Q3 2019: Digital health funding moderates after particularly strong first half

Stay up to date with the latest headlines in healthcare technology and new Rock Health content. Subscribe to the Rock Weekly to keep your finger on the pulse of digital health.

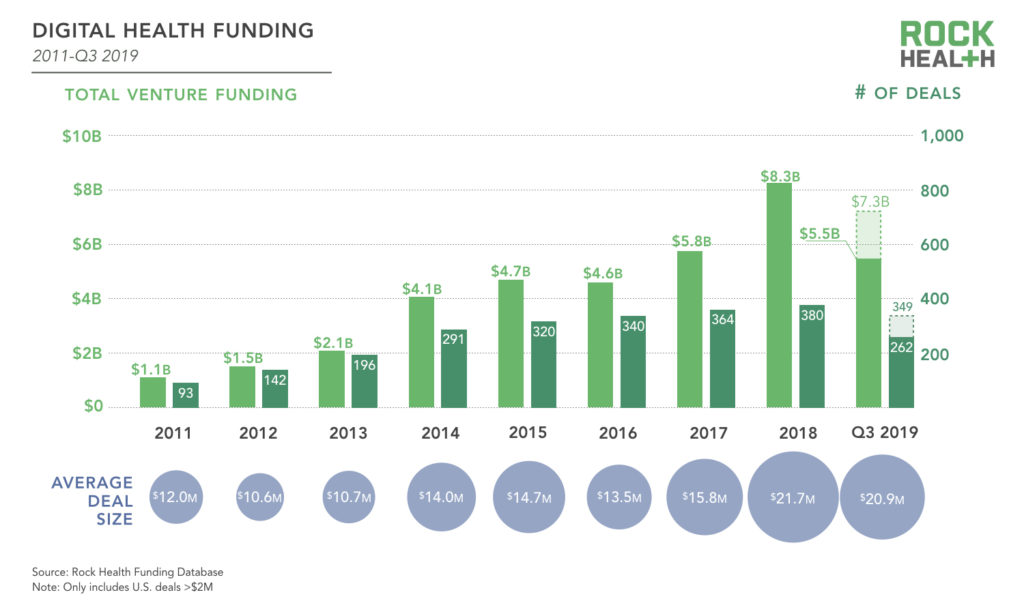

Digital health funding levels off after 2018’s high water mark

Digital health venture funding remains near all-time highs. Startups in the sector are on track to raise an estimated $7.3B by the end of the year—1.3X more than 2017, though short of the record $8.3B invested in 2018.

As with the overall VC industry, large deals are driving the funding trend in digital health. Investors are placing bigger bets on a small number of companies—average deal size in 2019 is $20.9M, up 32% from 2017 and in line with 2018’s $21.7M average deal size. Meanwhile, we anticipate the number of digital health deals in 2019 will be 5-10% lower than in 2018—potentially the first time deal count has declined year-over-year since we began tracking in 2011.

Mega deals (and capital concentration) continue to drive the trend

So far, 2019 has seen nine $100M+ mega deals—roughly on par with the record eleven mega deals in 2018. Two mega deals hit in Q3 2019:

- Capsule, the online pharmacy offering same day delivery in New York City, raised $200M in September to expand its service across the US. Capsule’s national expansion plans turn up the heat in the online prescription market—Amazon entered the pharmacy business in 2018 with its acquisition of PillPack to compete with pharmacy giants CVS and Walmart, both of which offer online pharmacy services.

- Beta Bionics, the developer of an automated bionic pancreas, closed two $63M rounds this year—a Series B in January and Series B2 in July—to bring the total Series B funding to $126M. The funding will be used for final product development, Phase 3 clinical trials, regulatory submissions, and product launch of the iLet Bionic Pancreas System. Beta Bionics is racing alongside digital health startups like Bigfoot Biomedical and medical device powerhouses like Medtronic and Dexcom to deliver a closed-loop insulin delivery system for patients with type 1 diabetes.

