Q3 2024 digital health market update: Weaving tapestries

In Q3 2024, the digital health sector continued on its track of small but mighty, with disciplined investment and strategic activity as the name of the game. While deal count dropped compared to prior quarters, average check size held steady, suggesting that funders are making calculated bets on fewer companies. Companies are launching new products and partnerships to improve consumer experiences. Retail and tech brands continue to roll out health programs and features on blockbuster products. Some digital health players are carefully planning IPOs, while those that aren’t faring well on the public markets are recalibrating through take-privates. Meanwhile, other companies are using strategic acquisitions to expand their product offerings—a trend we’re watching closely and will dive into later in this piece.

Q3’s digital health innovation story was less about funding volume and more about company moves and market positioning—specifically how digital health players are building up their offerings to compete with legacy healthcare players and market incumbents. Read on for a market overview and deeper look into recent strategic moves, particularly in mergers and acquisitions (M&A).

Q3 2024 market activity

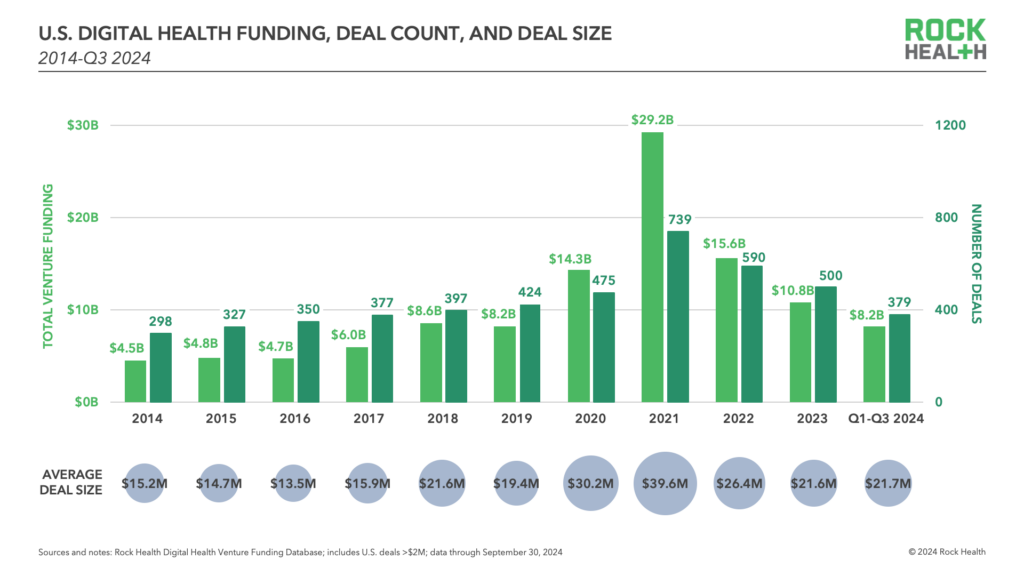

In Q3 2024, the U.S. digital health sector logged $2.4B in venture funding across 110 deals, bringing year-to-date funding to $8.2B. Though deal count has dropped across the first three quarters of 2024—Q3 logged 110 deals, compared to 136 and 133 in Q1 and Q2 2024, respectively—average deal size held steady at $22M in Q2 and in Q3, up from $20.7M in Q1 and roughly matching 2023’s average deal size ($21.6M). These patterns indicate that investors are making fewer, more focused bets with consistent check sizes.

“Focused funding” is a theme we’ve seen throughout the year and don’t expect to fade, even with the first of long-awaited interest rate cuts by the Federal Reserve. We’re also seeing investment overlap with partnership, with some companies financially supporting startups that they’ve already vetted and worked with, an important differentiator in crowded spaces like healthcare AI. Take Hippocratic AI, which received $17M from Nvidia’s venture arm in September, after launching a collaboration with the chipmaker in March to develop healthcare LLMs.

