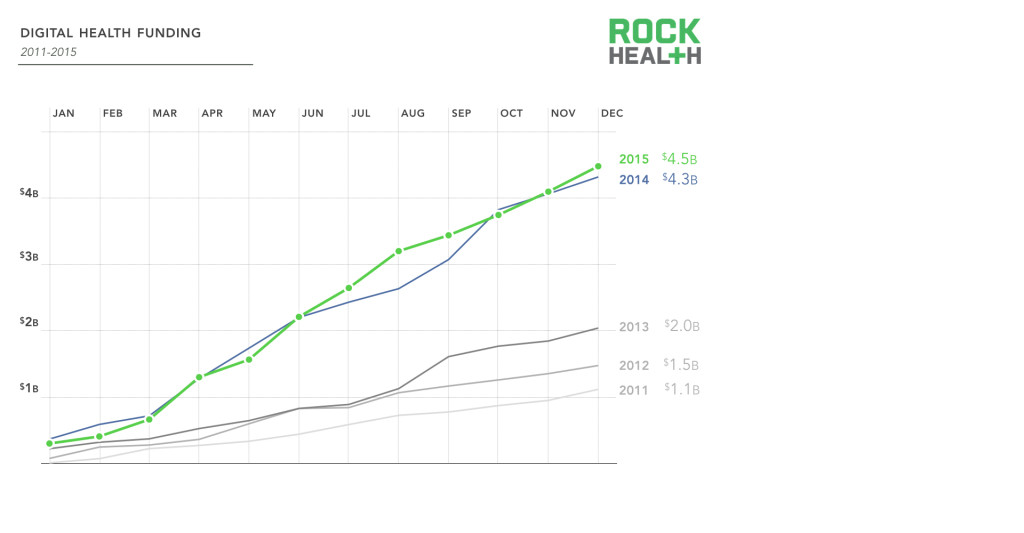

Digital health continues to receive strong investor attention, accounting for 7% of total venture funding.

Source: PwC MoneyTree (latest available is through Q3 only); digital health data based on Rock Health data

Note: Digital health only includes U.S. deals >$2M

Where overall venture funding showed a slight dip in 2015, digital health continues to hold a health 7% of total venture funding and took a less significant dropoff than other sectors, such as software and medical devices.

Both average deal size and total number of deals in 2015 closely mirrored 2014, with just a small increase in average deal size and a handful more deals.

Source: Rock Health Funding Database

Note: Only includes U.S. deals >$2M; data through December 8, 2015

In 2014, there was a sharp increase in both number of deals and average deal size, up 56% and 35% respectively. However, 2015 only saw a small increase in the total number of deals and average deal size.

Digital health companies showed growth internally as well with the average number of employees increasing from 44 to 50 over the course of the past year, which is also a significant bump from an average 40 employees in 2013.

