H1 2022 digital health funding: Two sides to every correction

So it’s not all good news. But it’s not all bad news either.

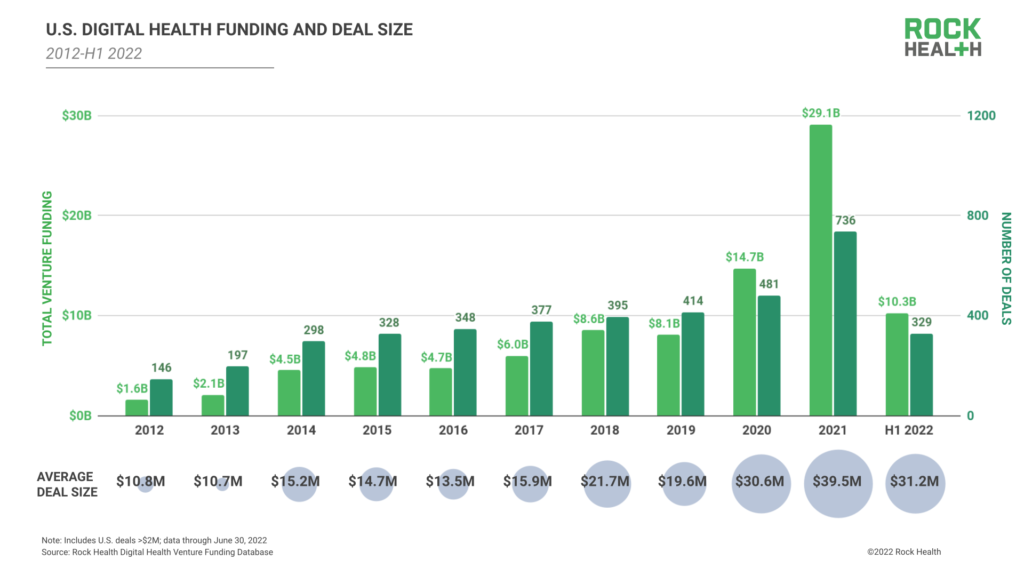

Coming off the launch ramp of 2021, digital health founders, funders, and corporate execs were anxious to see the sector’s 2022 trajectory. The first quarter of this year signaled the beginnings of a market cooldown and spurred inquiries regarding frothiness in digital health funding. As we close H1 2022, it’s safe to say that froth has turned to fade. With $10.3B raised this H1, 2022’s overall funding is on track to land around $21B1, significantly less than 2021’s total ($29.1B). And after 23 public market exits in 2021, digital health public exits came to a halt in H1 2022 (zero startups went public2), and a few publicly-listed digital health companies returned to private holdings.

But as the saying goes, there are two sides to every (market) story. Though this year’s funding will fall far short of last year, 2022 digital health funding is nonetheless on track to outpace funding in 2020. This multi-year trend indicates continued funding growth, with funding in 2021 perhaps standing out as an anomaly. Venture investors raised record funds last year, meaning they will have capital to deploy for years to come. Meanwhile, startups are using this market moment to reconsider valuations, trim costs (and, in some cases, people), and refine go-to-market strategies. We foresee these startup adjustments activating savvy M&A deal-makers in H2 2022, with pairings between complementary digital health companies likely leading H2 2022 M&A activity.

So far, 2022 abounds with these two-sided stories. H1 2022 saw digital health investors make familiar bets in top-funded therapeutic areas, notably digital mental health and support for biopharma R&D. Yet, increased funding for categories such as administrative and clinical workflow solutions suggest investors are diversifying their theses by tracking top pain points and opportunities for enterprise buyers. Not to mention, digital health companies demonstrated push-and-pull relationships with governing bodies. In some categories like health data interoperability, policy changes paved the way for startup innovation. But in other categories like digital therapeutics, digital health startups are leading regulators to new territory.

Read on for insight into these dual perspectives. In a digital health market as nuanced as 2022, all assumptions require a second look.

