The future of healthcare: The end of digital health

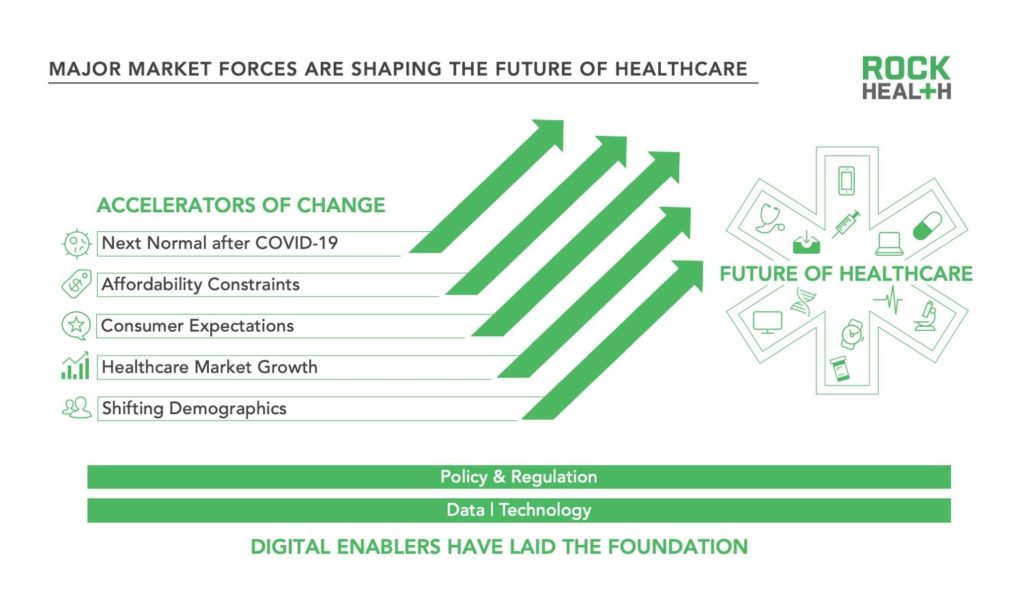

At Rock Health we think about the future of healthcare a lot. COVID-19 exposed weaknesses in public health and supply chains amongst other things, and accelerated change towards a next normal, but the pandemic is not the only force challenging long-term industry structures. US demographic changes are shifting patterns of demand and health insurance coverage as the population ages. The US population is growing more diverse and cultural norms put pressure on health systems to meet new expectations. In turn, the $3.5T healthcare market is an unmissable target for new entrants—big tech, big retail, and big telecom companies are going beyond dipping their toes in the waters. At the same time, these new entrants alter consumer expectations of the experience and price of care, putting pressure on legacy healthcare enterprises. And an associated consequence of the pandemic is the realization amongst people like you and I of how unaffordable the healthcare we are accustomed to really is, even with employer-sponsored or government-sponsored insurance.

These forces have collided with an environment primed for change. Advances in data and technology, and an evolving regulatory landscape make the historically slow-moving healthcare industry ripe for the rapid adoption of innovation. Historic levels of investment in digital health in 2020 are a coming of age moment for digital health: the $9.4B invested in digital health startups across three quarters this year already exceeds the previous annual record of $8.2B in 2018.

We are living through a truly unprecedented period in US healthcare. Today we’re outlining our perspective on the future of healthcare—over the coming weeks we will expand upon these themes in a series of deep dives from Rock Health’s consulting team.

Theme 1: A new world order will emerge

Over the next several years, digitally-enabled business models will shift the balance of power within sectors and across the industry’s value chain. This in turn will create unprecedented opportunity, competitive strategies, and profit rotations. Healthcare incumbents—providers, payers, pharmacies, pharma, medical device, healthcare IT, and channel players like PBMs—will also face different kinds of competition from disruptors such as startups, big tech, and big box retailers. As we work with enterprise clients navigating this future, three questions have been important to drive conversations from uncertainty to strategy:

- Which businesses will you win and defend in the future? Where do you have a right to play and what are the new table stakes?

- Within those businesses, what will differentiate you? How do you create a defensible moat?

- What capabilities do you need to win in the future? Are there partnerships you need to form to get there?

The $49B invested in digital health startups over the past ten years funded an ecosystem of disruptors that has now come of age1. For evidence, look no further than twelve digital health IPOs in the past eighteen months. Or the 24 $100M+ mega deals in digital health startups this year—2X as many as the previous high water mark of 12 mega deals deals in 2018. Or recent healthcare moves by Amazon, Apple, Walmart, Best Buy, and Walgreens. Healthcare incumbents have surely heard the “disruption is coming” story before. But from where we sit the future is clear: organizations that are complacent, relying on yesterday’s competitive advantages and beliefs about competition, risk surrendering pride of place in the new world order.