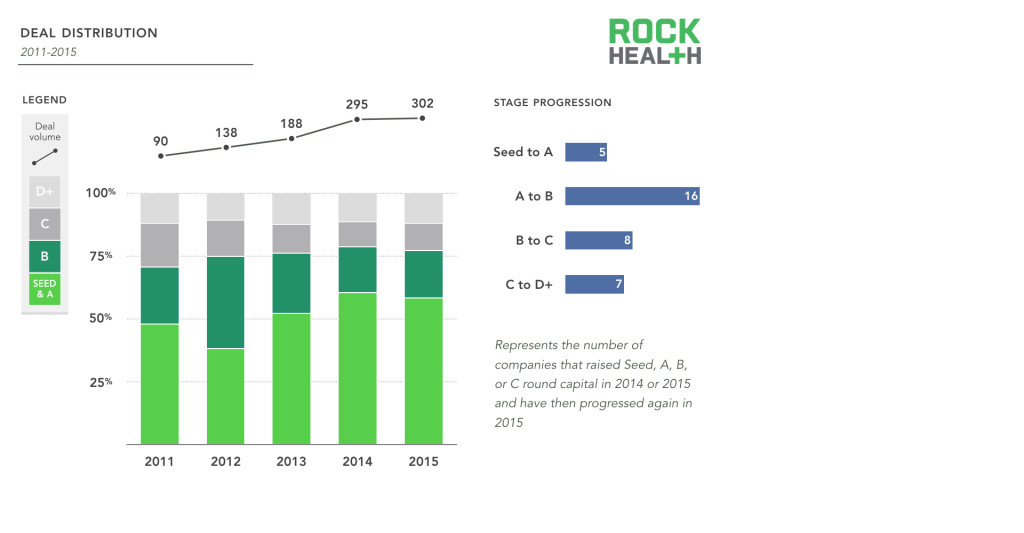

Digital health deal volume was relatively flat from 2014. However, 2015 saw the greatest number of late stage deals Series C and beyond thus far.

Source: Rock Health Funding Database

Note: Only includes U.S. deals >$2M; stage progression excludes bridge rounds; data through December 8, 2015

In 2015, Seed and Series A deals continued to account for the majority of deals. Series C and later stage deals represented 23% of all deal volume.

Thirty-seven companies that closed a deal in 2014 raised at least one more round in 2015. Collective Health and ClassPass each closed early stage deals in 2014, Series A and Seed & Series A respectively, and then Series B and C rounds in 2015. Peloton Interactive raised a Series B in 2014 and followed on with a Series C and Growth/PE round in 2015.

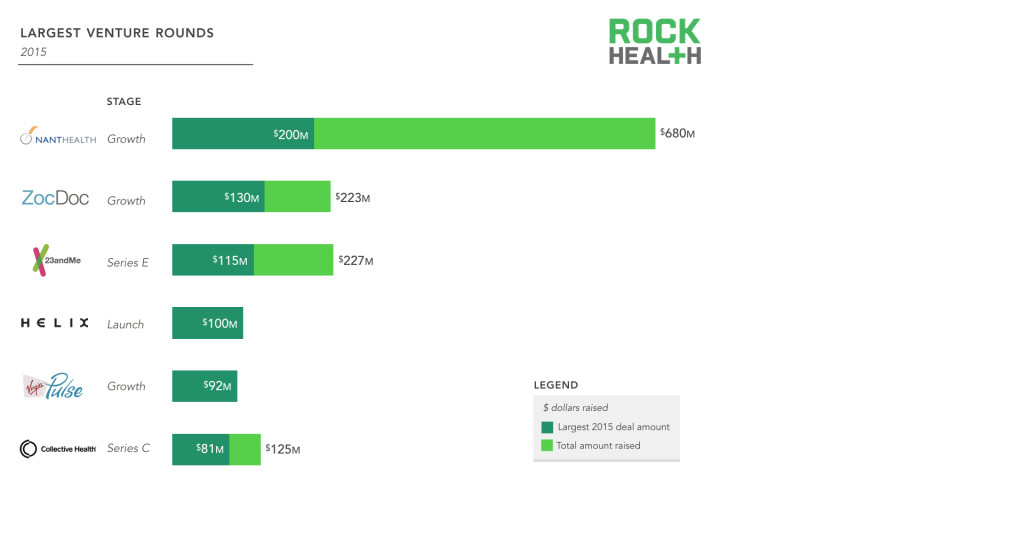

The six largest deals of the year totaled to nearly three quarters of a billion, representing 16% of all 2015 funding.

Source: Rock Health Funding Database

Note: Only includes U.S. deals >$2M; data through December 8, 2015

NantHealth closed the largest deal of the year with $200M in new funding, bringing its total amount raised to date to an impressive $680M.

Two of the six largest deals were won by consumer-driven genetic companies, 23andMe and Helix. With genetic services adoption only at 7% this year, investors are betting big that there will be continued growth and uptake by consumers to engage in their health via genetic products and services.

The top six categories accounted for 50% of all digital health funding in 2015, with payer administration entering the rankings for the first time.