Silver linings in venture downturns

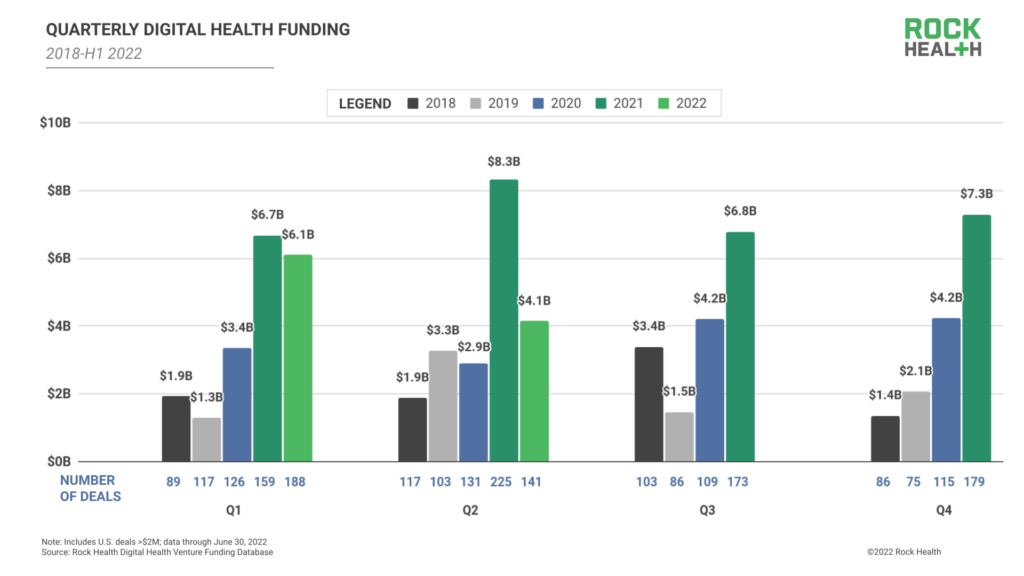

In H1 2022, U.S. digital health startups raised $10.3B across 329 deals, with an average deal size of $31.2M. Notably, H1 2022 featured stark differences between Q1 and Q2. While Q1 2022 funding generally matched Q1 2021, Q2 2022 ($4.1B) was the lowest funding quarter since Q2 2020 ($2.9B).

Why the significant drop between Q1 and Q2 2022? Many funding deals announced in Q1 2022 were likely structured in Q4 2021, as the broader venture capital market was in the throes of a Minsky moment: a period of high-velocity funding that motivated new and existing investors to ramp up investments, particularly in emergent sectors like digital health. However, early in 2022, investor confidence in both public and private markets was shaken by global conflict and inflation concerns. Notable investors Y Combinator and Sequoia Capital published letters to their portfolio companies warning them to prepare for an economic downturn, and venture funds in general battened down their hatches.