Theme 2: Platform wars are raging

The Teladoc-Livongo deal was the largest digital health acquisition to date at $18.5B. Its announcement sent the healthcare community into a flurry of discussion about the impacts of the deal. We called it a starter pistol for the virtual care platforms race, but participants in this race have been lining up for some time now. The question is not if but when platforms will win dominance in healthcare. Today’s contenders take several forms:

- Disease-specific care platforms such as Virta and Maven

- One-stop shops such as Ro, Cove, and Lemonaid

- Unified virtual care platforms such as Teladoc-Livongo and Omada

- Big box retailers offering care delivery such as Best Buy, CVS, and Walgreens

- Integrated in-person and virtual care providers such as Ochsner’s partnership with Hims

- Tech platforms that healthcare companies plug into such as Apple’s health records

As in other industries in decades past, the platform wars will redefine the competitive landscape. The data generated by digitally-enabled healthcare platforms open greenfield opportunities to improve outcomes, lower costs, and build truly consumer-centric patient experiences.

Theme 3: The science of medicine is going digital

If the last decade was about the digitization of existing processes (e.g. documentation from chart to EMR) this decade will be the decade of digital transformation in the science of medicine. From drug discovery to clinical trials and digital therapeutics, technology is transforming the pipeline of new therapies. Just this year, several companies digitizing medical science closed large deals:

- Drug discovery: Atomwise raised $123M and Schrodinger raised $232M in its IPO

- Decentralized clinical trials: Thread raised $50M, Science 37 raised $40M

- Real world evidence: Aetion completed a $87M round

- Digital therapeutics: Click Therapeutics and Boehringer Ingelheim agreed to develop and commercialize a prescription digital therapeutic for schizophrenia in a $500M deal

For patients this trend means access to better therapeutics sooner and at lower cost. For the current owners of therapy pipelines it means entirely new asset classes, capabilities, IP strategies, and worldviews reflecting the agility to compete in a digital landscape. For example, consider how clinical trials have been pulled into the virtual future out of COVID-necessity. Study sponsors are leaning on digital health companies for clinical trial startup (e.g. Teckro, TriNetX), recruitment tools (e.g. Deep 6 AI, TrialSpark), patient data collection (e.g. ClinCapture, Evidation), and end-to-end platforms (e.g. Science37, THREAD). Today’s sponsors have largely focused on digitizing traditional development and clinical trial practices—as these capabilities are honed during COVID, leaders will already be looking towards the future opportunity to fully reimagine clinical development.

Theme 4: Patient experience will become table stakes

Without real competition in most markets healthcare organizations see patient volumes as the result of successful physician strategies and geography. What about delivering care experiences that delight? Not a central part of the plan. Those days are numbered. Even before COVID-19, consumers’ use of digital solutions to access care was on the rise. According to Rock Health’s 2019 Consumer Adoption Survey, that year 76% of US consumers went online to learn about their health and care, 64% searched for provider reviews online, and 60% brought information they found online into conversations with their providers. Organizations that embrace the full measure of how consumers are shopping, and reshape themselves in the form of how patients want to receive care, will earn trust and business.

Patient access to the healthcare system itself will be personalized in the future. There are a growing number of healthcare access points such as retail clinics, urgent care centers, digital kiosks, and virtual care providers. In order to stand out, healthcare enterprises need to reimagine their digital footprints to create proactive, efficient, and integrated patient access journeys…before consumer expectations are set for them by the marketing professionals at Best Buy, Walmart, and Amazon.

Theme 5: Digital will be the great equalizer

Individuals are hungry for (and deserve) healthcare that addresses their individual needs. Digital technology has the potential to deliver more personalized health experiences than the brick and mortar world has previously allowed. It’s true that the “worried well”—young, wealthy, and healthy consumers—have been the beachhead market for many digital health companies. According to Rock Health’s 2019 Consumer Adoption Survey, 87% of consumers age 18-35 with incomes greater than $75,000 have used live video telemedicine, wearables, or mobile health tracking technology. More recently digital health companies have emerged to meet previously untapped demand from underserved populations.

For example, structural racism in healthcare has disproportionately affected black mothers in the US, who die at three to four times the rate of white mothers. Companies such as Candlelit, Culture Care, Poppy Seed Health, and Health In Her Hue allow black mothers to access care tailored to their needs. Another group that often lacks access to culturally-competent care is LGBTQ+ persons. Folx Health and Queerly Health connect the LGBTQ+ community with culturally competent healthcare professionals. Low-income, chronically ill seniors are a particularly vulnerable group that face significant challenges to adopting digital health technology such as lower rates of internet adoption. CVS partners with Unite Us to connect Aetna’s Medicaid and Dual eligible members to social services in their communities. Arine offers personalized medication counseling and treatment optimization services to individuals with chronic conditions through a partnership with Oklahoma’s Medicaid program.

The end of “digital health” is near

You don’t hear anyone talking about “internet companies” anymore. These days every company has a website, but they compete on differentiators such as consumer experience or brand trust. Despite its customary lag in all things digital, healthcare is now catching up with the rest of the economy. The future of healthcare is digitally enabled, and leaders in that future will act early with purpose, agility, and investment in innovation. Ten years from now there will be no such thing as digital health, because all healthcare will be digitally enabled.

Footnote

1Source: Rock Health Venture Funding Database