Source: Rock Health Funding Database

Note: Only includes U.S. deals >$2M; data through December 8, 2015

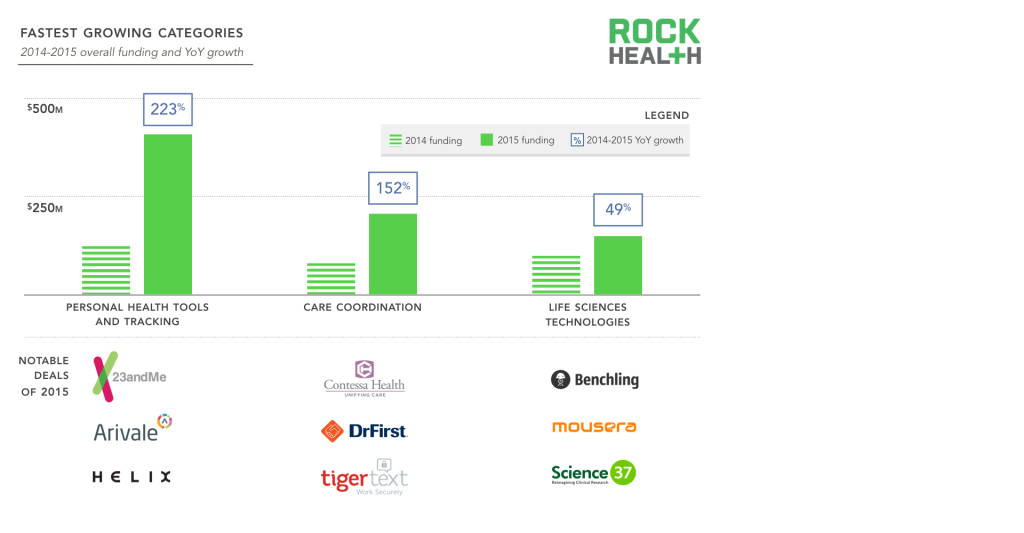

High growth categories of 2015 reflect the shifting industry needs to cut costs, engage with the end-user, and improve communication and coordination.

Source: Rock Health Funding Database

Note: Only includes U.S. deals >$2M; data through December 8, 2015

Aided by huge investments in consumer-driven genetic companies, funding in the personal health tools and tracking category totaled more than that in the care coordination and life sciences categories combined. This reflects the growing emphasis on and importance of creating a consumer-centric world for healthcare.

Care coordination companies offer not only solutions for more streamlined workflows, but also improvements to patient experience. Tools for life sciences experienced significant growth as biopharma continues to struggle with price pressures and the need to accelerate drug development processes.

Investors

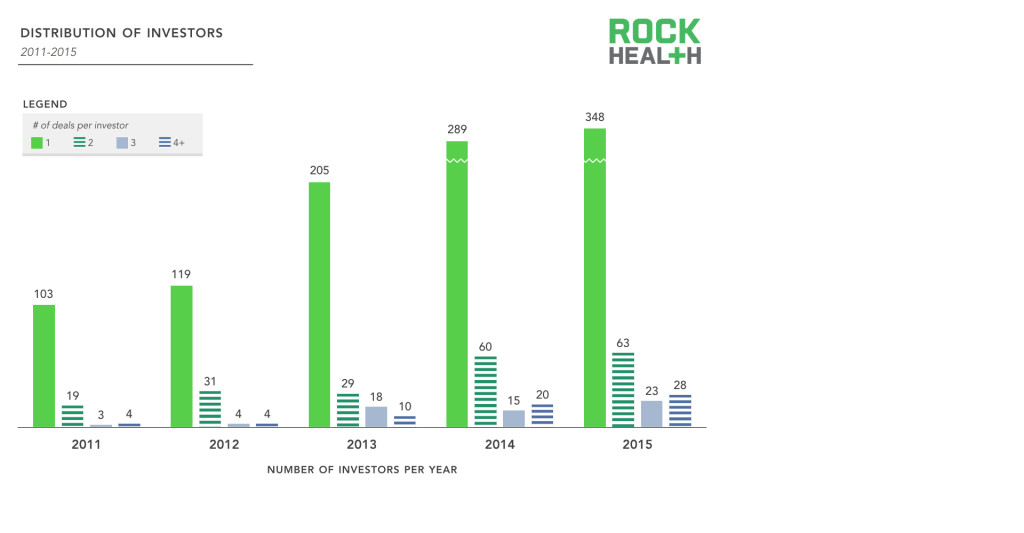

Investors who were most active in 2014 continue to invest in digital health in 2015, with 51 firms closing three or more deals.