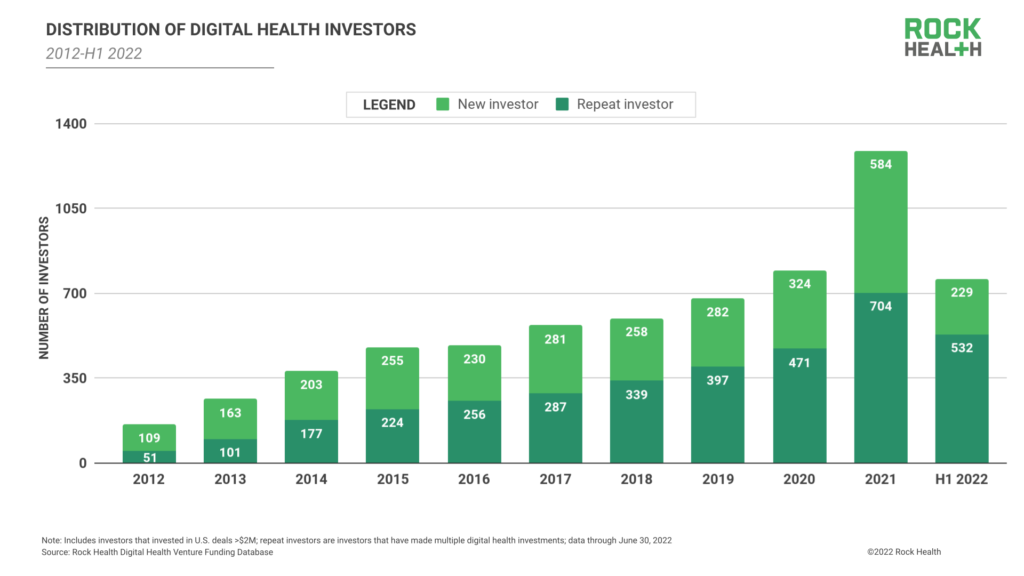

Non-specialist investors, rather than veteran digital health investors, were most likely to pull back from the sector. In H1 2022, approximately 70% of digital health investors were repeat investors in the space, whereas previous years saw more balanced distributions of new and repeat investors. In light of continued market volatility, we anticipate that the greater presence of veteran versus new digital health investors will remain a near-term trend. Additionally, because veteran digital health investors appear ready to stay the course and support their existing portfolio companies, we expect that this trend will disproportionately favor companies that already have committed veteran digital health investors on their cap table. That’s a potential silver lining for both the investors and their portfolio companies.

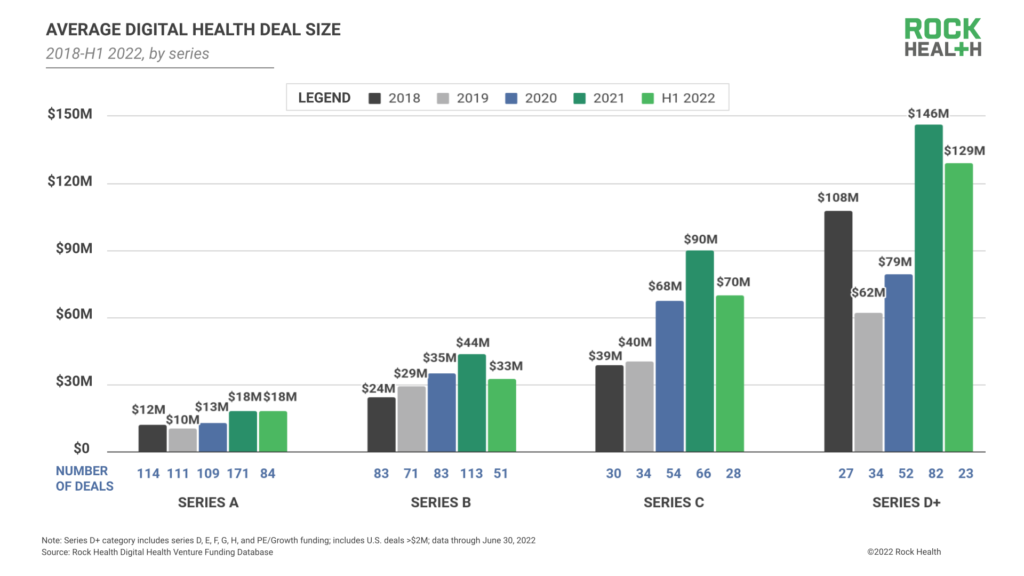

Digital health startups have varying levels of resilience to weather 2022’s adjustment. Depending on the timing and terms of their most recent funding rounds, growth-stage companies may face a unique set of challenges. Those who recently raised on valuations and terms that anticipated significant future growth might need to adapt to 2022’s tougher economic environment. Some in this cohort are already feeling the pain (cue H1 2022 layoffs) as they recalibrate operations to extend their cash runways, while others may be forced to pause or reconsider the timing of a public exit. Investors, sensing these concerns, are investing more conservatively in growth-stage digital health companies: H1 2022’s average check sizes for Series C and D+ deals declined by 22% and 12% respectively compared to 2021. While things may feel tough in the near term, companies that lean into these belt-tightening measures stand to emerge from 2022 as more resilient businesses, better positioned to navigate market scrutiny when the time comes to make a public exit.

“Funding conversations for growth-stage companies are taking on a ‘back to the basics’ sentiment. Investors are focused on unit economics.” – Sid Viswanathan, Co-Founder and CEO, Truepill

H1 2022 data also suggests a drop in B-stage digital health funding, with H1 2022’s average Series B checks 25% smaller compared to 2021. For digital health startups entering their B phases, investors are returning to historical norms and pricing expectations. Funders will seek out early signals of financial sustainability (balanced with healthy growth) and valuations that leave room for step-ups in later rounds.

