Unwinding the opportunity: Medicaid’s digital health moment

Imagine a market with a potential customer base of 92 million individuals, annual market spend of $728B, and high unmet needs—investors should be clamoring to support a rush of companies tackling this space’s thorniest problems. But when this market is Medicaid, the varied state-based regulations, byzantine reimbursement environment, and complex health and socio-economic intersections make many innovators and investors hesitant to dive in.

At Rock Health Advisory, we see Medicaid as one of the most promising arenas for digital health activity, despite the overall cooling of sector funding. Why? Digital health is already a reality for many Medicaid enrollees, despite a limited market of tailored solutions. According to our 2022 Consumer Adoption of Digital Health survey, 80% of respondents with Medicaid as their primary insurance reported having used telemedicine, identical to the 80% adoption rate among the broader respondent pool.1 This data upholds other research findings indicating that most adult Medicaid enrollees own mobile technologies, use them for a variety of health purposes, and are interested in trying new digital health applications in the future.

“Myths have been shattered that people with low incomes or disabilities won’t use health care technologies, that providers would not invest in them, or that serving these patients with new tools could not be financially viable.” – The California Health Care Foundation2

Today in particular is a critical time for Medicaid administrative and operational support following the end of the public health emergency (PHE). At the onset of the COVID-19 pandemic, the federal government extended Medicaid coverage indefinitely so that enrollees would not lose coverage throughout the PHE. In accordance with the end of the PHE this year, the U.S. government ended continuous coverage provisions on March 31, 2023, kicking off a 12-month unwinding period that is expected to bring unprecedented churn in Medicaid programs across the country. Between 8-24 million enrollees could lose coverage because they no longer qualify or are unable to complete the paperwork associated with re-enrolling. Medicaid administrators are in dire need of help to manage re-determination and re-enrollment processes, while also streamlining operations for current enrollees. Digital health solutions are well positioned to assist on the administrative and operational fronts—another reason we’re bullish on this space for 2023.

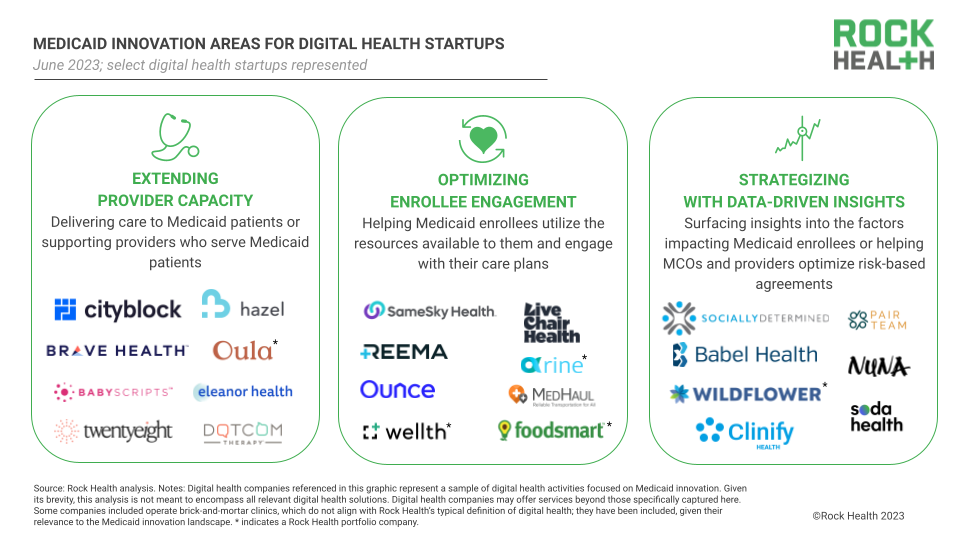

In this piece, we dive into three promising areas of Medicaid-startup innovation: extending provider capacity, optimizing enrollee engagement, and strategizing with data-driven insights. We also share where we expect Medicaid digital health innovation to go in the future (TL/DR: it’s preventative interventions and specialized care). Throughout, we highlight why Medicaid is a unique case study for digital health development, and why more innovators should be paying attention.

The mechanics of Medicaid

The U.S. Medicaid program provides health coverage for eligible individuals including low-income individuals and families, pregnant women and children, and people with disabilities. Medicaid is the nation's largest single source of healthcare coverage, by some estimates covering one in five Americans.