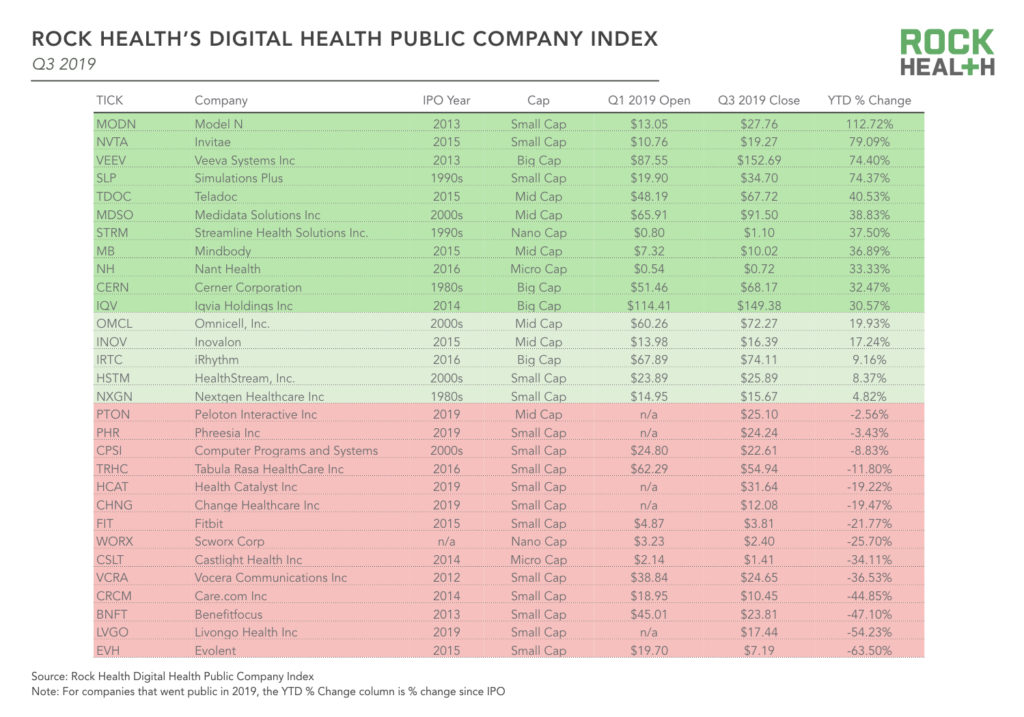

Digital health IPOs are hot—five companies have gone public this year, with one more on deck

The flow of capital to maturing companies coincides with an uptick in digital health exit activity. Five companies have gone public so far in 2019: Livongo, a chronic condition management platform; Health Catalyst, data and analytics technology and services for healthcare organizations; Phreesia, applications to help healthcare organizations manage the patient intake process; Change Healthcare, revenue cycle management, payment management, and health information exchange (HIE) solutions; and Peloton, live, on-demand fitness classes via its connected exercise bike, treadmill, and app.

Early public market performance for these IPOs has been mixed. As of October 1, Health Catalyst is trading about 20% below its closing price on the first day of trading after increasing more than 20% in the weeks following its public offering. Livongo’s share price fell following its first earnings report as losses were greater than analysts expected, despite 156% revenue growth that beat Wall Street estimates. Phreesia and Change Healthcare have largely traded within +/- 10% of their offering price. And Peloton’s stock price dipped after the company went public on September 26, which some took as a sign that 2019’s hot IPO market is cooling off for the moment.

At last week’s Rock Health Summit, we asked the audience who they thought would be the next digital health IPO (post-Peloton). The 700 attendees (including us!) missed the mark. Now we know we should have put our money on Progyny—the fertility benefits management company just released its IPO prospectus. This isn’t a coincidence, as investment in women’s health is on the rise. We’re seeing something similar in mental and behavioral health investments as well.