Notably, early-stage digital health companies, which are more likely to be free of 2021 valuation baggage, are likely to attract investor attention in today’s market. Investors raised record funds in 2021, and some of the biggest names in that group are looking to reduce exposure to late-stage startups and deploy their cash in earlier-stage opportunities, which they see as more protected from broader market forces. Seed and Series A digital health startups that demonstrate market traction and a conservative cash management mindset are prime targets for investors looking to make smart bets in today’s funding climate. In fact, digital health companies pursuing their Series A rounds raised $18M on average in H1 2022, consistent with 2021.

“Many founders are worried that the digital health market has changed for the worse. But fundamentally, this is a good market to invest in and to start a company in. As a new founder, set yourself up for success by seeking out a valuation you can grow into. There’s great opportunity, plenty of capital available, and plenty of people to employ.” – Justin Norden, MD, Partner, GSR Ventures

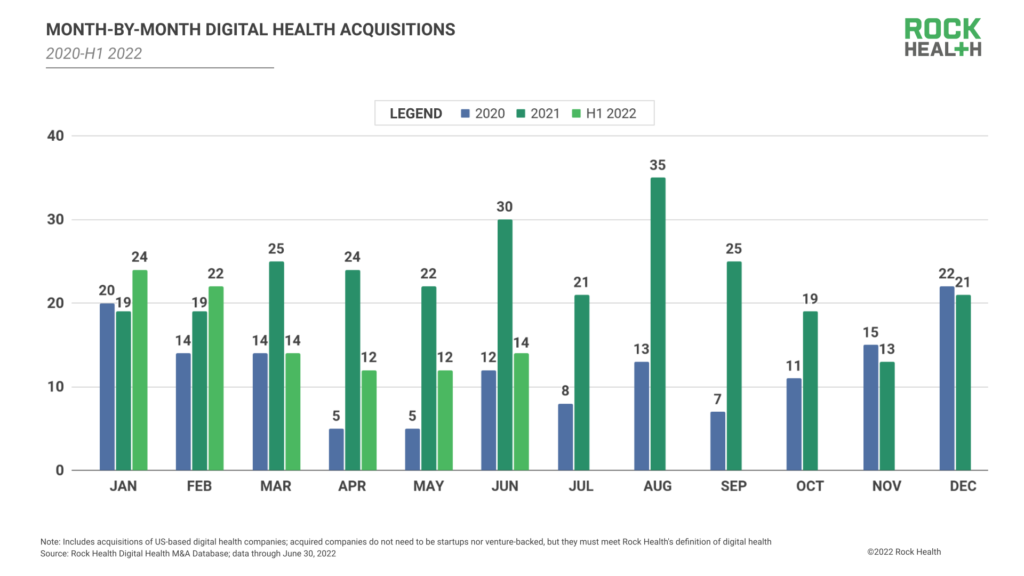

Competing attitudes toward M&A

Digital health’s market correction has also carried over to its acquisition landscape. While 2021 was the top year for digital health mergers and acquisitions—logging on average nearly 23 digital health exits via merger or acquisition each month—H1 2022 averaged only 16 M&A deals monthly. The difference is even more pronounced between quarters: Q1 2022 averaged almost 20 monthly M&A exits, while Q2 2022 averaged thirteen.

A few dynamics contributed to digital health’s acquisition adjustment. First, low M&A likely reflected buyers’ nervousness. With public and private markets in choppy waters, enterprises are likely to respond by conserving cash, trimming non-essential projects, and avoiding any decisions (including M&A) that could ruffle their shareholders’ feathers. Second, deal teams may have been wary of M&A prices, due to mismatches between potentially high startup valuations set in 2021 and their actual performance and profitability. Deal teams we spoke with for this piece indicated that in today’s digital health climate, potential buyers are less likely to rush into a bid; instead, they’re inclined to complete a higher fidelity of due diligence, investigating a potential target’s profitability, burn rate, and tech stack for cracks and concerns. We wouldn’t be surprised if some acquirers that planned to close a deal in H1 2022 are choosing to extend their diligence process given marketplace sentiment.