Medicaid is a joint federal-state program: the federal government sets baseline standards for states to adhere to, but states have significant leeway to design programs that cover additional benefits beyond the standard requirements. Many states employ a multimodal approach to Medicaid care delivery, with state-managed fee-for-service (FFS) plans covering a subset of high-need enrollees, as well as managed care delivery systems promoting risk-based arrangements to drive down overall care costs. In the managed care systems, states contract with private Managed Care Organizations (MCOs), which are subsidiaries of health insurers.3 In 2020, 72% of all Medicaid enrollees were enrolled in MCO plans.

In FFS arrangements, states directly contract with and pay providers for services. In MCO arrangements, MCOs are responsible for contracting with providers to deliver care to their enrollees, as well as vendors like digital health startups to provide ancillary services and support. The more efficiently MCOs can drive down costs, the larger portion of payments they can keep.

Because Medicaid enrollees may be less likely to have discretionary funds to pay for out-of-pocket digital services, it’s common for digital health startups entering this market to pursue B2B rather than D2C sales, even for consumer-facing solutions. As such, digital health players need to address the top needs of enterprise stakeholders—either state programs, MCOs, or contracted providers—in order to secure contracts that solve problems for Medicaid enrollees. In the next section, we outline three promising areas where startups are playing in to engage Medicaid’s enterprise customers.

1. Extending provider capacity

A top, if not the top, need within Medicaid systems is extending the capacity of participating providers. While almost all providers accept commercial insurance, only about three-quarters accept Medicaid, and far fewer actually provide care to Medicaid enrollees. Low participation is due to low reimbursement rates (Medicaid reimbursements average approximately 30% lower than Medicare and 49% lower than commercial insurance for outpatient services), as well as higher degrees of payment delays and claim denials. Even federally qualified health centers (FQHCs), which receive enhanced reimbursement from Medicare and Medicaid to deliver care in medically underserved areas, face many of the same challenges.

Digital health solutions working to address Medicaid’s provider problem usually take one of two approaches: supporting Medicaid providers or acting as providers for Medicaid enrollees themselves. Digital support tools for Medicaid providers include telemedicine platforms, remote patient patient monitoring (RPM) suites, and clinical workflow software that help providers manage the combined medical and social needs for Medicaid patients. For example, mobile prenatal care platform Babyscripts helps maternal healthcare providers manage up to 90% of pregnancies virtually, and the startup’s partnerships with MCOs in Pennsylvania and Washington, D.C. have helped the plans extend their providers’ capacity. However, provider support solutions are currently limited due to states’ low rates of reimbursement; for example, RPM is covered in fewer than half of state Medicaid programs with several restrictions. It still remains to be seen whether these products can expand patient volume enough to offset reimbursement limitations.

We are seeing a small but growing number of digital health startups offering virtual or hybrid care delivery for Medicaid enrollees, often with a focus on key underserved patient communities such as women+4 (Twentyeight Health), children (Hazel Health), or individuals with substance use disorders (Eleanor Health). While some startups in this space launch with a dedicated focus on the Medicaid population (à la Twentyeight Health), others like Maven are expanding into Medicaid after working with commercially insured populations—encouraged by Medicaid’s large addressable market and the chance to bring their operational learnings to Medicaid programs.

However, the state-based nature of Medicaid programs challenges virtual and hybrid care providers looking to scale. With each state covering a different panel of benefits for their enrollees, startups need to be responsive to each state’s regulatory environment. Though some have made the jump across state lines, regulatory nuances and reimbursement rates currently limit most virtual Medicaid care startups to operate in just a few states. Even players that already operate nationally in the commercial market struggle to escape this expansion friction; for example, well-established digital health companies like Maven and DotCom Therapy offer services to Medicaid enrollees in only one state each (Arkansas and Wisconsin, respectively). As startups wade further into Medicaid waters, they’ll be tasked with maintaining state-by-state programs that are responsive to unique policies, enrollee populations, and regional needs.

2. Optimizing enrollee engagement

Though Medicaid MCOs typically operate at less than 3% margin, they see opportunities to improve operating performance through value-based contracts with network providers. Of course, these opportunities are only viable if the plan and provider can work together to engage and support enrollees, many of whom are overwhelmed by complex systems that often feel designed to work against them. Digital health players can help MCOs build capacity for this type of enrollee engagement.

Startups are stepping in to help Medicaid enrollees understand and utilize the services and resources available to them. Most often they combine the scaling power of technology with on-the-ground community liaisons. Take Reema, which equips its community health guides with AI-powered insights to achieve 80%+ engagement rate among historically unreachable high-risk Medicaid enrollees. Many of these players are stepping up to support Medicaid enrollees during re-enrollment post-PHE; for instance, Live Chair Health offers enrollment support and care coordination at community sites such as barber shops, nail salons, and faith centers.