Source: Rock Health Funding Database

Note: Only includes U.S. deals >$2M; data through December 8, 2015

The industry continued to see an increasing number of dabblers investing in digital health with 336 venture firms investing in one deal each this year. There was a growing long tail of investors who have done three or more deals, up 40% from last year to 49 unique investors. Moreover, there was a significant increase from 15 to 25 investors that completed three digital health deals each.

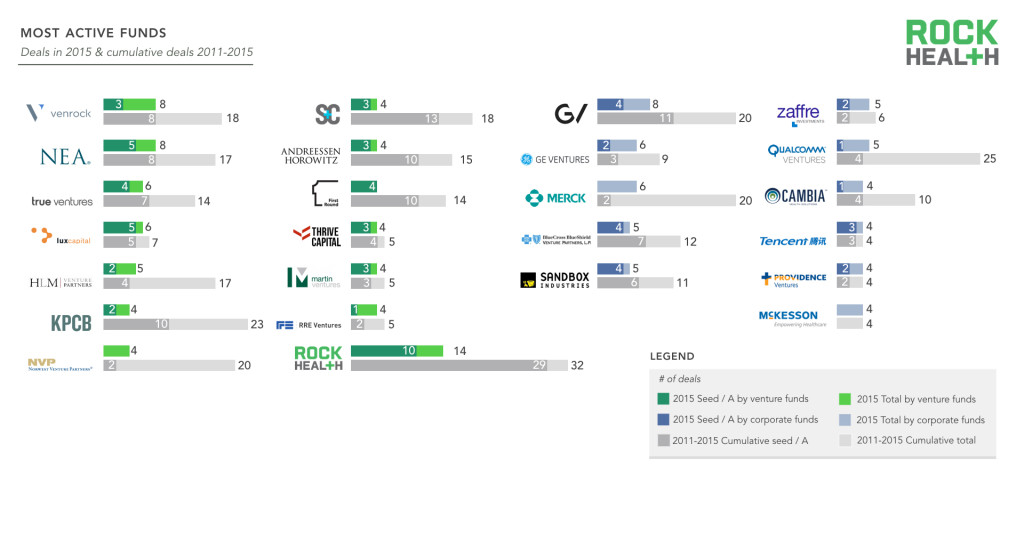

One fifth of the investors who have done ten or more deals since 2011 are strategic / corporate funds. The most active investors of 2014 (those who participated in four or more deals) continued to invest in at least one digital health company in 2015.

Digital health continues to receive funding from a wide range of funds with a noticeable growth in the number of active corporate investors.

Source: Rock Health Funding Database

Note: Only includes U.S. deals >$2M; data through December 8, 2015

Since 2011, there have been a total of 24 investors who have done 10 or more deals. All 24 investors did at least one deal in both 2014 and 2015.