“Enterprises are using this market moment as an opportunity to evaluate digital health acquisitions and value investments—but it’s all about how and when startups will be willing to take lower valuations. Additionally, we expect to see more digital health consolidation. Investors will be doubling down on their winners and pushing for strategic acquisitions.” – Alyssa Reisner, Lead Director and Principal, CVS Health Ventures

But for buyers with strong capital positions and iron stomachs, the time is ripe to acquire digital health companies that round out platforms or turbocharge new business units. As 2022 continues, we expect to see digital health’s pace of acquisitions in the private markets rise once acquirer confidence buoys in the market. Like funding numbers, we don’t foresee a return to 2021 M&A pace, though we expect 2022’s M&A activity to grow steadily from 2020 baselines. We’ll be watching to see if well-positioned digital health companies in increasingly saturated segments of digital health start to acquire smaller competitors—which could mean the biggest waves of digital health consolidation are just getting started.

Old favorites and emerging possibilities

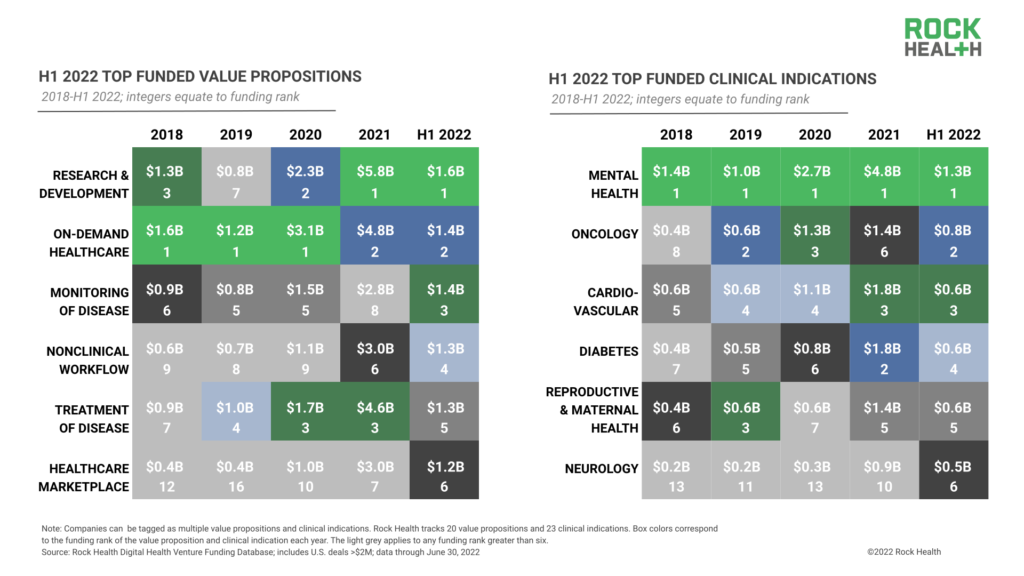

On one hand, H1 2022 saw funding continue to flow to old favorites—digital health categories that attracted the most funding over the past several years. After a slow Q1 2022, funding for digital health startups catalyzing R&D in biopharma and medtech picked up in Q2 and finished the half at $1.6B, with rounds raised by biopharma analytics player Sema4 ($200M), clinical trial accelerant Verana Health ($150M), and real-world data solution ConcertAI ($150M).

Despite concerns about market saturation, digital health startups offering mental healthcare raised a combined $1.3B in H1 2022 to again reach the top-funded clinical spot, led by Lyra’s $235M raise in January. However, of that $1.3B, just $300M closed in Q2 2022—possibly signaling a slowdown in funder excitement.

Yet, opposite these few “regulars,” H1 2022 witnessed shakeups in funding allocation, with substantial venture dollars flowing to areas emerging as priorities for enterprise buyers, particularly health systems. With hospital labor costs at an all-time high and staff burnout endemic, investors are taking notice, pouring funds into clinical and nonclinical (administrative) workflow support. Funding for startups augmenting nonclinical workflow reached the fourth funding spot in H1 2022, led by cloud analytics and payments platform Clarify Health ($150M). Just off the edge of our chart, funding for startups supporting clinical workflow also totaled $1.2B, closing out the half in seventh place.