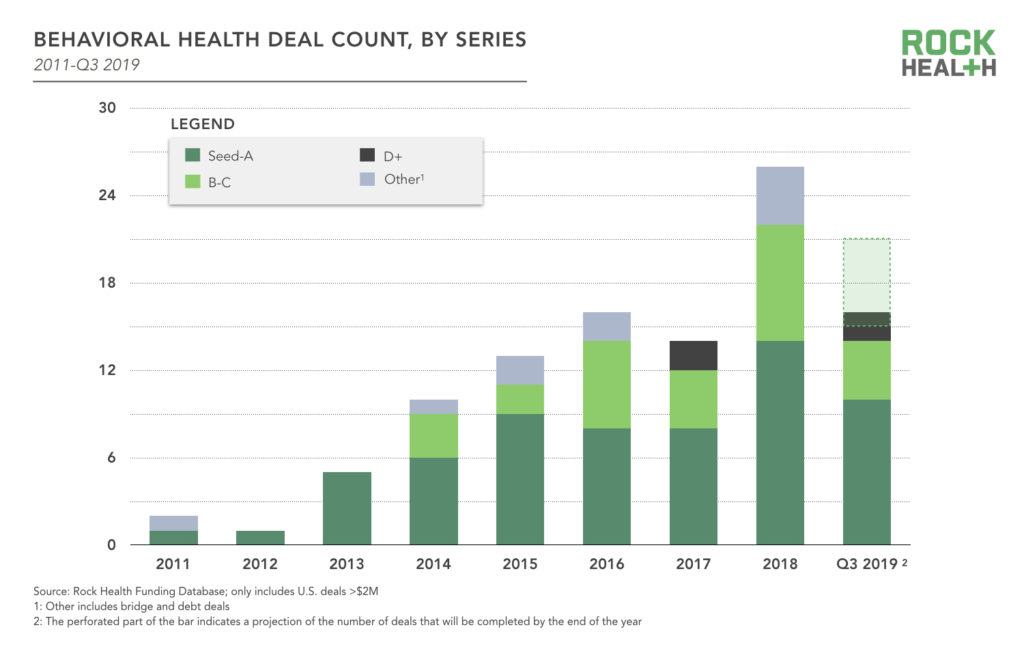

Behavioral health garnered significant funding in 2019, and funding for women’s health is on the rise

Digital behavioral health is showing signs of a maturing investment sector with: more funding and larger deals, a greater number of later stage companies, and a consistently strong pipeline of early stage innovation. We define behavioral health as solutions that address a spectrum of needs from basic mental wellness through treatment of disease (from relaxation and meditation solutions including Calm and Headspace to digital therapeutics such as Akili Interactive), as well as platforms offering access to behavioral health care such as Lyra Health. This is an area of enormous need given alarming increases in suicide and depression rates, a symptom of the mental health epidemic that affects 50% of Americans at some point in their lives.

Here’s a bit more about digital behavioral health startups, by the numbers:

- Funding: Through Q3 2019, sixteen digital behavioral health companies raised a total of $416M—8% of overall digital health funding in that time period. The number of behavioral health deals has grown steadily from just one in 2012 to sixteen in 2016—and has remained near or above that level ever since.

- Deal size: The average behavioral health deal size thus far in 2019 is $26M—up 73% from 2018. Overall digital health deal size is down 4% across the same period.

- Later-stage deals: Since 2016, 30%-40% of annual behavioral health deals have been Series B or later stage—with 60% of companies early-stage, there’s still a robust pipeline of emerging companies.