Some startups are choosing to focus on a discrete social challenge for Medicaid enrollees such as housing (Ounce), nutrition support (Foodsmart5), or transportation access (MedHaul) in order to deliver the biggest impact to enrollees and demonstrate the highest ROI to MCO partners. While point solution fatigue plagues other parts of the digital health ecosystem, here point solutions enable MCO customers to capitalize on discrete state incentives for top health-related social needs (e.g., homelessness, isolation). In the near term, we expect Medicaid’s digital point solution market to grow, as MCO plans look for nimble partners to address earmarked needs in state Medicaid budgets. For startups that succeed in delivering against explicit incentives, they may earn the trust of their MCO partners to expand into other enrollee management responsibilities (an approach discussed later).

“It's really hard for Medicaid MCOs to find and engage members for many reasons, such as having inaccurate or stale contact information. By working with residents of affordable housing, we’re able to meet members where they live and establish ourselves within a community. From there, we work to build trusted relationships with members that open doors for better care management.” – Smitha Gopal, COO and Co-founder, Ounce of Care

3. Strategizing with data-driven insights

The trajectory of each state’s Medicaid program is dependent on effective data use. State budget holders need population health data to form meaningful insights about program design and incentive structure. MCOs need longitudinal data across enrollee journeys in order to identify drivers of utilization and cost. Both plans and providers need whole-person health data to identify the macro-level factors impacting enrollees and connect them to resources to improve those conditions.

Startups looking to support Medicaid data analytics typically offer tools that provide MCOs with insights into the risk factors impacting their enrollees. For example, Socially Determined analyzes a wide range of data sources to help decision makers quantify social risks, such as health literacy or transportation barriers, within their communities. Socially Determined’s SocialScape tool even flags enrollees most at-risk of losing coverage following the PHE.

“I often ask health plan executives if they would get behind the wheel of a car if they could only see 20% of the road. The answer is of course no, and yet that’s how they’re operating their businesses today – with a limited view of the factors that are influencing members’ utilization, costs, and outcomes – and therefore plan performance. Incorporating social risk data with the clinical and claims data they’re currently using is the key to seeing the full picture, which is what enables plans to both improve member outcomes and drive overall business performance.” – Ashley Perry, Chief Strategy & Solutions Officer, Socially Determined

Another important role of data analytics is helping MCO plans and providers work together to optimize risk-sharing arrangements. Players like Nuna capture all data relevant to value-based arrangements and use it to power models that compare contracting scenarios, track performance toward care goals, and match enrollees to providers in order to maximize provider capacity and retention.

In both scenarios, clinical, administrative, and population health data are strategically integrated in order to optimize cost of care and better support enrollees and providers. But navigating the world of Medicaid data analytics comes with its challenges. Players often struggle to find meaningful data trends among a Medicaid population that tends to lose and regain coverage frequently, a trend exacerbated by the unwinding of continuous enrollment. It’s also difficult for analytics players to prove their value to MCO customers within short contract timelines, which gives little runway to identify trends, develop and deploy interventions, and see results via outcome improvements. Startups in this space need to deliver short-term wins to gain the buy-in and intel needed to retain contracts and pursue longer-term strategies.

Digital Medicaid innovation: Where we expect growth

We predict that the next twenty-four months will see significant digital health innovation activity geared toward Medicaid, driven by re-enrollment support needs, enrollees’ appetite for digital solutions, and the dearth of provider capacity. Below, we spell out where exactly we’ll be watching for growth.

Re-enrollment and transition support through 2023-2024

As the post-PHE unwinding period continues, we anticipate a significant portion of Medicaid administrative focus to be on redetermining enrollees’ eligibility. This will be an area of high opportunity for existing and emerging players to support MCOs’ retention and re-enrollment efforts. During this time, we may also see some startups expand beyond MCOs to work with marketplace plans. Since April 1, 2023, more than 600,000 Americans previously enrolled in Medicaid plans have lost coverage, and many may need to enroll in ACA marketplace plans. These plan administrators may look to Medicaid engagement startups as continuity partners to support the transition.