“Our clinicians and frontline staff members have been through so much these past couple years. Whether it’s automating non-value add tasks, or clinical staff development and retention, health systems are looking for startups that can help find and drive efficiencies to improve clinicians’ work lives and build the workforce back up.” – Ben Chao, President of CareConnect, MultiCare Health System

In another provider-related category, funding for digital health solutions monitoring disease rose from eighth to the third most-funded slot, bringing in $1.4B so far in 2022. The category jump was largely driven by raises from Biofourmis ($300M), a solution that helps cardiologists monitor heart failure patients at home, and Omada Health3 ($192M), which offers remote monitoring companions for its diabetes and hypertension programs. Investor interest was also bolstered by CMS’s addition of five new CPT codes, which providers can use to bill for remote monitoring services.

Push and pull on the policy front

Beyond funding and exit activity, digital health has seen its fair share of legislative and regulatory action in H1 2022, both directive and collaborative. In some cases, political bodies directly influenced paths of digital health innovation. For instance, mandates from CMS and the FDA requiring increased health data transparency and interoperability have carved out opportunity areas for startup innovation. Stemming from these health data policy measures (and their looming deadlines), we’ve seen the emergence of Flexpa’s Patient Access API ($8.5M), as well as Turquoise Health and Ribbon Health’s4 partnership to integrate provider and cost data for consumer awareness.

“Healthcare is one of the last industries to get consumerized. From e-commerce to finance, everything has been transformed. Healthcare is going through that experience today, and it’s changing how investors, strategic partners, and regulators view the industry.” – Chris Hogg, Co-Founder and CEO, Marley Medical

In another example, the Supreme Court’s overturning of the constitutional right to abortion directed a national spotlight on telemedicine and medication delivery programs such as Choix ($1M), while also catalyzing service expansion at hybrid women’s health clinics like Tia, which now offers medication abortions via virtual visits in New York and California. While it’s likely that digital health startups supporting abortion care will receive national attention and interest, we have yet to see how the post-Roe world will impact funding in reproductive health. While some investors may be more motivated than ever to invest in women’s healthcare and access, others may be hesitant to invest until more clarity exists surrounding political, legal, and regulatory ramifications.

On the flip side, H1 2022 also featured case studies of digital health companies collaborating with federal bodies to push forward regulatory innovation. Unlearn.AI has received preliminary support from regulators at the European Medicines Agency (EMA) to push forward frameworks for implementing digital twin control arms into Phase 2 and 3 clinical trials. Meanwhile, prescription digital therapeutics (PDT) manufacturer Pear Therapeutics is paving the way for testing PDT regulatory pathways, obtaining a Safer Technologies Program (STeP) designation from the FDA earlier this year and publishing a Prescription Digital Therapeutics Digest to explain regulatory and commercialization decisions for industry peers.

No matter the direction, increased government involvement in digital health stems from the following: (1) the COVID-spurred technologization of our healthcare system and (2) the maturing digital health landscape (i.e., more digital health companies are large enough to attract regulatory scrutiny). With neither of these dynamics slowing down, digital health companies would be smart to plan ahead for regulatory interaction.

However, regulatory preparedness varies greatly across the digital health landscape. A quarter of digital health developers don’t know whether their solution should be regulated. Additionally, according to a Rock Health piece published in June, many clinically-focused digital health companies offering prevention, diagnosis, or treatment solutions do not have any clinical trials or regulatory filings—an important prerequisite for regulatory approval. We’re interested to see how public-private initiatives like nonprofit DiMe’s partnership with Google, the FDA, and (yours truly) Rock Health might help digital health startups adopt a proactive mindset toward regulatory relationship-building.

A return to balance?

As digital health investors and advisors, our job remains to evaluate the market from all angles—and in H1 2022, there were certainly plenty of angles to explore. We don’t find it surprising that H1 2022’s digital health funding numbers align more closely with 2020 rather than 2021’s mega year, and it might be time for us to consider 2021 as the anomaly rather than the norm. For us, historical digital health funding data presents a steady, optimistic view: from 2020 to 2022, the sector has demonstrated sustained gains, even amidst a tougher overall economy. With that in mind, we expect to see funding flow into digital health in H2 2022 at a pace similar to that of H1, leveling out on a fundamentals-driven track.