How Rock Health portfolio companies stand out in a crowded employer health market

As more and more employers take an active stance in managing employee healthcare costs, we’re seeing increased appetite for experimentation with novel strategies. And as the largest source of healthcare coverage in the US, employers have the clout and scale to enact substantial change.

Amazon, Berkshire Hathaway, and JPMorgan teamed up in a venture (though still nameless, we fondly refer to it as “Berzerkshire Morgazon”) to reduce costs and improve care for its collective one million employees. If successful, the venture could conceivably offer its solutions to other companies—meaning its impact could extend to the 156M+ people in the US who receive insurance through their employer.

Meanwhile, an increasing number of employers empower employees by lowering barriers to care and streamlining care delivery. Onsite medical clinics are making headlines, with tech giants such as Apple and Tesla helping employees leapfrog the system. These behemoths are not alone: nearly one-third of all companies with 5K+ employees provide a general medical clinic at or near the worksite—a 24% increase since 2012. Companies aren’t just banking on on-site convenience, they’re also investing in novel digital health solutions. But an abundance of exciting solutions can leave employers struggling to extract value from a seemingly large and fragmented marketplace.

To equip startups with an understanding of what it takes to make it in the employer market, we interviewed our portfolio companies alongside a group of experts who represent the investor and health benefits consultant perspectives. Here’s what we learned—and how a few Rock Health portfolio companies are providing meaningful value to employers and employees.

Consolidation and curation are coming

Early winners are beginning to emerge among startups selling digital health services to employers. As this sector matures, both consolidation and curation of existing solutions are likely to shape the market.

Consolidation through M&A is already a trend. As we’ve said elsewhere: digital health companies are the most prolific group of acquirers of other digital health companies, signaling a potential ongoing trend towards consolidation in coming years. Meanwhile, curation of solutions—by which we mean meaningful endorsements and choice-narrowing mechanisms that favor certain companies in relation to others—will be driven by three emerging themes we heard on expert calls:

- The emergence of (and preference for) platform solutions

- Brokers broadening their expertise to consult on digital health services

- Increasingly savvy benefits leaders

Consolidation will likely result in fewer, more comprehensive offerings, while curation will further simplify the market for buyers by highlighting solutions that are able to deliver demonstrated, concrete benefits.

There are three ways we believe these forces will shape the market in the coming 12 to 18 months:

1. Platforms drive consolidation among point solutions, simplifying offerings for employers

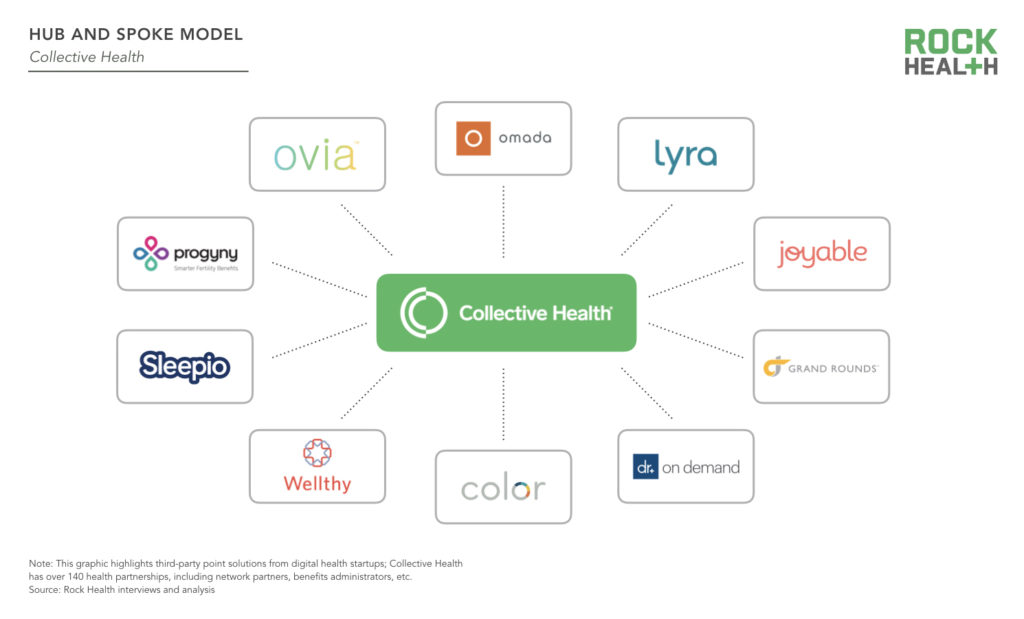

Employers generally see two types of offerings: point solutions and platforms. We like to think of these offerings as organized within a hub and spoke model. Individual services (spokes) offer solutions to manage a specific component of a patient’s journey or specific health need (e.g., Omada Health for management of chronic conditions such as Type 2 Diabetes, Sitka for virtual patient triage to empower shared decision making). Platforms (hubs) aggregate these services and often serve as a concierge for employees and source of advanced data analytics for the employer. The operational simplicity and reduced costs offered by a hub are potentially significant. As platform solutions increasingly take hold, they will create a curated group of vendors more readily available to employers based on integration with and promotion by the platforms.

Rock Health portfolio company Collective Health offers a one stop shop for employers seeking to reduce costs, enhance the employee healthcare experience, and streamline how they work with vendor/startup offerings. The Collective Health platform hosts over 80 third-party point solutions, and each individual employer decides which (if any) they want to offer to their employees. Going through the vetting process, contracting, integration, data collection and reporting, and payments with each of these individual vendors is a headache—which is where Collective Health comes in. In addition to taking care of these processes for its clients, Collective also creates a more seamless experience for employee users and their dependents. Collective Health’s Member Advocates are trained on all third-party programs, enabling them to proactively guide employees to relevant programs and care to meet their health needs—without feeling overwhelmed by the multitude of options available.

For employers, these solutions can ultimately be more effective and cost-efficient options to supplement the traditional care offerings that come with their health plans. As Collective Health continues to measure the impact of its solution, a recent analysis revealed the medical cost trend for clients that had been with Collective for at least two years was -0.3%, compared to the industry average of +5%.

2. Brokers become strategic digital health advisors

With a fairly fragmented, noisy vendor market, it’s no surprise employers are turning to their benefits brokers for help in evaluating digital health offerings. These long-standing relationships yield a high degree of trust; as brokers gain perspective on the market, solutions they deem to be most effective will catapult into the lead by virtue of having the attention of employers. For startups, brokers may present a new path to reach employers and turbo charge sales. But few startups are leveraging this channel since ensuring financial benefit for both parties can be tricky.

Our portfolio company Amino’s partnership with Aon showcases the competitive advantage brokers can offer to startups. Aon’s exclusive partnership with Amino and MPIRICA, a startup providing healthcare quality scores, offers its clients real-time data on the price and quality differences of medical procedures across local healthcare providers. This partnership gives Aon a competitive advantage to its clients and simultaneously raises awareness with Aon Account Executives to introduce Amino to both middle market and enterprise clients as a solution capable of addressing their rising healthcare expenses. While we look forward to seeing other creative arrangements startups build alongside brokers, Amino CEO David Vivero cautions startups to not utilize brokers as a sole communication pathway to reach employers. Startups, especially those in early stages, should seek direct feedback from employer customers for product iteration.

3. Savvy employee benefits leaders purchase the cream of the crop

HR leaders are inundated with hundreds of cold outreaches each year from startups promising to reduce healthcare spend. While this noise presents challenges, benefits directors are becoming disciplined in their evaluation of digital health solutions. Over the next couple of years, as startups have time to prove clear ROI and validation, employers will quickly scale successful solutions and drop the others.

HR leaders increasingly have greater accountability and authority within the C-Suite as managing healthcare costs and offering competitive benefits packages take on greater strategic importance. This elevation of the HR leader role creates more opportunity for startups if they can withstand the scrutiny of HR leaders who must defend their purchases every year.

Startups need to address benefits leaders as knowledgeable customers. Don’t assume they’ll be less savvy than investors in assessing your solution.

Blake Wu, Principal, NEA

A one-size-fits-all approach won’t work—and when startups spend excessive amounts of time defining the problem and describing the market, their solution can be perceived as wasting a prospect’s time. Instead, startups should engage employers in a dialogue to understand how their solution fits the employer’s goals.

Innovative payment models are catching the eye of employers

To stand out in this competitive space, some startups are leading the way with outcomes-based payment models—and these models align with large employers’ growing interest in value-based payment design to reduce costs. These business models have emerged among startups offering point solutions with clear, measurable clinical outcomes. Yet among platform solutions, per employee per month (PEPM) models still reign supreme.