“For engagement-focused digital health solutions, this period [of disenrollment and re-determination] is your time to shine. There is an opportunity to sell to state programs, MCOs, and even Marketplace plans whose staff aren’t equipped to handle this level of churn.” – Andrey Ostrovsky, MD, FAAP, Former Chief Medical Officer for U.S. Medicaid

New and familiar faces in care delivery

The period of unwinding will not last forever, and there are plenty of longer-term activity areas we’re watching. Given the critical provider capacity gap for Medicaid patients, we expect more innovative approaches from states and MCOs to grow their provider bases—including forming partnerships with virtual and hybrid care providers, provider tools, and even digital therapeutics.6

While there will be startups that launch with a focus on Medicaid care delivery, a sizable portion of this opportunity will be captured by later-stage virtual care providers that extend their services to Medicaid markets (sometimes using new funding to do so). In today’s market, many startups are facing headwinds in commercial and D2C sales and may be enticed by Medicaid’s addressable market and plan customers—even with the hurdles of state-by-state regulations. These later-stage players may have an advantage over new entrants if they can extrapolate clinical and business outcomes from their commercial populations to strengthen their pitches to MCOs and state programs.

“For virtual and hybrid care providers, Medicaid might not be the origin, but it could be a destination.” – Dan Gebremedhin, MD, Partner, Flare Capital Partners

Specialized providers and patient engagement tools

Currently, incentives such as waiver programs earmark dollars in state Medicaid budgets for particular types of care or patient engagement (e.g., maternal health, housing support). Under the Biden Administration, we expect incentives to proliferate, empowering Medicaid programs to test out innovative approaches to tackle the thorniest health and social challenges for enrollees. We anticipate these incentives will concentrate on high-need, high-cost of care instances, including maternal health, mental health and substance use disorder support, and chronic disease management, and home and community-based care.

While Medicaid incentives are fostering a point solution influx today, continuity risks such as administration changes and state budget cuts will push startups in this space to build toward a more stable operating base. Some startups will expand to capture multiple incentives (possibly by acquiring other point-solution players) while others may expand their purviews to include care delivery or analytics (e.g., supporting Medicaid enrollees in finding stable housing and then delivering care within those residences).

Realizing preventative efforts in value-based care

Perhaps what’s most exciting is the opportunity that Medicaid programs present to test the viability of value-based care at scale. Given that MCOs manage almost three-quarters of the Medicaid enrolled in value-based arrangements, MCOs have a unique charge to invest in preventative care in an effort to reduce downstream medical costs. In December 2021, the Centers for Medicare and Medicaid Services (CMS) approved a proposal by the state of California to allow MCO plans to deliver (and bill for) “in lieu of” service (ILOS) health-supportive services that correspond to disease prevention, such as asthma remediation in the home and nutritious foods for people struggling with food insecurity.7 Recent CMS guidance aims to help other states to follow suit. As MCOs prove out the value of preventative care in these arrangements, their lessons could pave the way for preventative care integration in other government and commercial plans.

To government programs and beyond!

The complexity of Medicaid care delivery and management cannot be understated—and yet, it’s an area that’s especially ripe for digital health support. We’ll be watching how new (and new-to-Medicaid) digital health startups position their offerings to extend provider capacity, optimize enrollee engagement, and strategize with data-driven insights. We’ll also keep an eye on how startups spin up new offerings to support state programs, MCOs, and marketplace plans impacted by re-determination and re-enrollment in 2023-2024.

To really run at the opportunity in Medicaid, startups will need to prioritize policy acumen alongside technological enterprise and go-to-market strategy—an increasingly important lesson for digital health teams across the sector. As digital health matures as part of our national healthcare infrastructure, startup business strategies will need to evolve to meaningfully respond to policy measures, as well address social needs and equity gaps, in order to have a shot at industry success.

Tap into insights and strategic guidance for enterprise companies with Rock Health Advisory.

Get in touch with the venture team at Rock Health Capital.

Join us in building a more equitable future at RockHealth.org.

And last but not least, stay plugged into the Rock Health community and all things digital health with the Rock Weekly.

Footnotes

- Of all Survey respondents (n=8014), 15.8% (n=1246) reported Medicaid as their primary health insurance.

- Direct quote from California Health Care Foundation’s 2021 white paper, “Technology Innovation in Medicaid: What to Expect in the Next Decade.”

- The “Big Five” MCO plans include Centene, CVS Health Aetna, Elevance Health (formerly Anthem), Molina, and UnitedHealth Group.

- Rock Health uses the term “women+ health”—rather than “femtech” or “women’s health”—to encompass the full spectrum of health needs experienced by cisgender women, as well as transgender individuals, nonbinary individuals, and others whose health needs relate to those of cisgender women.

- Foodsmart is a Rock Health portfolio company.

- It’s worth noting that Pear Therapeutics, a prescription digital therapeutics company that filed for bankruptcy in April 2023, had commercial relationships with Medicaid programs.

- In Lieu of Services (ILOS) authority was originally introduced by CMS in 2016, but was not adopted at scale in any state prior to California’s proposal.