Q3 also saw the continued trend of publicly-traded digital health companies responding to reporting and regulatory pressures from the stock market by going private or being acquired. Revenue cycle management player R1 RCM announced it would be taken private by PE shareholders in order to reduce operational costs and optimize performance. Leadership at genetic testing company 23andMe tried to align on a way to do the same. Even the August bankruptcy of remote monitoring solution Nuvo—just three months after it went public via SPAC—can be viewed as a wake up call to public market pressures and a cautionary tale of disregarding the lessons of the SPAC bubble. Delistings like these don’t spell the end of public exits for digital health players, but they reinforce the importance of discipline in financial stability, corporate governance, and market positioning for players heading toward the exchange.

Strategic M&A: Weaving tapestries

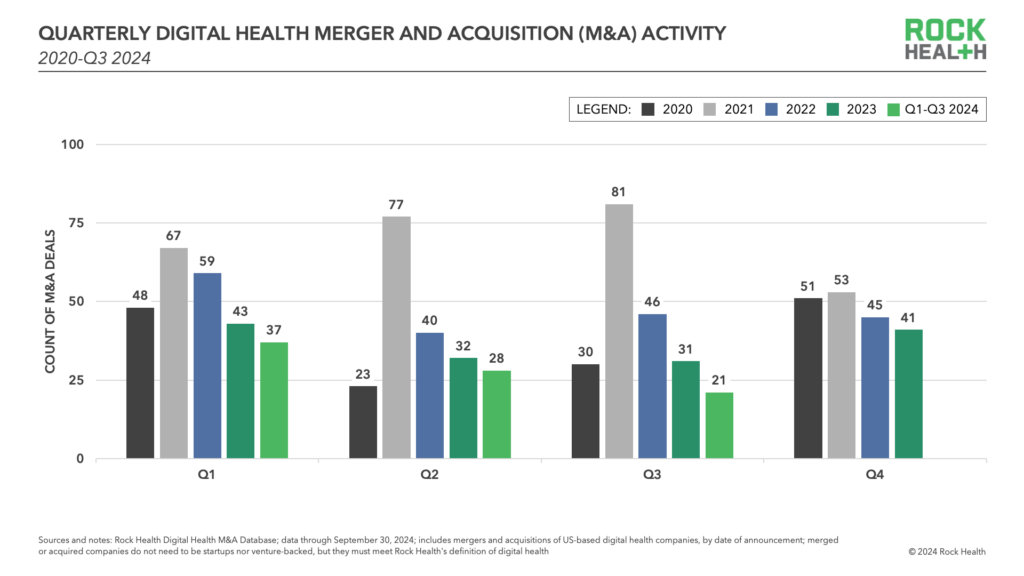

Like venture funding, M&A activity was low in Q3 2024: the quarter logged 21 mergers and acquisitions of digital health companies, down from 28 in Q2, 37 in Q1, and a quarterly average of 37 in 2023.

What’s happening? 2024 has seen relatively few peer acquisitions, or digital health companies acquiring like competitors. These acquisitions, which drove high M&A numbers in 2021 and 2022, tend to spike when interest rates are low and there is higher tolerance for acquiring companies as a growth strategy. Today, while such deals are overall lower in volume, we’re seeing interesting moves where digital health companies are using M&A to integrate new features and capabilities into their offerings—types of arrangements we’ve dubbed “tapestries”. Like weaving a tapestry, these deals stitch together different solutions to create offerings that are more robust and address a broader range of customer needs.