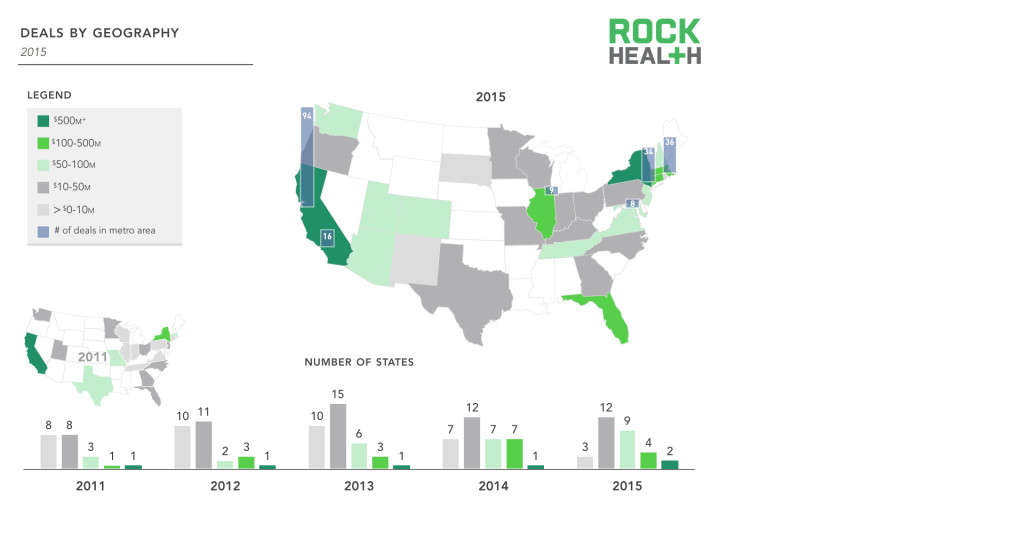

Geographies

Digital health companies headquartered in California continue to garner the majority of funding, with Bay Area-based companies accounting for 36% of overall digital health investments.

Source: Rock Health Funding Database

Note: Only includes U.S. deals >$2M; data through December 8, 2015

Digital health companies from 30 states received funding this year, with New York finally joining California as home to companies accounting for over $500M in deals.

Boston beat out New York City ever so slightly to claim the title of second largest digital health hub, but both should watch out as digital health continues to heat up in the metro areas of Miami, Salt Lake, Orlando, and Denver; each home to companies that brought in more than $65M.

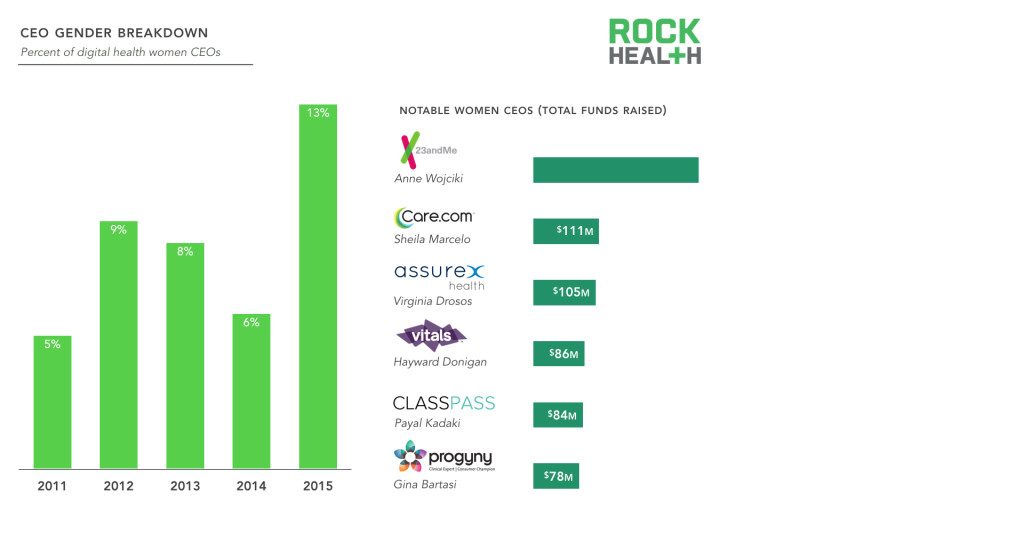

CEO demographics

A record number of women CEOs received funding in 2015, but men still make up the vast majority of digital health CEOs.

Source: Rock Health Funding Database

Note: Only includes U.S. deals >$2M; data through December 8, 2015

While men still make up the majority of funded digital health CEOs, women led twice as many companies funded in 2015 than those in 2014. Of the companies funded in 2015, over 13% had a woman CEO. Of the companies founded and funded in 2015, 29% had a woman CEO.

The majority of women CEOs have advanced graduate degrees; over one-third have MBAs, 11% have PhDs, and 9% have MDs.

States that have the most women digital health CEOs include California (21), Massachusetts (7), and New York (6).