Success with an outcomes-based model requires startups to collect reliable data demonstrating efficacy. In certain disease states, like diabetes, the biomarkers are clear (e.g., a meaningful reduction in A1c levels—a measure of blood glucose). For other conditions, desired outcomes are not as evident or easily measured. For instance, it is difficult to assess the counterfactual, i.e., inferring that a solution prevented a health outcome, such as a hospital admission. Startups need to determine, in partnership with employers, which end-points to measure (clinical and/or financial), and the baseline to measure against.

Our portfolio company Virta, a clinically-proven, digitally-administered treatment to safely and sustainably reverse type 2 diabetes, announced an outcomes-based care model that puts 100% of its fees at risk. Under the payment structure, employers (and health plans) pay an enrollment fee only after an engagement milestone is met, ensuring patients stay active during the critical early stages of treatment. After that, every dollar, and the majority of overall payment, is at-risk and tied to health improvement based on diabetes reversal metrics such as HbA1c reduction—without per-member per-month payment or implementation fees. By measuring short- and long-term outcomes (e.g., engagement and A1c reduction, respectively), Virta sets the groundwork for a successful partnership. If startups focus too heavily on short-term metrics, they’re likely not addressing the meaningful (and often massive) cost challenges of employers. Conversely, if they just target the long-term, startups run the risk of having the partnership cut due to a lack of clear (and more immediate) ROI.

With curation—and a handful of winners—coming, startups willing to bet their existence on meaningful outcomes may be the ones most likely to endure.

Startups should align their value prop to an employer’s business objectives

To compete for talent, employers in tech hubs like San Francisco and New York offer a robust set of health benefits, and anecdotally tend to offer a wide array of digital health solutions to their employees—from mindfulness apps to diabetes prevention programs to fitness trackers.

This begs the question—what are digital health startups selling to employers? A recruitment and retention tool, or a healthcare solution? The answer, of course, is “it depends.” And there’s room for both.

An employer’s benefits philosophy is aligned to the company’s key business goals. If an employer’s medical spend is high and growing, they may be more likely to invest in clinically-validated tools capable of reducing healthcare costs. Separately, if an employer is focused on ameliorating a high-stress work environment, they may seek wellness solutions as a means to retain talent, even if the ROI in terms of long-term healthcare costs is less clear. While there is a market for both types of solutions, it is likely that employer interest (and investment dollars) is more limited for the latter. Few employers can afford to provide robust benefits packages for the sake of engagement and retention, and the cooling off of a hot labor market is more likely than a reversal in the steady upward trend of healthcare cost growth. For market penetration and sustainability, it’s wise for startups to hinge their value proposition on improving health outcomes and managing healthcare spend.

If you’re not achieving quantifiable cost savings that we can run through an underwriting model, then you’re being thought of in the wellness category, where employee engagement and satisfaction are more likely to be the measures of success.

Brian Hasday, EVP, Frenkel Benefits—an EPIC Company

The employer market is quickly evolving—don’t get left behind

With healthcare spend ever on the rise, digital health startups able to bend the cost curve, drive employee engagement, and garner satisfaction are offered a chance to prove their worth. Yet standing out in an increasingly crowded market is the first step to being given an opportunity to do so.

We look forward to startups continuing to develop innovative strategies that reach and retain employer customers. If you’re working on a solution to drastically improve employer-sponsored healthcare, tell us about your company.

A special thank you to our generous corporate partners for their continued support. For full access to all of Rock Health’s insights on the digital health ecosystem (including analysis of digital health startups selling to employers and beyond), become a Rock Health corporate partner. Get in touch to learn more about how your enterprise organization can work alongside Rock Health to make healthcare massively better.

Acknowledgments

This report would not have been possible without the help of a number of individuals who have graciously shared their expertise.

Special thanks to Chris Chan (Purple Light Idea Factory), Brian Hasday (Frenkel Benefits—an EPIC company), Tim Lopez (Collective Health), David Vivero (Amino), Natalie Waltz (formerly Collective Health), and Blake Wu (New Enterprise Associates) for their time and insights.

Footnotes

1 Clinical evidence generation only applies to startups seeking to provide support for clinical conditions. This excludes tools offering benefits such as employee benefits navigation and concierge services.