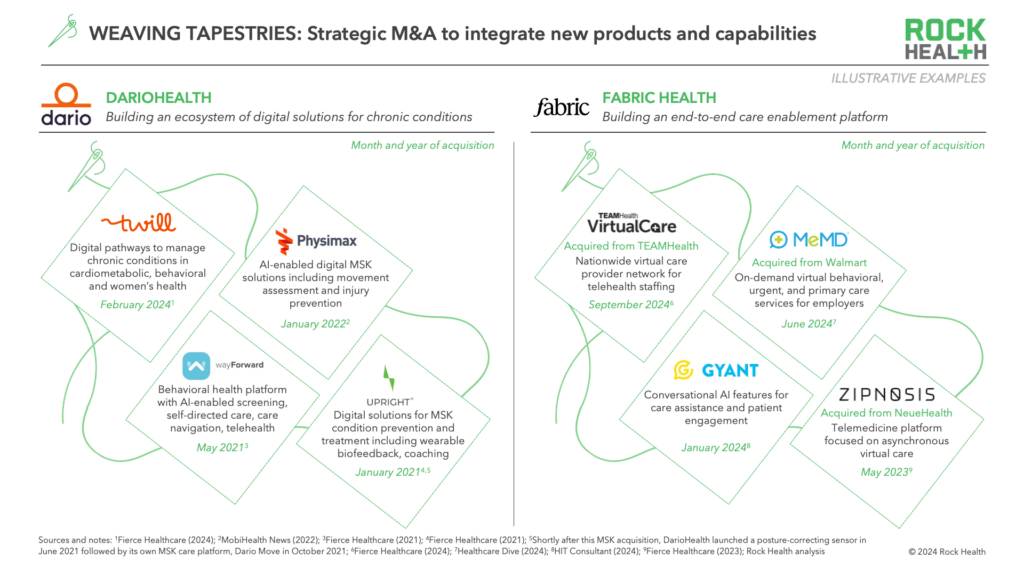

It makes sense for tapestry acquisitions to increase after periods of startup valuation recalibrations. Acquiring a startup with a built-out product and sales, potentially at a depressed price, can be more affordable than building a new product and customer base from scratch. Active tapestry weavers in digital health include chronic condition management player DarioHealth, which bought Twill in February to expand its mental health offering and acquire new patient engagement features (DarioHealth previously made tapestry acquisitions to boost its mental health and MSK programs). Similarly, provider operating system Commure merged with Athelas in October 2023, to expand its capability set with RCM features, purchased Rx.Health for care coordination, and then acquired Augmedix1 in July to enter the AI scribe game—following prior acquisitions for clinician safety, clinical workflow and patient communication, and patient data management capabilities buildout.

Younger players can weave tapestries too. Take Fabric Health (fka Florence); founded in 2021 to drive efficiencies in emergency rooms, Fabric has since made four acquisitions in 2023-2024 (in addition to raising capital) to expand into a larger virtual care platform. It bought Zipnosis from NeueHealth (fka Bright Health) for asynchronous telehealth capabilities, acquired Gyant for conversational AI features, purchased MeMD’s corporate and health plan offering from Walmart, and purchased TeamHealth’s nationwide virtual provider network for telehealth staffing. Each of these acquisitions contributes to Fabric’s growing feature set.

“The digital health market is transforming from single-solution companies that want to ‘do it all’ solo to scalable, combined offerings that drive efficiency for both vendors and clients. In Dario’s case, the Twill acquisition not only contributed to a more comprehensive product offering, but it also accelerated our path to profitability. The decision to build versus buy was straightforward for us. Given the capital requirement and the time it takes to build, the buy option was much more attractive.”

— Erez Raphael, CEO, DarioHealth

Like any craft, tapestry weaving doesn’t come easy. Integration between products, teams, brands, and go-to-market strategies will need to happen in layers. Sometimes, integration plans backfire, and large acquisitions can strain acquirers’ balance sheets. That said, we expect this type of M&A to continue, with companies making strategic purchases of solutions, features, and capabilities. For potential acquirers, success hinges on weaving together these products and capability sets at scale to really compete for the largest, most lucrative healthcare customers.

The devil’s in the details

If we’ve learned anything from the choppy, post-pandemic waters in digital health, it’s to avoid conflating volume of activity (e.g., venture or M&A deal counts) with quality of activity (e.g., strategic M&A). Trends like tapestry weaving remind us that the true impact of digital health innovation is shaped in the details—the details of deal structures, mergers and acquisitions, capability integrations, and targeted partnerships. New best practices in product integration and digital health go-to-market will be forged through these arrangements. We’ll be paying attention to how they surface, and are here to help you do so too.

Tap into insights and strategic guidance for enterprise companies with Rock Health Advisory.

Get in touch with the venture team at Rock Health Capital.

Join us in building a more equitable future at RockHealth.org.

And last but not least, stay plugged into the Rock Health community and all things digital health with the Rock Weekly.

Footnotes

- Augmedix is a Rock Health portfolio company