Exits and public markets

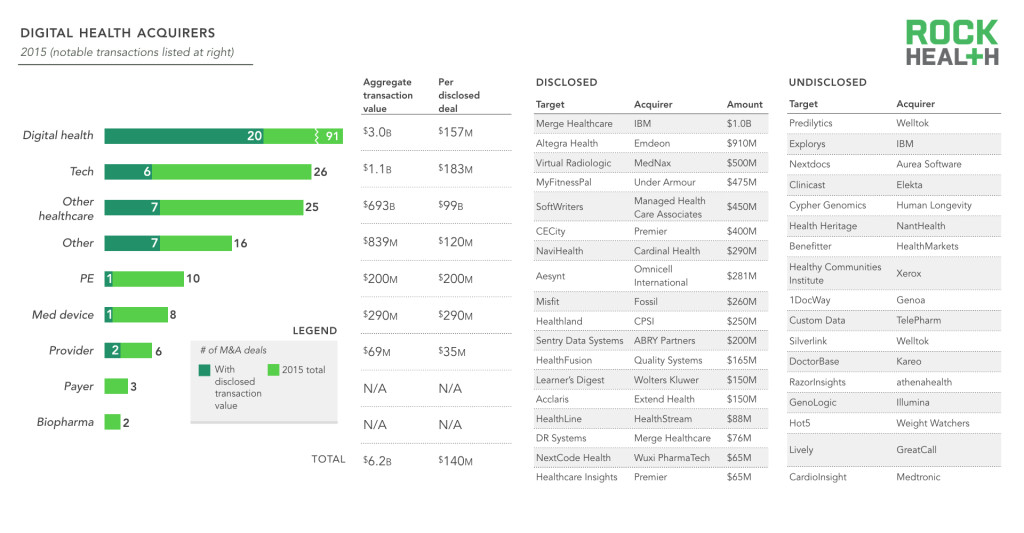

We tracked 187 M&A deals throughout 2015, nearly doubling in transaction volume from 2014.

Source: Rock Health tracking and analysis based on news reports

Note: M&A transactions totals and lists are not meant to be comprehensive; deals through December 8, 2015

2015 was a year of massive consolidation across the healthcare industry, whether payer, provider, pharma, or digital health. With over $6B in disclosed transactions and averaging $140M per disclosed deal.

A select group of categories proved particularly appealing to acquirers. For example, 34 EHR and clinical workflow companies were acquired in 2015, up from six in 2014.

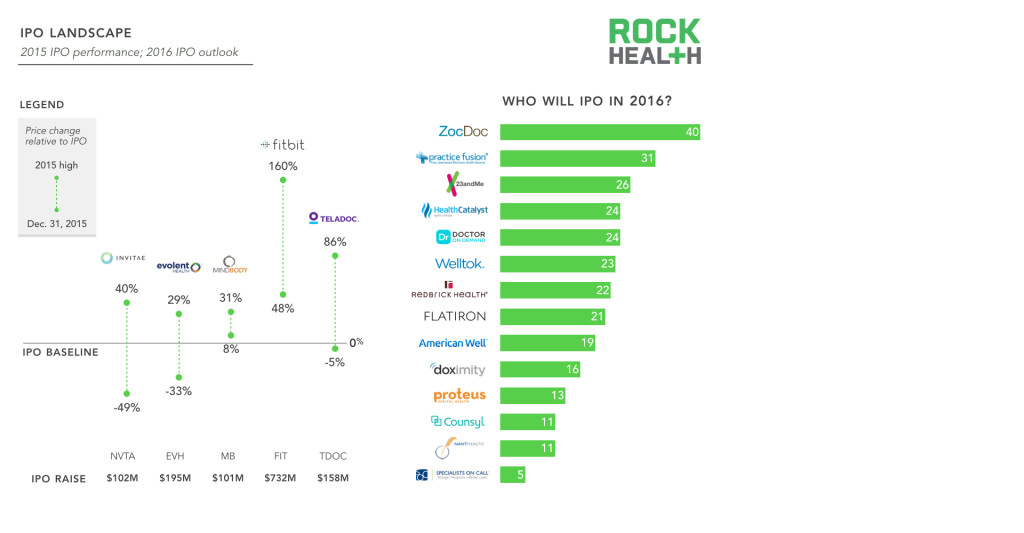

Five digital health companies went public in 2015, with two companies trading above their IPO price.