Across 2019, four behavioral health companies raised rounds of $50M or more:

- Talkspace ($50M), a telebehavioral health platform that connects users to licensed therapists

- Quartet ($60M), a platform that enables providers to collaborate on treatment plans and concierge-like support for patients

- Pear Therapeutics ($64M), a portfolio of clinically-validated, software-based therapeutics—its two products on the market address substance use disorder and opioid use disorder

- Calm ($88M at a $1B valuation), app for sleep, meditation and relaxation

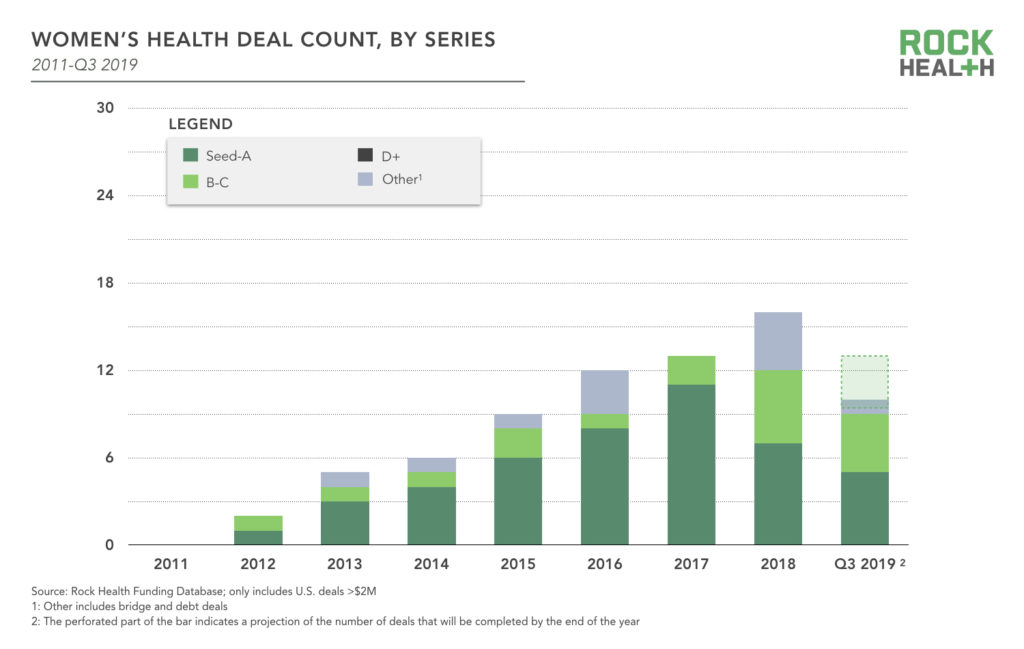

Women’s health appears to be on a similar trajectory:

- Increased funding: Funding for digital women’s health companies increased 812% across 2014-2018, with sixteen rounds of funding closed in 2018—two years after behavioral health companies raised the same number in 2016. Through Q3 2019, 10 women’s health companies raised a total of $177M.

- Later-stage deals: 2018 was the first year for which 30% of the women’s health deals were Series B or later stage, and that has continued in 2019.

The three largest rounds in women’s health so far in 2019 include:

- Nurx ($52M), online access to medical providers and delivery of birth control, home HPV testing, and the HIV prevention medication PrEP

- The Pill Club ($51M), online prescription and delivery service for birth control and contraceptives

- Cleo ($27.5M), virtually connects employees with “guides” to coach them through pregnancy and subsequent return to work

With women as the primary healthcare decision makers and healthcare workers, we are relieved women’s health is emerging as a significant investment sector. As CNBC.com’s Chrissy Farr put it, “let this be the moment where investors stop saying that women’s health is niche.” Startups are tackling the full spectrum of women’s health needs across contraception, fertility, pregnancy, maternity, OB/GYN, and menopause.

While some of the most-funded startups in this space are creating a D2C connection with patients via prescription telemedicine models, we’re also excited to see employers investing in solutions as a means to improve cost and outcomes around fertility, maternal, and child care. As digital diagnostics and biomarkers emerge, we believe the industry is just scratching the surface in terms of how new solutions will empower women with robust information about their health, especially conditions that may impact fertility and pregnancy (e.g., endometriosis and polycystic ovary syndrome).

Are you building a solution for women’s health and wellbeing? We’d love to connect!

A special thank you to our generous corporate partners for their continued support. For full access to our digital health market updates and databases, become a Rock Health partner. Email for more information about how your organization can work alongside Rock Health.