Source: 2015 performance from NASDAQ and Google Finance as of market close on December 8, 2015; 2016 IPO outlook based on Rock Health survey of Rock Weekly readers (n = 132)

In 2015, five venture-backed digital health companies went public. Three of the five are currently trading above IPO price, with Fitbit seeing the most growth.

Overall, Fitbit’s performance in the public markets has been a success story. Fitbit raised $732M and now has a market cap of $6.1B, which makes it the third largest publicly traded digital health company behind Cerner and IMS Health.

Of the companies that went public this year, there was no correlation between their total venture funds raised, years of operation, or current market cap.

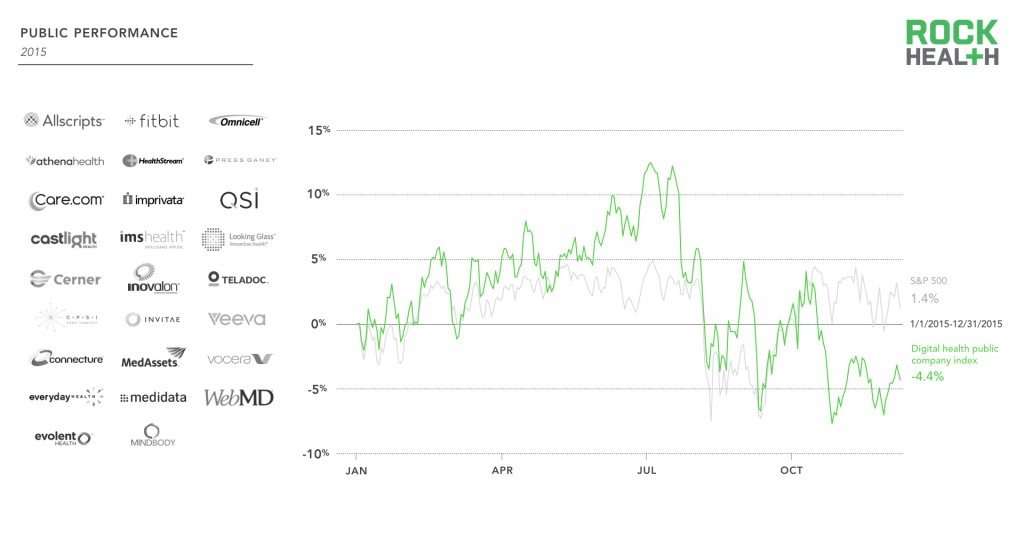

Publicly-traded digital health companies did not fare well even when compared to the public market’s overall performance.

Source: The Digital Health Public Company Index by Rock Health (as of market close on December 8, 2015); Available from: https://www.motifinvesting.com/motifs/the-digital-health-index-by-roc-O7xghiOF#/

Summary

Venture funding for digital health companies in 2015 raised $4.5B, passing 2014. This represents a compound annual growth (CAGR) from 2011-2015 of 32%. There was 302 deals across 267 companies, closing with a slight new record average deal size of $14.8M.

Major themes The top six themes of the year that received 50% of all funding included: healthcare consumer engagement, wearables and biosensors, personal health tools and tracking, payer administration, telemedicine, and care coordination. Payer administration joined the top six for the very first time this year, and personal health tools and tracking and care coordination joined for the first time since 2012.

Growth categories Three areas that experienced noticeable growth in funding: personal health tools and tracking, care coordination, and life sciences technologies. As the industry faces growing pressure to cut costs, digital health will play a key role in enabling engagement with the end-user and improving communication and coordination.

Prolific investors Digital health continues to attract the attention of investors, with an growing tail of investors who participated in at least one deal. Over the past five years, the most active digital health investors have remained stable and diverse. Fourteen venture firms and ten strategic / corporate funds participated in at least four digital health deals each in 2015.

Exits activity In 2015 there were a flood of M&A transactions, with 187 tracked and disclosed deals valued at over $6B. Digital health companies continued to be the most active acquirers, with technology coming in second. Public markets remained a viable exit with over $8B in current market capitalization created through five digital health IPOs.